Trust in farming and coronavirus

Friday, 22 May 2020

As we head towards the third month of lockdown, it is clear that the British way of life has been profoundly altered.

Simple things we once took for granted like popping to a supermarket to pick up something for tonight’s dinner or swinging by a café to meet a friend for lunch are gone or altered, at least for now. Accepted sureties like easy availability of affordable and varied food have become less sure. Few would have thought we would have lived through rationing of staples like bread, pasta and toilet paper, however short-lived. And the economic situation has radically shifted from one of comparative comfort for many to widespread job insecurity and fear of recession. So, how have these profound shifts impacted attitudes towards issues like farming, animal welfare and the environment?

A shift in the conversation

Last year the key issues at hand were the reputation of the farming industry and meat and dairy production. Plant-based was the buzzword of the day and sustainability and environment was a key focus. Today, coronavirus has eclipsed everything and short-term concerns about getting the family fed and longer-term financial worries have taken centre stage.

Reducing the reducers

During lockdown, one thing has become clear – there is more positivity towards meat and dairy. Many people have moved back to products they know and love to build nourishing meals. This has led to impressive growth figures in sales of meat and dairy, particularly for staples such as beef mince, chicken breast, milk, cheese and cream (https://ahdb.org.uk/consumer-insight-coronavirus-weekly-retail-tracker).

There is also a significant reduction in the number of people claiming to be cutting back on meat and dairy in the period post-lockdown. In fact, the amount of people claiming to be eating more meat has doubled from seven to 14% (AHDB/YouGov) whilst those reducing has moved from 27% to 16%. For dairy, there has also been a reduction in those claiming to cut back (from 17% to 11%) and consuming more increasing from 5% to 12% (Source: AHDB/YouGov Apr 20. Consumers are returning to traditional favourites using more familiar ingredients.

Provenance and British meat and dairy: food security?

Source: AHDB/YouGov

As highlighted in last year’s trust report (https://ahdb.org.uk/consumer-insight-trust-transparency-and-traceability), consumers generally feel positive towards British agriculture. Most consumers are appreciative of the work that farmers do – 71% agree they are doing a good job producing food during the pandemic. But it is unclear whether this will lead them to seek out British produce post-coronavirus restrictions. Whilst within the food industry Britishness may equate to food security, it appears not to be the case for consumers who do not make those links.

Britishness is often a secondary factor for consumers. Therefore, communications need to go further than the country of origin, towards key points of difference like local, sustainable, high quality. Even in more prosperous times not all consumers are motivated by what “British” delivers to them personally and whether those factors would justify increased price – only 22% say they would buy British if it was more expensive (Source: IGD). Because of that only half of consumers said they would proactively seek out British products post pandemic.

Environment and recession

Money has become a major concern for many, with IGD reporting a decline in consumer financial confidence throughout March and April. Latest data shows that when thinking about the next year, 23% of shoppers were more focused on saving money compared to 17%, who prioritised quality (1-25th Apr’20 IGD). However, overall, 48% are more price conscious or have allocated their shopping budgets differently.

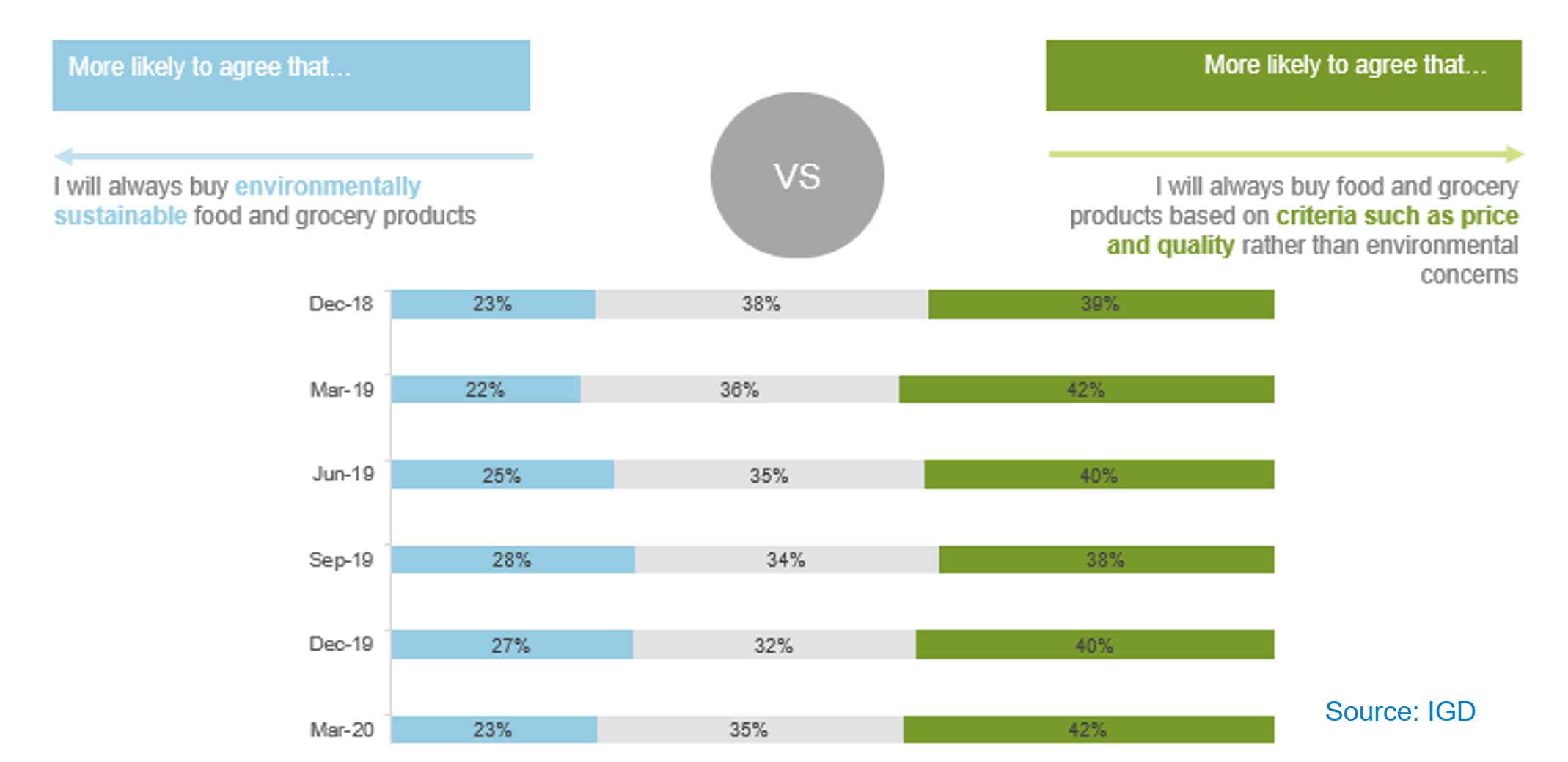

While price has always been key, before the pandemic, factors such as environment had been edging forwards in importance. Some of that momentum has now been lost as the price of food becomes even more important. Only very slight movements however, suggesting the importance of environment will bounce back fairly rapidly.

After lockdown, we may see some re-evaluation about which factors relating to the environment are most important to consumers. Dramatic footage of clear skies over Wuhan and wildlife returning to city streets raise questions about the relative impact of sectors such as transport and manufacturing on the immediate environmental problems we face. Awareness of negative stories in the media relating to red meat have almost halved in this period. Therefore, it is important that we monitor sentiment here in the coming months.

Conclusion

The immediate needs and concerns of consumers are certainly changing rapidly. In the face of an impending recession, factors such as provenance, environment and welfare temporarily take a back seat to price and availability. There is also much positivity in how consumers feel about farming, and a growing acknowledgement of the important role that meat and dairy play in the British diet. However, this pandemic has also raised questions about environment and our way of life which means these concerns are still bubbling under the surface. Much valuable work has already been done but it is important that the industry continues to make demonstrable progress in areas such as welfare and the environment alongside the very clear immediate focus on how best to continue to deliver safe, affordable and sustainable food.

Related content

Topics:

Sectors:

Tags: