How might Brexit change currency in the coming months?

Thursday, 22 November 2018

The value of Sterling hinges on many variables and currently one of them is the sentiment around Brexit.

We saw after the EU referendum, Sterling fell nearly 6% against the Euro. The last time a change like that occurred was early June 2006 where Sterling fell 5.5% before increasing 5.6% the following day.

Over the past few months, there have been various fluctuations in its value after various announcements/news reports/rumours. Recently, we saw a slight increase in Sterling after it was announced a withdrawal deal had been agreed. However, we subsequently saw it fall following the first Prime Minister’s Questions after Cabinet approved the deal.

Therefore, we can safely assume that Brexit sentiment will cause further fluctuations in the coming days/weeks.

The EU summit on 25 November, where there will be a vote on the withdrawal agreement, is likely to be the next key point of change. A yes vote could see a small increase in Sterling’s value while a no vote would likely see a decrease, potentially a sizable one at that.

Assuming the agreement is passed, the UK Parliament debate will be next. The movement of Sterling will likely be more significant if the document is passed. Again though, a no vote would likely see a large decrease.

What does this mean?

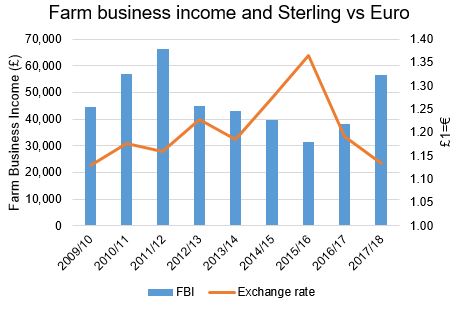

Simply put, a stronger Sterling would make imports cheaper while exports would be more expensive, and vice versa for a weaker domestic currency. Farm Business Income tends to benefit from a weaker currency although not always, as shown below.

Source: Defra, OFX

Note: currency changes occurred around the events of interest addressed in this article. However, there is not necessarily always a direct link to those events and movement in Sterling.

Luke Crossman - luke.crossman@ahdb.org.uk

Topics:

Sectors:

Tags: