How will red meat perform Easter 2018?

Thursday, 22 March 2018

Easter is a key event in the retail calendar, not least for categories such as red meat. Last year we saw traditional cuts underperforming, so this year can they turn things around or will we see a continued break with tradition?

A break from tradition

Retailers tend to bring out their Easter range at approximately the same time each year irrespective of when Easter falls. Given that Easter 2017 was later than in 2016, sales of Easter categories took place earlier given a longer run up, the warmer weather last year also stunted sales on the Saturday before Easter weekend. There was generally less engagement across the majority of Easter categories compared to 2016, not least in the traditional Easter categories, including Easter eggs, hot cross buns and lamb roasting joints.

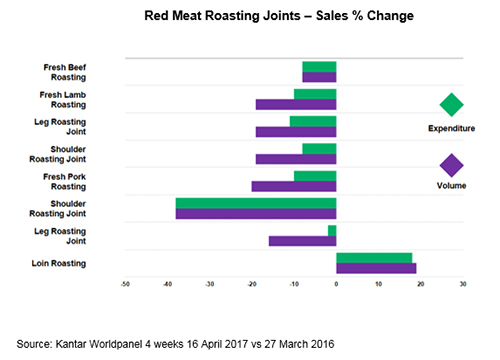

Last year, in the four weeks to Easter, shoppers spent £177.2m across total fresh roasting joints* a fall of 8 per cent in spend on Easter 2016. Red meat roasting joints were down 10 per cent in value and 16 per cent in volume, a significant decline at such an important time of the year. While shoppers bought lower volumes, the key driver of this decline was 918,000 fewer people buying into the market, perhaps driven by an 8 percent rise in prices.

Across the board, volumes were down, with only fresh chicken and pork loin roasting joints bucking the trend. Fresh chicken’s success came predominantly from shoppers switching spend from all other proteins. Against a backdrop of a good Easter 2016, lamb joints struggled the most last year, with an 18 per cent decline in volume, losing £3m to other proteins.

Topics:

Sectors:

Tags: