Meat, potatoes and dairy could tap into boom in popularity of Halloween and Bonfire night

Friday, 7 December 2018

The Halloween season has gained a significant presence in retailers’ aisles in recent years. The increased popularity and visibility of the spooky celebration has led to more of us buying into Halloween. New research by Kantar Worldpanel shows that, in the two weeks running up to the 2018 event, we spent an additional £90.5m on pumpkins, sweets, chocolate and bakery goods, representing growth of 5.2% on last year. Retailers offering value and convenience came out top, with bargain stores, Co-op and Lidl seeing market share over index the most on Halloween categories.

While traditionally linked to children and families, Halloween celebrations are not just for kids. An impressive 73% of Halloween sales came from households with no children. Under 28s showed the greatest spend uplift on Halloween overall, as they stocked up for Halloween parties (Kantar Worldpanel 2w/e 4th November 2018), having a positive halo effect on the alcohol category.

Meat, fish and poultry sales rely heavily on Easter and Christmas, but smaller events in the calendar, such as Halloween and Bonfire night, can still offer sizeable opportunities if the right conditions are provided for growth.

Pumpkins and sweet treats

This Halloween season, 2.4 million UK shoppers bought pumpkins – 523k more than last year. These additional shoppers led sales of the carving vegetable to rise by 46%, adding £4.5m to the grocery market (Kantar Worldpanel 2w/e 4th November 2018). Since Halloween fell on a Wednesday this year, the Saturday before proved to be the most popular day for purchasing pumpkins. A secondary spike in sales was also seen on the Monday before Halloween, showing that last minute purchases are still key.

The impact of the increased popularity of Halloween with the UK shopper doesn’t stop with jack-o’-lanterns. Bakery and chocolate confectionary were the main drivers of growth in the market. Chocolate confectionary sales grew by 9% and bakery by 3% during this Halloween period versus last year, as shoppers got ready for trick-or-treaters or indulged their own sweet tooth (Kantar Worldpanel 2w/e 4th November 2018). With the rise of scratch cooking, there may be an opportunity for the dairy category to utilise this trend by encouraging home-made Halloween-themed bakery goods.

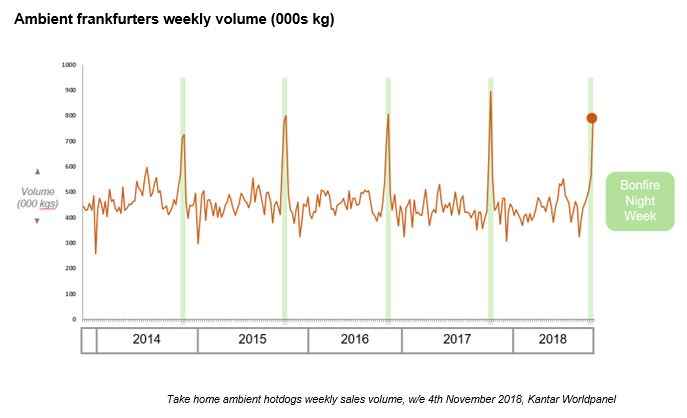

Hotdogs rocket

Whether they take theirs with ketchup or fried onions, the UK shopper picks up more frankfurter hotdogs during Halloween and Bonfire night week than in any other week across the year (Kantar Worldpanel 2w/e 4th November 2018). Fresh sausages also experience an uplift in sales volumes during Bonfire night week versus the other weeks in October and November, but this is less pronounced than frankfurters.

This increased appetite for quick and easy hand-held options could offer an opportunity to push fresh sausages further, as well as utilise other fresh cuts or BBQ favourites.

Other food opportunities

Celebrations are one of the most valuable types of meal, with shoppers spending more than double on these meals than they do on dinners ‘in front of the TV’ (Kantar Worldpanel 2018, 52 w/e 20 May 18). As consumers splash out on making Halloween and Bonfire night go with a bang, there is an opportunity for manufacturers to position themselves as a part of the party.

Whether through marketing protein-based winter warmers, such as chilli or big pot curries, or jacket potatoes as the perfect thing to batch-cook for a crowd, new product development and retailer activity could secure meat, fish and poultry party food’s place as a part of the celebrations. Since this week offers twice the opportunity to celebrate, there is a sizeable opportunity for protein, dairy and potatoes, with a bit more encouragement in store.