- Home

- Dairy Market Outlook

Dairy market outlook

February 2024

Overview

- GB milk production is forecast to decline moderately in 2024 in the region of -1.1% as a result of contracting margins and lower prices.

- Despite recent signs of lower inflation in agricultural input costs, replacement costs through 2024 will remain high, putting pressure on cash flows.

- Global dairy demand is likely to remain challenged by low economic growth, with Chinese demand suppressed by economic challenges and growth in its domestic dairy production.

- Domestic demand is showing signs of returning, although this nascent demand could be stymied by both continued stagflation and the potential for a developing Middle Eastern conflict to produce more economic challenges.

- Farmgate prices are expected to slightly increase in the first half of 2024, but more sustained growth will depend on return of stronger global demand.

Supply

Domestic milk production

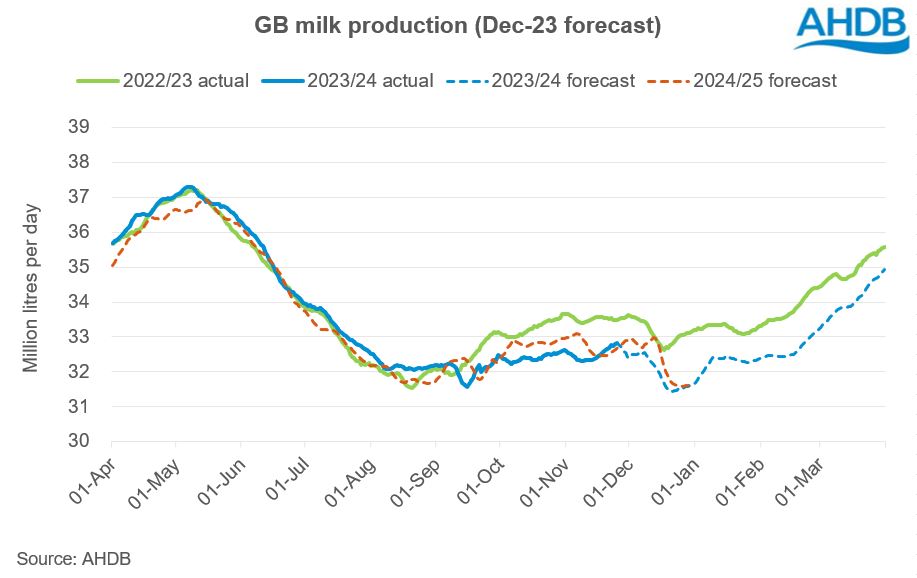

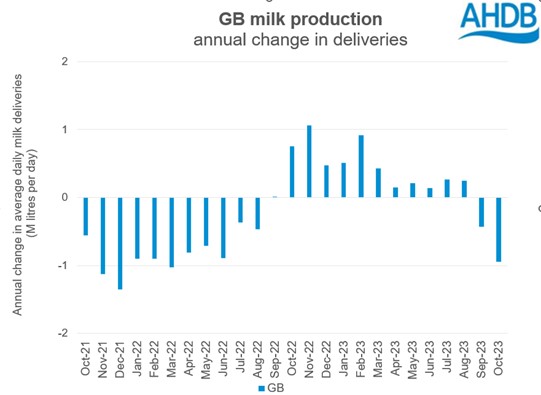

GB milk production is forecast to reach 12.25bn litres for the 2023/24 season, back by 1.1% on the previous season. This represents a small increase compared to the December forecast update and is due to production in December 2023 shrinking less than expected. On a calendar year basis, GB production for 2024 is estimated to total 12.20bn litres. This would be a 1.1% decline compared to 2023, equivalent to 138 million litres less milk.

The 2023 milk year was one of two halves, with the first half running ahead of 2022’s production being driven by the higher prices seen at the end of 2022/beginning of 2023. This led to higher yields and a slowdown in the rate of cows leaving the herd. In addition, favourably wet weather through the majority of the summer led to high levels of forage availability, keeping production ahead of last year.

Margin pressures have continued to be a feature of 2023 as global energy prices, along with feed and fertiliser costs, remained elevated over pre-Ukraine war levels. Since January 2023 farmgate costs began to fall sharply, and by mid-year average farmgate prices had plateaued at the 36-37ppl range where they stayed for the remainder of the year.

Deliveries since September have been declining due to the impact of lower prices and squeezed margins through 2023. September was back by 1%, the decline accelerated in October and November with 3% respectively, and then a slower rate of decline in December of only 0.5%. This tightening in supply meant that Q4 2023 was behind by 61 million litres, or 2%.

The downturn in production from Sep-22 onwards, and the expectation that yields will remain challenged as we move towards the 2024 spring flush, shifted the December forecast for the 2023/24 season from an expectation of some contraction (-0.5%) into a more marked decline (-1.3%).

As we move into the final quarter of the current season (Jan-Mar) we expect our yield expectations to return to greater malaise, with little incentive for farmers to push production until prices see a more sustained recovery.

Reports of forage availability indicate that stores were filled, but with question marks over quality. This could mean farmers need to feed more or supplement more, or in some cases to rely on 2022 stocks. There are indications that farmgate prices are beginning to come up a little, but there are no strong indications for a sharp uplift yet; this will retain margin pressures and add further impetus for further tightening in supplies.

Decreasing farmgate milk prices, labour shortages and higher interest rates, combined with the continued burden of high input costs on working capital requirements, are expected to limit further yield growth through 2024.

GB production is projected to decline by 1.8% in the first half of the year, but then have a flatter profile in the second half of -0.4%. This is due to expectations that commodity prices are expected to recover, to some extent, in response to tightening supplies and that margin pressure will continue to reduce as costs come down. If the ongoing conflict in the Middle East continues to put pressure on freight costs via the Suez Canal and further fuels inflation on input costs, there could be more downward pressure on milk production.

In contrast to the dampening of yields as farmers reacted to cost pressures and falling prices, the GB milking herd has remained relatively static with signs of stabilisation. The latest British Cattle Moving Service (BCMS) data . At the time of the December forecast, the number of cows in the milking herd estimated to be static year-on-year, meaning that the major part of the supply changes were driven by yield declines.

The age profile of the milking herd has been becoming consistently younger over time, with farmers taking advantage of better genetics and culling older stock, which could support cow numbers moving forwards over the coming year.

Disease risks

The following abnormal risks are likely to impact dairy cows throughout 2024, and we are aware of an increased number of cases. However, we have assumed a minimal impact on production at the UK level in 2024, because this is difficult to predict and quantify. If more severe impacts materialise our production forecast will look optimistic.

- Schmallenberg virus: the severity of this disease varies between species and ages of animal. In cattle it can cause abortion, stillbirths, foetal abnormalities leading to calving difficulties, reduced milk yield and loss of body condition. The impact is difficult to predict but likely to result in a reduction in milk yield and number of calves in 2024 for affected herds.

- Bluetongue virus: depending on the strain of virus, scale of any outbreak, and the timing of a disease incursion, bluetongue can lower productivity (including a reduced milk yield), cause sickness, reduce reproductive performance and cause abortions. Calves may be born small, weak, deformed or blind, and it may result in increased calf mortality. The impact is difficult to predict but could be high for some herds, and significant if a large-scale outbreak were to occur.

- Other impacts from bluetongue include disruptions due to impact of prolonged animal movement and trade restrictions, administration, and additional costs as a result of restrictions. This includes the need for a licence to move animals out of an affected zone. These can take up to five days to process, as animals can only exit the zone to move directly to slaughter, and may require farmers to change their usual routes to market. Farmers may incur costs from reduced market access, including export markets.

Global milk production

According to the latest delivery data for the key milk- producing regions (at time of publication)[1],

global production has been in deepening year-on-year decline for the past four consecutive periods. Total production across the key growing regions in the year to date (Jan-Oct 23[2]) was 0.2% higher compared to previous year due to growth in the first two quarters. Production in the year to date increased across all major regions except Argentina and Australia.

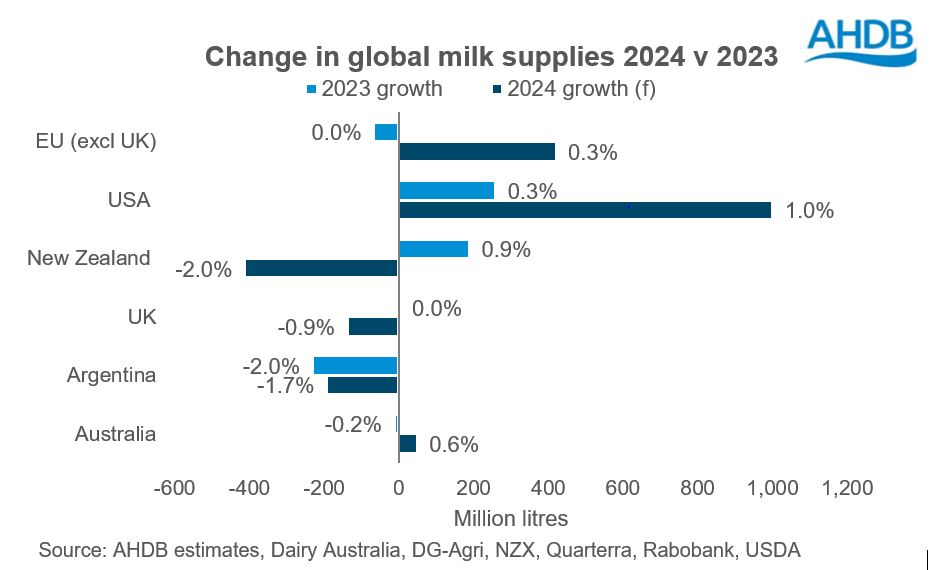

Early forecasts for 2024 suggests a modest global growth of 0.25%. Lower production in UK, Argentina and New Zealand will be offset by higher production in Australia, EU-27 and the USA. Most of the growth is likely to be seen in the first half of 2024 considering the flush period in the Northern hemisphere.

[1] US, EU-27, UK, New Zealand, Australia, and Argentina; forecasts from Oct23

[2] EU-27 and US data for November, December is not yet available

Product availability

With more milk in the system, 2023 production of dairy products grew by a modest amount in almost all major producing regions. A marginal decline in milk deliveries was reported in EU during the third quarter of 2023, and available supplies were trending lower driven mostly by higher exports. Competitive prices in Europe made exports attractive and helped to offset increase in production. Demand from the Middle East and North Africa (MENA) and South-east Asia fuelled exports. According to the latest data[1], available supplies declined across the board in the EU-27, while whole milk powder (WMP) availability improved bolstered by higher production.

The situation in the UK is similar. Despite higher exports of cheese, increase in production volumes and imports meant some supplies built up in the third quarter. Butter availability also grew a little due to higher imports. Milk powders benefitted from growing demand from MENA, meaning supplies fell.

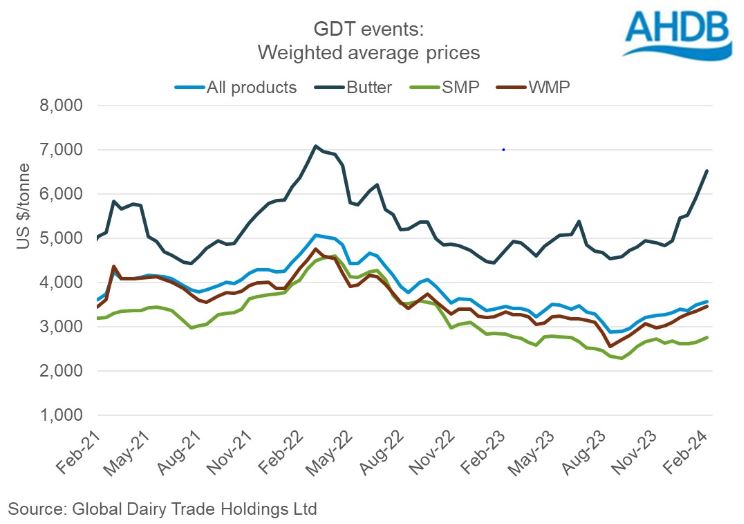

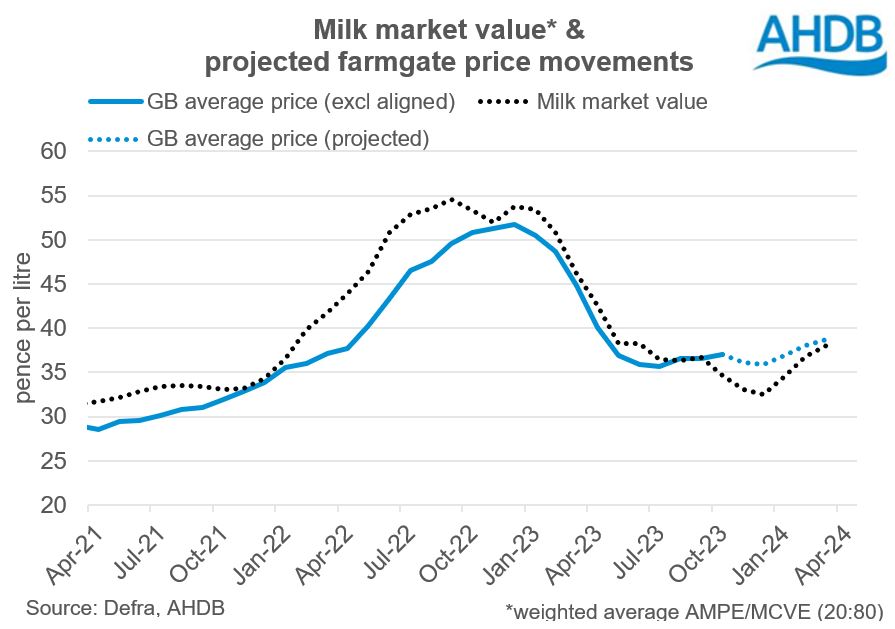

Looking into the fourth quarter of 2023, milk deliveries in the UK have been lower by around 2% year on year, meaning that supplies have been tightening. Wholesale markets, both domestically and globally, have been recovering during the last months of 2023, supported by declining milk volumes.

In December and January there have been signs of an easing in milk flows; December milk supplies were only back by 0.4%. This could put a brake on the upward trajectory of pricing, particularly if global supplies grow in 2024.

[1] Data is available on product production to Oct23

Pricing expectations

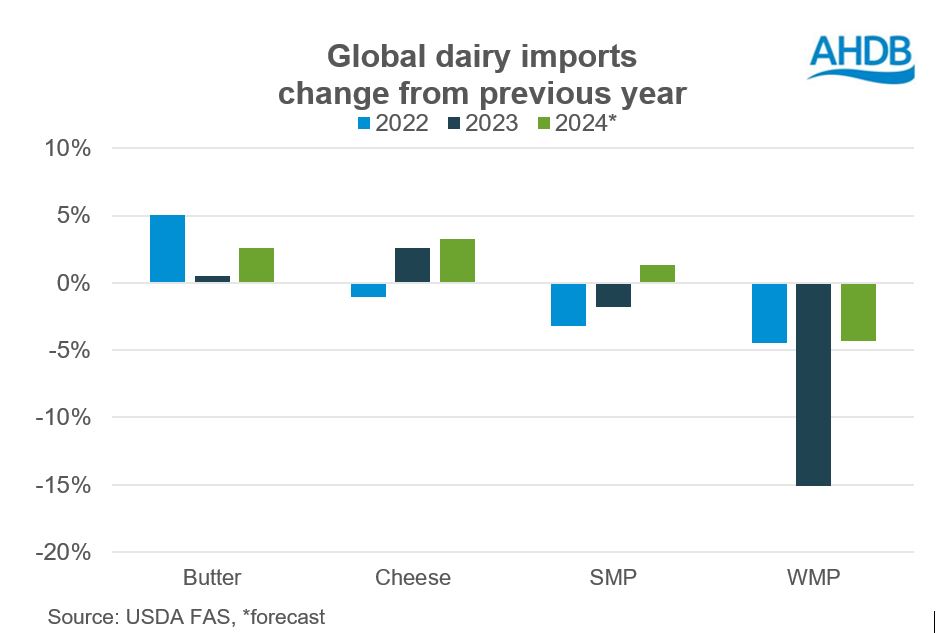

Consumer demand is expected to remain sluggish through 2024 as economic growth remains subdued and consumer confidence remains disappointing. Geopolitical uncertainty could also fuel further inflationary pressure. However, moderately tightening supplies in GB should offer some support for prices. Unfortunately, plentiful global supplies in some areas, teamed with weak demand, means we won’t see prices soaring. Import demand globally looks to see some recovery in butter, cheese and SMP, but WMP remains down according to latest forecasts for import demand from the USDA published in December 2023.

With significant increase in domestic milk production, supplies of WMP remain surplus in China as the Chinese government implemented subsidised policies to stabilise the domestic processing sector, supporting higher production of WMP. According to the latest Rabobank outlook, China’s import volumes are expected to flatline in 2024 after having withdrawn from the global markets during the last two years. However, much depends on demand and stocks in the Chinese domestic market.

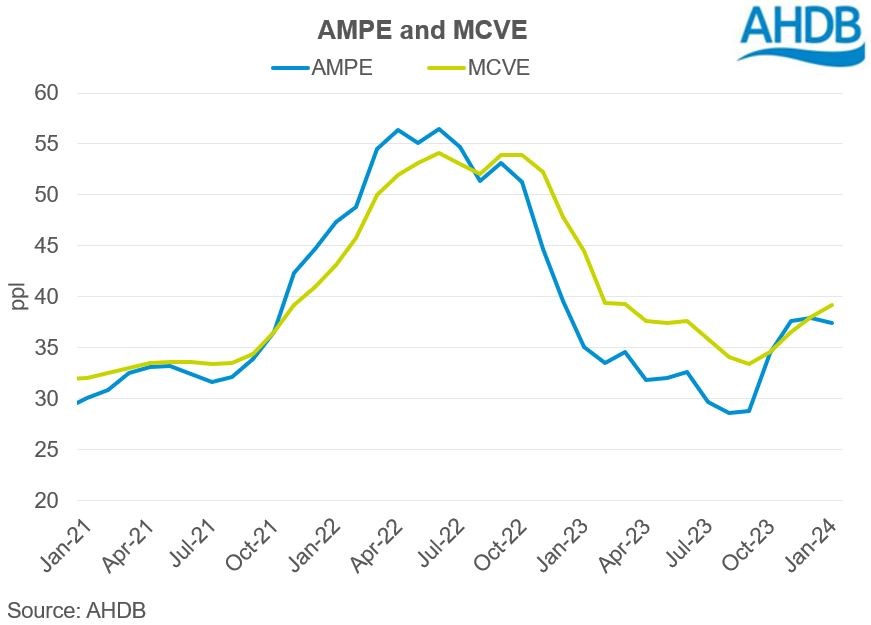

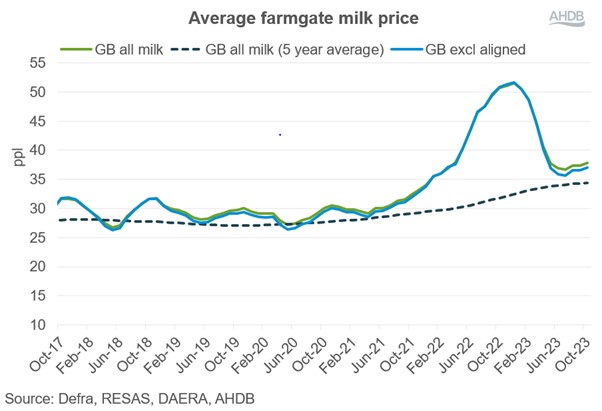

Impact on farmgate prices

GB farmgate prices dipped significantly through 2023, although marginal recovery was witnessed after the first half from August onwards. Prices remain significantly below 2022 levels. The annual average milk price in GB is expected to be in the region of 40ppl for the 2023/24 season, taking into account announced price increases to Jan-24. This compares to an average of 47ppl in the previous season.

Declines in milk prices in the first half of 2023 emerged faster than the gains in 2022. This was triggered by an overwhelming increase in milk production and lacklustre demand.

Although input costs declined in 2023, they remained well above pre-Covid levels. Softening of input prices has given welcome relief to margin pressures – but only partially, with many reports of some businesses struggling with cash flows. Unfortunately, this has led to some farmers leaving the sector, with the number of dairy farms in GB declining by 4.5% since 2022.

While the cost of some inputs did ease in 2023, they remained historically high. We explore prospects for farm inputs in our dedicated outlooks:

The decline in the value of dairy products has now halted, and prices have been increasing marginally during the latter part of 2023. These savings have not completely filtered through to consumers, who are still experiencing some inflation in dairy prices. At total category level, retail inflation of dairy products has now eased to a reasonable 2.3%, but this headline figure belies that deflation is being led by liquid milk, while cheese, yogurt and butter are still increasing in price according to Nielsen. This will not aid demand for these products, although is welcome for liquid milk. There are early signs of some consumer demand coming back into the category, although at muted levels thus far.

The combination of declining milk production and some emerging demand suggests some tentative positivity for milk prices in the first half of 2024. However, much will depend on the spring flush. Production increases through the flush period could pressurise the market which could stall the recovery in prices, depending on demand. China is expected to return to the market this year, but not in a large way. Rabobank expect Chinese imports to stabilise after two years of decline: the extent of this demand will play a major role in supporting prices.

Dairy consumption trends

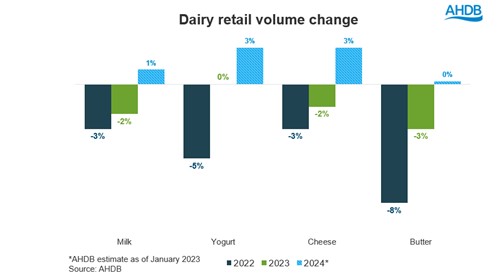

In 2023, total dairy retail volume was down 2.5% year-on-year (Source: AHDB/Nielsen 52 w/e 30 December 2023). All dairy sectors saw average price increases during this time, resulting in volume declines across all sectors.

For further information on 2023 trends for all dairy categories, visit our Dairy retail dashboard.

For 2024 we expect inflation to continue to fall, and wages to continue to rise. The overall 2024 economic outlook will improve, although there are headwinds, including world conflicts, which have the potential to derail this.

This means that some shoppers will feel genuinely better off, while others will continue to struggle and look to make savings when they can. After three years of overcoming challenges and reconsidering how to spend their money we expect any changes in shopping behaviour to be gradual.

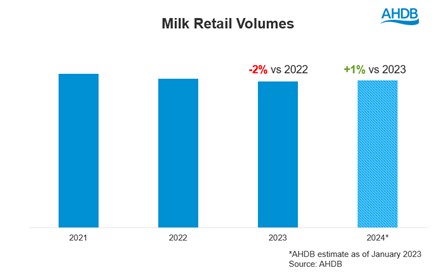

Milk

As retail prices are predicted to stabilise in 2024 and the pressure on cost-of-living eases, we expect health to return on consumers’ agendas, which could lead to an increase in consumption levels. With over 9 in 10 households buying cow’s milk (Source: Nielsen 52 w/e 30 December 2023), we believe this provides a real opportunity for consumers to benefit from the naturalness of milk. This growth will likely be restricted by the trend for more consumers buying food and drinks out-of-home. Therefore, we predict retail milk volume to be up by 1% year-on-year.

Cheese

Consumers are looking for tasty, cheaper ingredients when cooking dishes, and we expect this will benefit cheese demand during 2024. Cheese experienced the greatest average price increase last year of all the dairy sectors, which led to a change in consumer purchasing habits. As a result, we expect consumers will continue to shift between tiers from standard to economy, move between strengths, and transition from brand to own-label to save money. However, we also forecast growth of the premium sector, especially the speciality and continental categories. We predict retail cheese volumes will increase by 2.5% year-on-year.

Butter

The price differentiation between butter and plant spreads will be a key driver of demand during 2024. We forecast it may narrow slightly, which could benefit cows’ butter. Looking forward, butter is a key ingredient within the baking sector and we forecast that it will continue to experience growth year-on-year. We predict that butter volumes will remain at 2023 levels, with minor uplifts at the start of 2024 but then levelling off as health returns as a priority later on.

Yoghurt

As the pressure on consumers’ spend decreases in 2024, we expect health to become a greater priority once again. As consumers are changing their eating habits and turning away from traditional desserts, the wide varieties of yoghurts available provide the opportunity for a guilt-free, healthier alternative across all meal occasions. As a result, we anticipate purchases of yoghurt to return to a 3% volume growth versus 2023.

The dairy outlook might be improved, if the industry:

- Encourage consumption of dairy with consumers looking for tasty and filling meals. This is particularly an option for cheese which can add a lot of flavour at a cheaper price.

- Highlight dairy as an affordable source of nutrition, addressing consumers’ need for value while supporting the long-term health perception of dairy. This could include promoting dairy as a cost-effective source of protein, calcium and vitamin B12.

- Reassure consumers looking at dairy alternatives about the natural health benefits of dairy.

- In the longer term, look to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers.

Read our insights

Visit the Dairy market analysis page for the latest information and insights to guide you through market movements

Sign up to receive the latest statistics and news on the UK, EU and world dairy markets from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.