Arable Market Report - 29 April 2024

Monday, 29 April 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

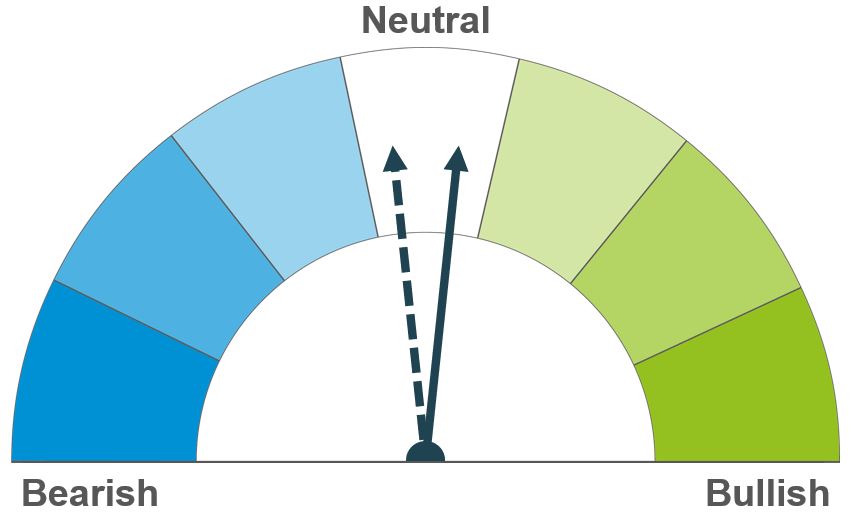

Grains

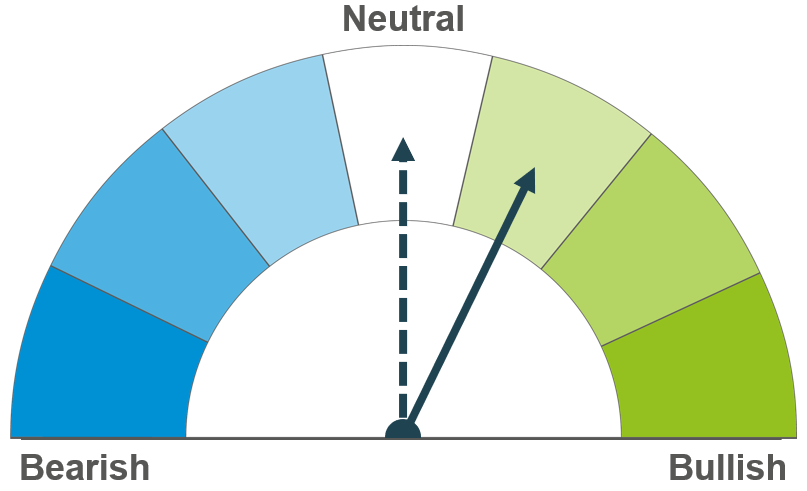

Wheat

Weather, especially in Russia, is now in the driving seat as to the longer-term outlook for the global wheat market. It’s a case of watch and see.

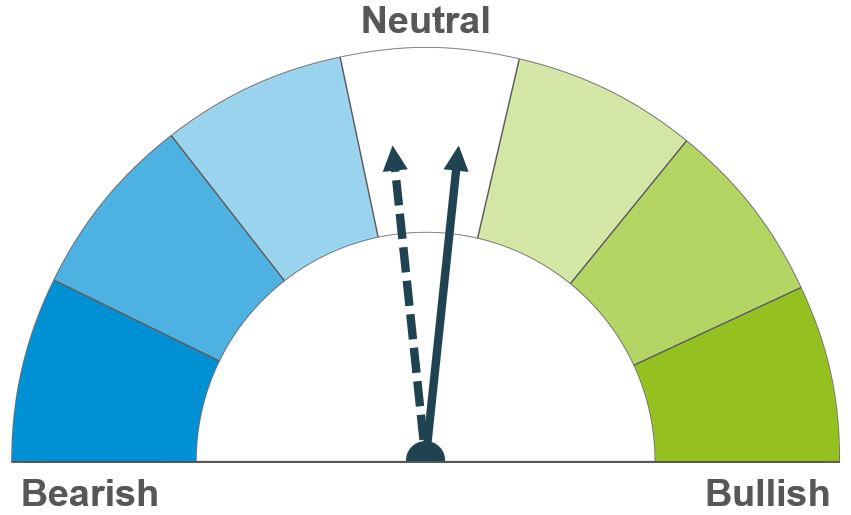

Maize

Argentina’s 2023/24 crop estimate was unchanged last week but concerns persist for the crop. Larger global maize crops are forecast for 2024/25, but any issues with global wheat supply could push more feed demand to maize.

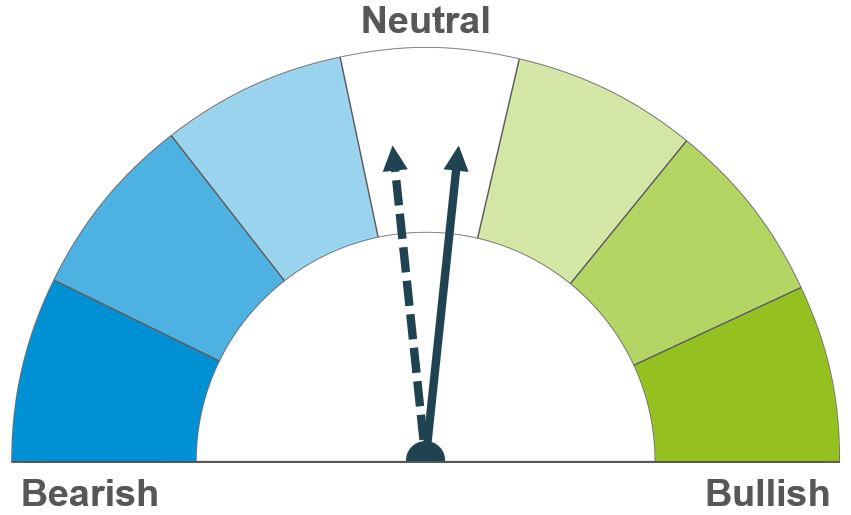

Barley

A larger EU barley crop is still expected in 2024/25, and rain has also improved soil conditions ahead of planting in North America and parts of Australia. However, weather in the coming weeks will have a large bearing on the longer-term outlook.

Global grain markets

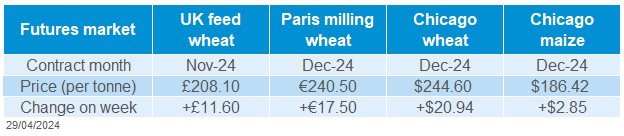

Global grain futures

Global grain prices rose last week due to weather worries for key wheat producers, plus renewed tensions in the Black Sea. Short covering by speculative traders also likely added to the rises. On Friday, Dec-24 Chicago wheat futures reached its highest price since the end of December, while Paris wheat futures reached its highest price since 6 December.

There were smaller gains week-on-week for maize prices. The Buenos Aries Grain Exchange held its estimate of the 2023/24 Argentine crop stable at 49.5 Mt, though cautioned further cuts are possible.

At the start of last week, Russian missiles damaged grain storage facilities at Pivdennyi, in Ukraine and US crop condition ratings for winter wheat declined more than expected. While the US crop is still in its best condition for four years, the proportion of the US winter wheat area experiencing drought rose last week to 30%. This is up from 24% on 16 April and 17% at the end of March, though still below last year’s 51%. The USDA issues it’s next crop condition ratings tonight.

Russian wheat potential is in focus following continued dry weather in winter wheat areas. While a large crop is currently forecast, more rain is needed. Over the weekend Russia’s state weather forecaster warned that drought remains a threat in the Southern district.

The EU Commission cut its forecast for the EU-27 2024 wheat (exc. Durum) crop by 0.6 Mt to 120.2 Mt due to a smaller area. Though the EU crop monitoring service edged its yield expectation higher, the Commission held its yield projection steady. The impact of the smaller crop was offset by expected higher imports this season and next.

The EU Commission also reduced its forecast for the EU-27 barley crop by 119 Kt to 53.6 Mt as planting delays reduced the area. But the crop is still some 6.0 Mt larger than last year.

UK focus

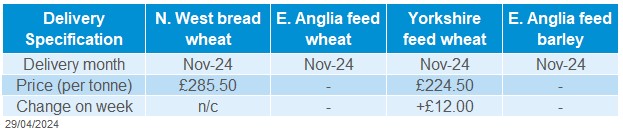

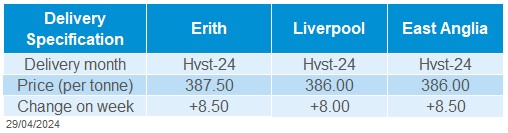

Delivered cereals

UK feed wheat futures for Nov-24 gained £11.60/t last week to close at £208.10/t. The May-24 contract also gained £10.35/t to £183.45/t though with the contract’s last trading day approaching on 23 May, technical factors are increasingly influencing the contract.

Large tenders (845 original tenders) were submitted against the May-24 contract last week, though sizeable open interest remains. There were large tenders against the May-24 futures in the east and south of England, echoing the reduced local demand after low exports this season.

A recovery in sterling against the US dollar and euro, meant new crop UK feed wheat futures rose by slightly less percentage wise than the global markets. Sterling rose against these currencies as US economic growth was weaker than expected, while German consumer confidence remained negative.

Delivered prices rose largely in line with the futures market Thursday to Thursday. Northamptonshire bread wheat (Nov-24) gained £8.50/t Thursday-to-Thursday to £274.50/t, while North Humberside feed wheat (Nov-24) rose £12.00/t to £224.50/t.

AHDB’s next crop condition and progress report will be out on Friday 3 May.

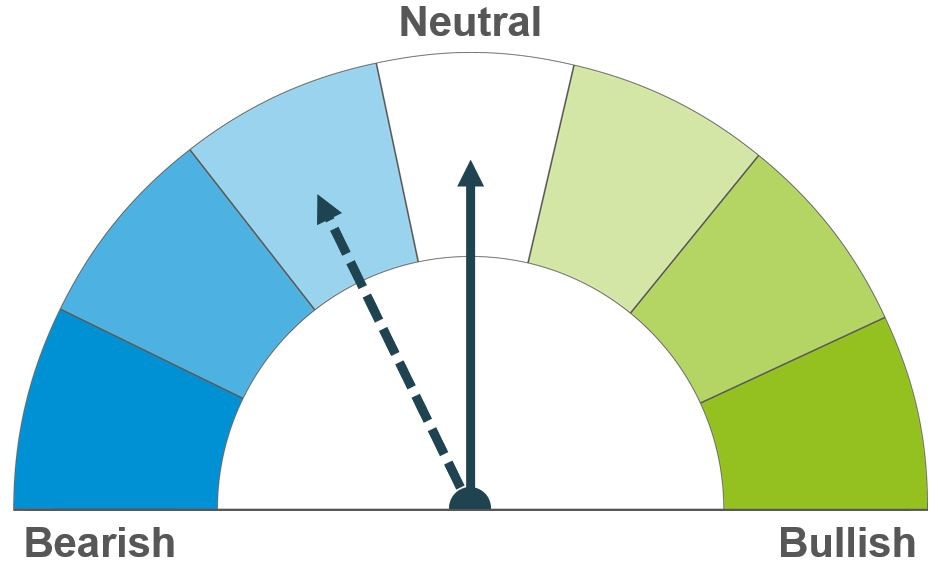

Oilseeds

Rapeseed

Tighter rapeseed supplies are forecast globally in 2024/25, with reductions in both the Canadian and EU rapeseed areas. However, the wider oilseed market currently looks well supplied, influencing the overall sentiment.

Soyabeans

While there was some support from rallying grain markets and harvest delays last week, global soyabean supplies continue to look ample longer-term.

Global oilseed markets

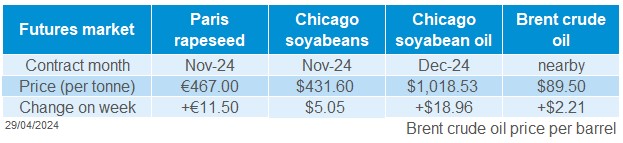

Global oilseed futures

Chicago soyabean futures (May-24) were supported over the week (Friday-Friday), rising $9.00/t on Friday. This was the first weekly rise following five consecutive weeks of declining Chicago soyabean prices.

Soyabean prices were supported last week by rallying in global grain markets. Some short-term support has also been seen from wet weather conditions in the US Midwest on Friday, which could lead to some delays in soyabean planting.

Brazil could also see some slowing to the closing stages of its soyabean harvest due to expected rainfall. Additionally, wet weather has also caused delays to the harvest in Argentina last week, with soyabeans 14% harvested late last week. This is up just 3% on the previous week and behind compared to the average of 36% complete.

Crude oil markets added an element of support to oilseeds last week, with the nearby contract trading upwards by $2.21/barrel on the week (Friday-Friday). Prices have been on a generally upwards trajectory since the start of 2024.

However, global soyabean supplies continue to look ample long-term, which could cap any further gains.

The US market has also continued to see pressure from a relatively strong US dollar. While the dollar eased back a little last week on US inflation, it is still close to its highest levels since autumn 2023. This has driven a reduction in the competitiveness of US soyabeans on the global market.

Stratégie Grains opted to keep its EU-27 rapeseed forecast for this season at 18.1 Mt last week, but 9% below last year’s harvest after a reduction in the planted area. The fall in rapeseed production is expected to reduce crushing by nearly 10% next season, with ending stocks tightening in the EU by the end of June 2025 (LSEG).

Rapeseed focus

UK delivered oilseed prices

New crop futures (Nov-24) saw support last week (Friday-Friday) to a close price of €467.00/t up by €11.50/t. Rapeseed generally followed soyabean futures price movements last week.

However, old crop Paris rapeseed futures (May-24) were pressured over the week (Friday-Friday), declining €8.75/t to a closing price of €440.25/t. The contract’s last trading day is tomorrow (30 April).

Rapeseed delivered into Erith for May 2024 delivery was quoted at £379.50/t on Friday, up £5.00/t over the week (Fridy-Friday). Meanwhile, the price for new crop delivered in Erith in November was quoted at £398.50/t, up £8.00/t from Friday 19 April.

A tighter rapeseed supply outlook appears to have supported prices last week, with forecasts suggesting a tightening. The latest balance sheet from Statistics Canada forecasts a planted area of 8.69 Mha for harvest 2024, a 3% decline from harvest 2023 and a 1% decline over the five-year average. The EU-27 has also seen a drop in its rapeseed area due to unfavourable weather conditions, at 5.98 Mha, down 3.6% on the year (EU Commission).

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.