Feed Report: 30 March 2022

Wednesday, 30 March 2022

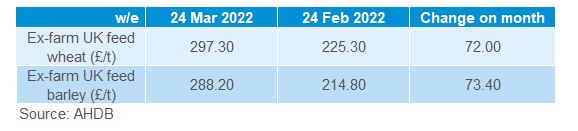

Grains

UK ex-farm feed wheat and feed barley prices have risen sharply over March, following gains on the UK feed wheat futures. UK feed wheat (May-22) futures have reached record highs of £316.00/t (on 25 Mar).

UK prices follow global price rises, rising in response to the war between Russia and Ukraine. The market is concerned for global grain availability.

This season, Russia and Ukraine were set to account for 29.0% of global wheat trade. Ukraine averages c.14.5% of global maize exports too (average 2016-2020). For the remainder of the 2020/21 season (from 21 February), Ukraine is still forecasted to export 1.5Mt of wheat and 7.7Mt of maize. How much of this will be possible? Well, maize is understood to be leaving Ukraine by rail. However, only very small volumes are expected to move. Ukraine is also in talks with Romania, to use Romanian ports for export, although nothing agreed to date. Russian wheat exports are understood to continue through the Black Sea, but financial and trade restrictions are likely to have some impact on volumes exported.

Global factors to watch longer term:

- The length of the Russian and Ukrainian conflict – can Ukraine plant maize in April? Will Ukrainian farmers have access to fuel, bank funding and fertiliser for winter crop management? What is the impact to export infrastructure?

- The size and condition of the US wheat crop – drought continues in many areas.

- South American maize production

In the UK, the cereals supply and demand balance for 2021/22 continues to look tight for wheat and barley. Despite wheat prices strengthening further in recent weeks, barley cannot afford to take much more domestic demand. This is likely the reason for ex-farm barley prices rising slightly faster over the month than wheat.

It is worth noting, the UK agreed to lift the tariff on US maize imports from 1 June 2022.

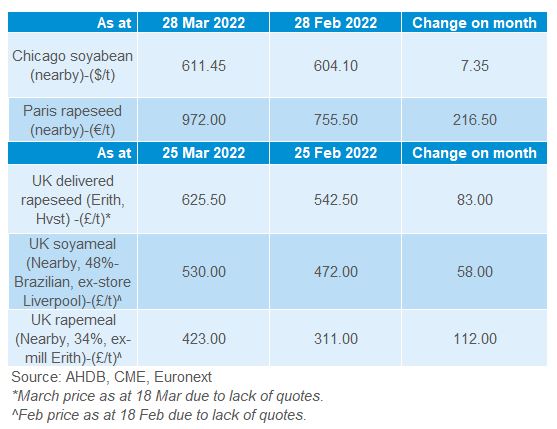

Proteins

Like grains, volatility in global markets have been causing some significant price changes in brent crude oil (nearby) and wider oilseed markets.

Ukraine and Russia also account for 75.7% of global sunoil exports (average 2016/17-2020/21). With Ukrainian sunflower planting due to start in April (for 2022/23 supply), the market is concerned crops may lose out in area as the country prioritises buckwheat, oats, and millet.

Concern of limited availability of sunflower pushes demand to other oilseeds, like rapeseed. This is especially in biofuel blends. With EU (and global) rapeseed supply and demand tight this season, the market is reacting to any new news.

For soyabeans, the Brazilian harvest is progressing well. However, US demand remains strong supporting prices.

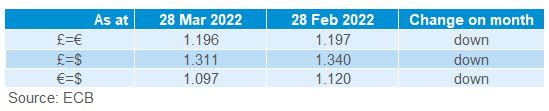

Exchange rate

The pound sterling has weakened against the euro and US dollar last month. The UK economic growth is reportedly slowing, with inflation pressures causing concerns to cost of living.

The war between Russia and Ukraine is having an impact across the board in currencies, as commodity prices soar, and the market assesses the possible impact to economies. This includes the introduction of Russian sanctions, mostly notably Germany pulling the introduction of the natural gas pipeline Nord Stream 2.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.