No gains expected in global milk production for 2022

Tuesday, 19 July 2022

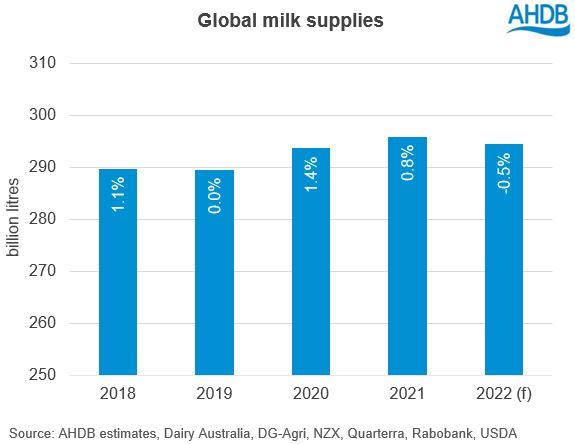

Global milk deliveries continued to record a year-on-year deficit in May, with little expectation of a turnaround for the rest of the year. According to the latest forecasts for the key milk producing regions[1], global production looks set for a decline of 0.5% on the year for 2022. This is a reduction from the April forecast, where production was expected to remain stable on the year.

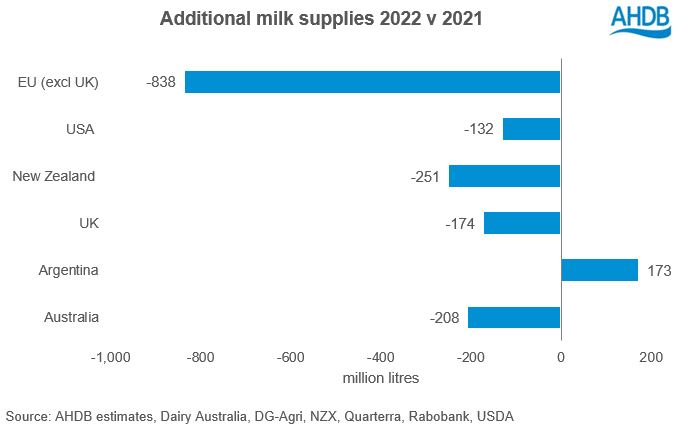

In volume terms, the forecast decline in the EU will be the largest, down 838m litres from 2021 levels. Lower grass quality due to hot, dry weather and lower feed use due to lack of availability and increased cost are the main drivers. These drivers are also expected to decrease milk fat and protein content, reducing the availability of milk solids for processing, according to the latest EU short-term outlook.

Milk deliveries in the UK have continued behind the volumes of last year with GB deliveries specifically performing lower than anticipated. Production in Northern Ireland had started the year with strong growth; however, this has now eased and so forecasted growth for the region has now dropped to an annual decline of 1.2%.

After a worse than anticipated start to 2022, Australia and New Zealand are both now forecast to record year on year declines for the year (-2.4% and -0.7% respectively). This is despite the seasonal peaks still to come, as any volume gains in H2 2022 aren’t expected to outweigh those lost in H1.

The US is anticipating a small drop in production on slower than expected growth in yields. Meanwhile, Argentina is expected to continue to see year on year growth, although at a slower rate than last year as farm finances become less favourable.

With no sign of inflationary pressures on input costs easing, farmers do not feel encouraged to improve yields despite the current strong milk prices. Add to this the ongoing challenges of labour shortages, transport delays, increased greening requirements and unfavourable weather, and the feasibility of increasing production in the short term looks doubtful.

The tight supply situation does provide support to dairy prices, although demand may be dampened when the large price jumps flow through to consumers. This is starting to be seen with lower retail sales in GB, a situation which is likely also occurring in EU and US markets.

[1] US, EU-27, UK, New Zealand, Australia, and Argentina

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.