How might the EU-NZ trade deal impact trade? - Dairy

Tuesday, 30 April 2024

The EU-NZ Free Trade Agreement will enter into force on 1 May 2024. Trade of goods between the two was worth almost 9.1 billion euros in 2022. The agreement provides improved access into the EU market for New Zealand products.

Improved access for New Zealand goods includes

- 91% of NZ goods trade will enter duty free from day one. This will rise to 97% after 7 years

- NZ$100 million tariff savings from day one. This will rise to NZ$110 million after 7 years.

- Increased Tariff Rate Quotas (TRQs) for beef and dairy products.

Potential impact on the EU

Cheese

The current tariff rate quota (TRQ) for cheese (cheddar and cheese for processing) for New Zealand export to the EU is 6,021 tonnes, with a tariff of €170.60 per tonne. Under the FTA New Zealand will have access to a TRQ of 8,333 tonnes from day one, rising to 25,000 tonnes by year seven after entry into force. There will be no in quota tariff, however any exports of out quota will be subject to a tariff of €185.20 per tonne.

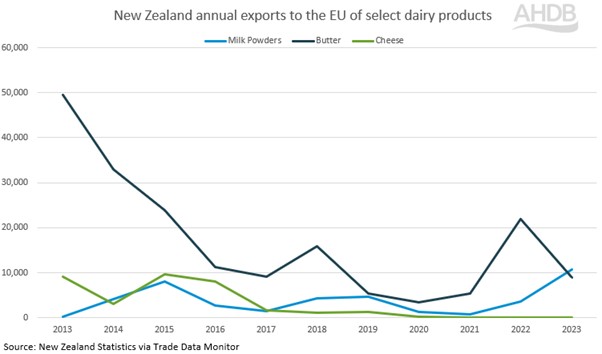

New Zealand cheese exports have been relatively low, as the tariff is quite restrictive, so the quota has not been utilised. Cheese exports from New Zealand have only surpassed the quota twice, in 2013 and 2016, with volumes dropping off from 2020 onwards.

Butter

Following the FTA, New Zealand will also have access to an additional TRQ starting at 5,000 tonnes in year 1, rising to 15,000 tonnes by 2031. The in-quota tariff will also reduce from 20% of the MFN rate in year 1 to 5% of the MFN rate in 2031. New Zealand will still have access to the WTO quota of 35,000 tonnes at a varying in-quota tariff from 5% to 30% of the MFN rate depending on the amount of product exported.

Exports of New Zealand butter into the EU has not surpassed the WTO CSTQ in the past 10 years, and recently has not fulfilled at least 50% of the available quota. Butter exports were strong in 2013 at just under 50,000 tonnes but have subsequently fallen to just under 10,000 tonnes in 2023.

Milk powders

For milk powders, New Zealand does not have any preferential access to the EU. Following the FTA, New Zealand will be able to export milk powder products to the EU under a tariff rate quota, starting at 5,000 tonnes in year one, rising to 15,000 tonnes by 2031 will an in-quota tariff of 20% of the MFN rate.

New Zealand milk powder exports to the EU has varied in volume over the past 10 years. Export volumes are much smaller in comparison to other dairy products which could be due to lack of preferential access to the EU. Exports over the last 10 years have not exceeded the proposed TRQ volumes but this could change once the agreement comes into force. Volumes exported from 2021 onwards have grown to just over 10,000 tonnes in 2023 but still remain minimal.

Dairy processed animal proteins (PAPs) and high protein whey

For dairy processed animal proteins (PAPs) and high protein whey, New Zealand does not have any preferential access to the EU. Following the FTA, New Zealand will be able to export 3,500 tonnes of Dairy PAPs and high protein whey duty free by 2030 with no in-quota tariff. Similarly to milk powders, as dairy PAPs and whey has not benefitted from any preferential access to the EU, exports could perform differently under the FTA. With the exception of 2020, volumes over the past 10 years have not exceeded the proposed TRQ.

New Zealand annual exports to the EU of select dairy products

Source: New Zealand Statistics via Trade Data Monitor

Historical dairy exports from New Zealand to the EU have rarely exceeded the respective quota volumes agreed under the FTA. New Zealand has strong trading relationships with countries in Asia, China being a key market for dairy exports. Furthermore, in 2024, all dairy exports to China are expected to become tariff free, supporting the already strong trade to the region.

Potential impact on the UK

The UK has a strong foothold in dairy exports to the EU, accounting for the vast majority of EU dairy imports. In terms of market share the UK holds a strong majority across the main dairy products:

- 65% of milk powder products

- 70% of butter products

- 64% of cheese products

- 66% of dairy PAPs and whey products

The UK is likely to remain a key exporter of dairy products to the EU. Across the four dairy products, butter is the only category where New Zealand has held a notable market share, although this has since declined following increased exports to Asia and increased exports from the UK.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.