- Home

- South America, Central America, Panama and the Dominican Republic: Consumer insight

South America, Central America, Panama and the Dominican Republic: Consumer insight

This insight is primarily based on consumers in Argentina, Brazil and Chile.

South American consumers prefer to cook or bake at home, with consumers from Argentina, Brazil and Chile scoring above the global average. This suggests promising growth through the wholesale retail channel, something exporters can harness. Because Brazil is such a large market, it is worth noting that consumers here also prefer reheating and preparing a ready meal, or ordering food for home delivery. We see this more so in millennial consumers, with many stating they do this because it is more convenient.

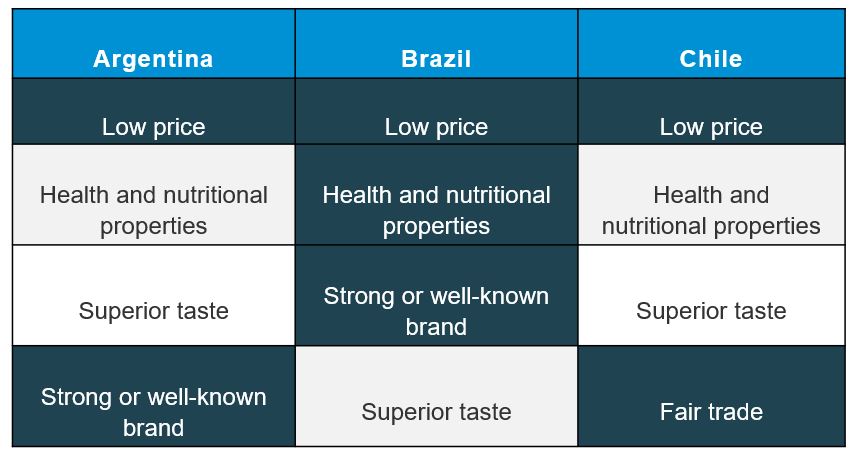

Table 1. What consumers look for when buying red meat in Argentina, Brazil and Chile

*Shaded cells are where food features and attributes score above the world average for that given market.

Source: Euromonitor International Limited, Lifestyles, Consumers Edition 2022 © All rights reserved

The common theme across the South American market lies in price: all three regions score well above the global average. Communicating value for money in these markets will be important.

The pandemic, alongside rising health awareness, has resulted in an uptick in the importance of health and wellbeing. Consumers actively look for healthy ingredients in food and beverages, and closely read the nutrition labels.

Well-known brands are also strongly favoured in all three countries. As the wholesale market grows, exporters may wish to consider the branding visible to consumers and the messages being communicated.

Within the retail market gradual growth is predicted over the next five years. Taking Brazil as an example, IGD forecast sales growth of 6.6% between 2022 and 2027. The traditional channels (independents, street vendors, kiosks and food markets), while dipping in market share, are still predicted to account for 46% of the market in 2027. It is forecasted that supermarkets and hypermarkets will continue to lose share as more Brazilians convert to the wholesale channel (Source: IGD, The Americas Channel Forecasts 2022). Online is predicted to be the fastest growing channel, albeit from a low base.

Continue reading about the South America, Central America, Panama and the Dominican Republic market

Market access and barriers to trade