- Home

- Prospects for UK agri-food exports: Sub-Saharan Africa

Prospects for UK agri-food exports: Sub-Saharan Africa

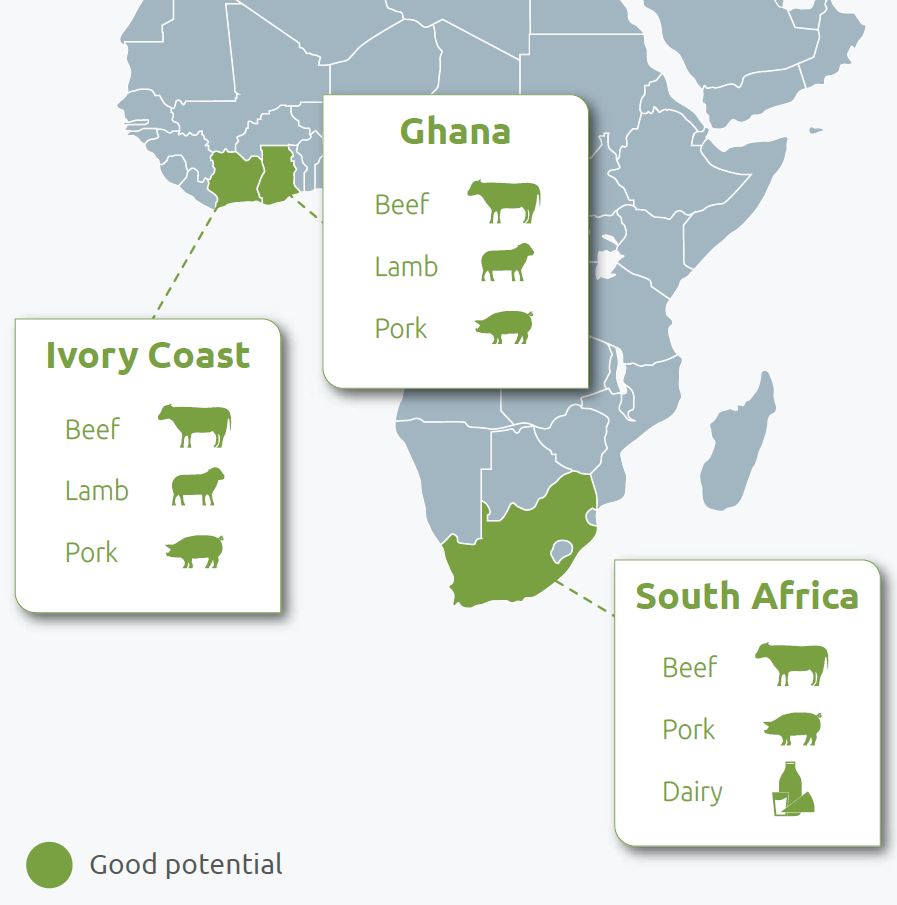

There’s room to expand on the amount of commodity level red meat the UK currently exports to Ghana, Côte d’Ivoire and South Africa as well as increasing premium cuts into South Africa.

|

What African countries are not part of this analysis? Algeria, Egypt, Libya, Morocco and Tunisia are included in our Middle East and North Africa analysis. |

Summary of findings

The UK has market access for red meat in many countries in sub-Saharan Africa and is already exporting products to various markets in the region. The UK is the top supplier of sheep meat to Ghana, and – although volumes imported are lower than imports of beef and pork – there is potential to build on the amount of lamb exported to the country.

Pork is the main meat the UK exports to Côte d’Ivoire (Ivory Coast), with an annual average of over 1,000 tonnes shipped in recent years. EU countries (such as France and Spain), as well as Brazil and Canada, are leading suppliers, but the UK is a top ten origin for pork imports, and there is space to grow market share. Improvements can also be made for beef and lamb exports to Côte d’Ivoire.

Offal is a key export product to Ghana, Côte d’Ivoire and South Africa as an affordable protein source. The UK, USA and Australia are the top three origins for South African offal imports. The main pork offal products the UK exports to South Africa are feet, hearts and bellies, while the main beef offal products are livers, hearts, kidneys and feet.

In South Africa, there is potential for premium cuts and dairy due to it being among the richest countries in Africa. However, it has a considerable wealth gap: 10% of the population owns 80% of the nation's wealth. Per capita consumption of beef and sheep meat in South Africa is higher than the global average.

South Africa is also a larger cheese importer than other sub-Saharan countries. The UK exported a few thousand tonnes of cheese to the country in 2015 and 2016, but this fell to a few hundred tonnes between 2018 and 2022.

While it is hard to generalise in such a diverse region, the UK has a foot in the door. UK red meat and dairy exporters can, in the long term, take advantage of the opportunities that arise as this region develops further and its population expands.

Where do the opportunities lie?