- Home

- Sub-Saharan Africa: How much do they consume?

Sub-Saharan Africa: How much do they consume?

Meat consumption per capita in sub-Saharan Africa is around three times lower than the global average. However, this varies by country: some have higher than average consumption of meat, such as South Africa, Gabon and Chad, while some, such as the Democratic Republic of Congo, Côte d’Ivoire, Nigeria and Ethiopia, have much lower consumption than the global average.

Beef

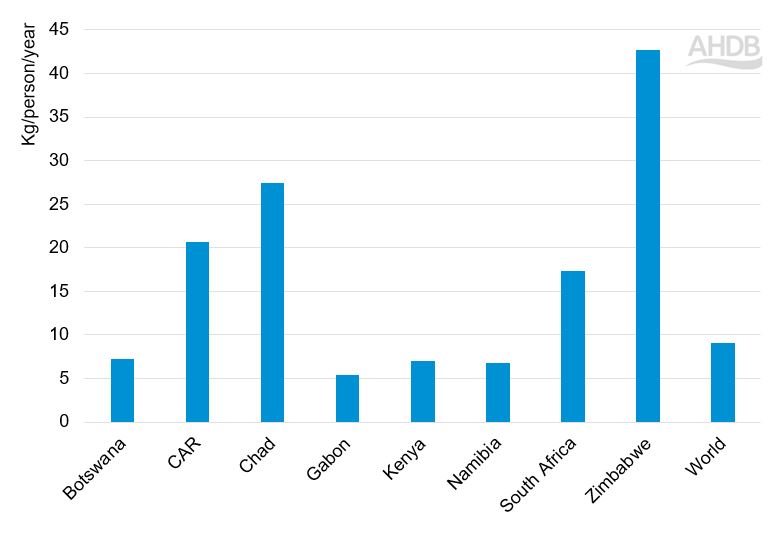

Beef consumption per capita is particularly high in Zimbabwe, with average consumption of over 40 kg per person per year between 2018 and 2020. Consumption in Chad, Central African Republic (CAR) and South Africa is also higher than the global average of 9.1 kg per person per year.

Figure 1. Beef consumption per capita in selected sub-Saharan Africa countries, 2018–2020 average

Source: FAO

South Africa is the largest beef producer in sub-Saharan Africa. Based on the 2018–2020 average and the countries shown in Figure 1, beef production in Chad, Botswana, Namibia and South Africa outweighs consumption by at least 10 Kt. In Kenya, however, average beef consumption per year between 2018 and 2020 was almost 36 Kt lower than domestic production over the same period. Overall, in most sub-Saharan African countries, beef consumption exceeds production levels.

The UK exported an average of 2.7 Kt of pork and 2.0 Kt of beef per year to South Africa between 2019 and 2021. To put things in context, the UK was in the top three origins for pork imports to South Africa over this period and in the top five for its frozen beef imports.

Beef production systems in the region vary from modern integrated operations to small-scale, inefficient, restricted by infrastructure and have poor access to markets. These latter production systems are in the majority. So to satisfy domestic demand, sub-Saharan Africa is likely to have a high dependency on imports.

The last published OECD/FAO forecasts of beef consumption growth in sub-Saharan Africa are from 2016, when beef demand in the region was expected to increase by 2.6% per year out to 2025. Beef consumption growth in Kenya, Tanzania, Ethiopia, Zambia and Nigeria was expected to be particularly strong (at least 3% per year) to 2025. Economic modelling work published in 2021 by Falchetta et al. projects that beef consumption in sub-Saharan Africa could reach an average of 19 kg/person/year by 2050.

Pork

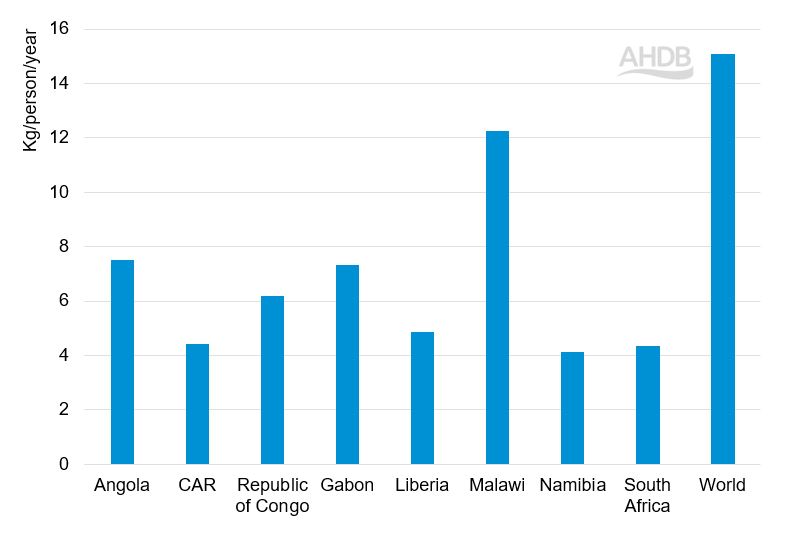

Pork consumption per capita in sub-Saharan Africa is lower than the global average. Malawi has the highest pork consumption per capita (12.3 kg/person/year) out of the countries shown in Figure 2.

Figure 2. Pork consumption per capita in selected sub-Saharan Africa countries, 2018–2020 average

Source: FAO

Nigeria, Malawi and South Africa are among the largest pork producers in the region, with output averaging around 265 Kt to 300 Kt per year between 2018 and 2020. In most sub-Saharan African countries, consumption outweighs production.

Angola, in particular, has a high imbalance of pork production against consumption, with output over 100 Kt lower than domestic demand (2018–2020 annual average). As a result, the country has high pork imports compared with other sub-Saharan Africa nations. The Democratic Republic of Congo, Republic of Congo and Côte d’Ivoire also have a deficit of 20–30 Kt of pork.

Pig farming in the region is dominated by smallholders in rural areas with poor infrastructure and limited biosecurity leading to spread of disease. The pork industry in South Africa is more advanced and has better prospects for expansion due to the strong genetics of the pig herd and more scientific feeding practices, although biosecurity is an issue there too.

The latest forecasts for pork consumption growth in sub-Saharan Africa by the OECD/FAO (2016) suggested a slowdown compared with previous years, but also that 45% of additional pork demand would be met by increased imports. A more recent analysis by Falchetta et al. projects that pork consumption in the region will reach 15 kg/person/year by 2050.

Sheep meat

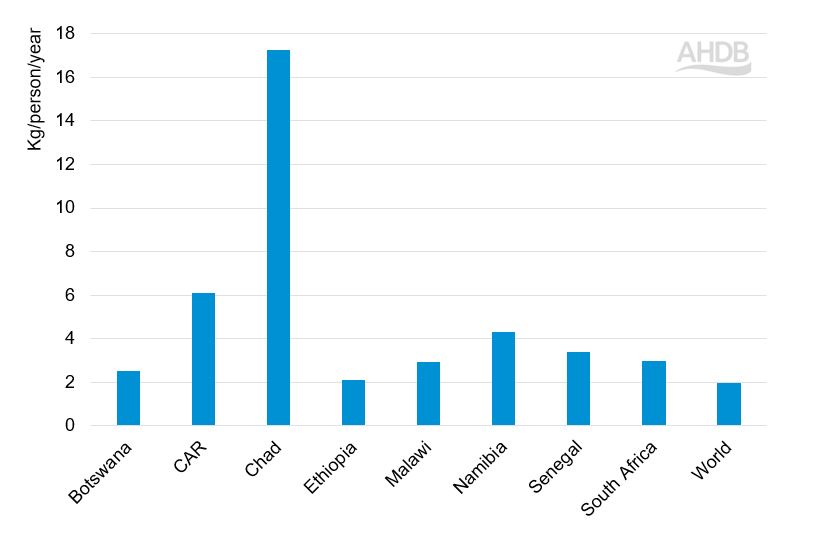

Sheep meat consumption in sub-Saharan Africa is low compared with other red meat, most probably because it is more expensive.

Since FAO data groups sheep meat with goat meat as ‘mutton and goat meat’, Figure 3 shows per capita consumption of this group in selected sub-Saharan African countries (2018–2020 average).

Figure 3. Mutton and goat meat consumption per capita in selected sub-Saharan African countries, 2018–2020 average

Source: FAO

Chad has the highest per capita consumption of mutton and goat meat in the region, at more than eight times the global average.

Nigeria and Chad are among the top mutton/goat meat producers, with an annual output of 420 Kt and 300 Kt (2018–2020 average), respectively. In the Central African Republic and Democratic Republic of Congo, mutton and goat meat consumption outstripped domestic production by around 1.6 Kt per year over the same period.

The last published OECD/FAO forecasts of sheep meat consumption in sub-Saharan Africa (2016) estimated that growth seen in recent years would be sustained out to 2025 and that sheep meat imports would comprise a small share of additional consumption due to advances in domestic production. Economic modelling by Falchetta et al. predicts average sheep meat consumption in sub-Saharan Africa to reach 8 kg/person/year in 2050.

Poultry

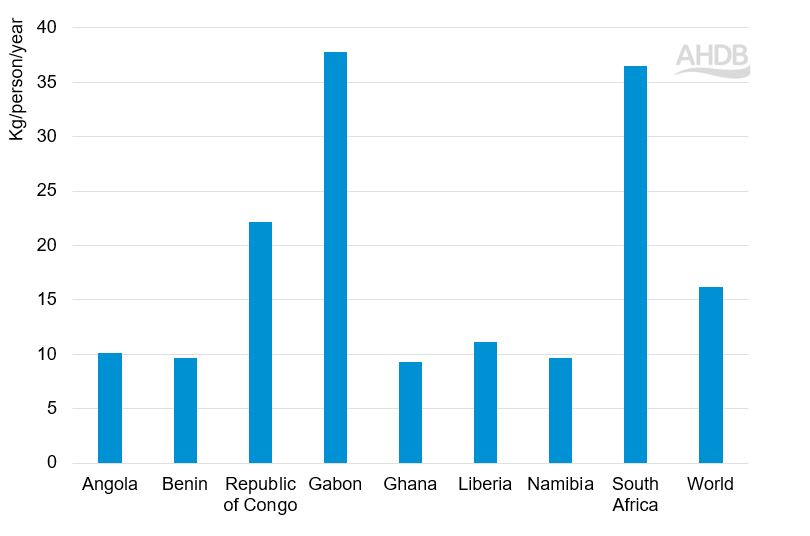

Poultry meat is widely consumed in sub-Saharan Africa and provides competition for red meat demand. Figure 4 shows that South Africa and Gabon are big consumers of poultry in the region, with per capita consumption greater than the global average.

Figure 4. Poultry meat consumption per capita in selected sub-Saharan African countries, 2018–2020 average

Source: FAO

The OECD/FAO’s outlook to 2031 predicts that poultry meat will comprise two-thirds of the increase in meat imports to Africa over the next decade.

Offal

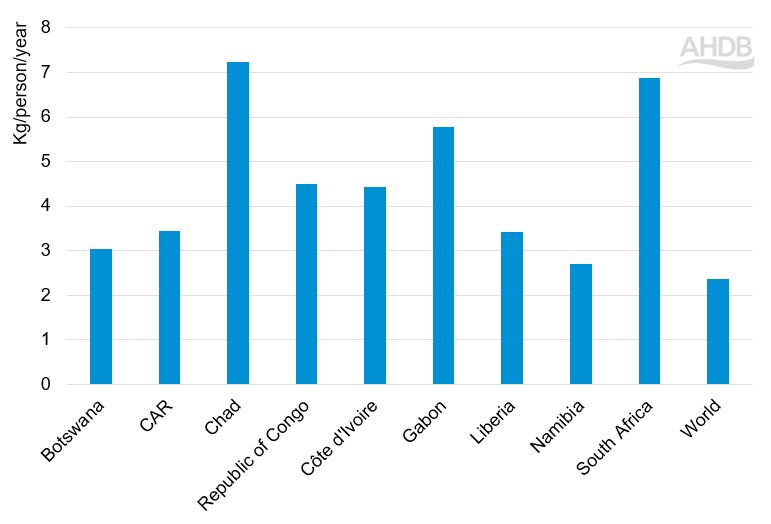

Offal is a source of low-cost protein which has high demand in parts of sub-Saharan Africa. Offal products are commonly used by street restaurants known commonly as ‘chop bars’ and are popular with people on low incomes. Figure 5 shows that offal consumption is above the global average in many sub-Saharan African countries, particularly in Chad and South Africa.

Figure 5. Offal consumption per capita in selected sub-Saharan African countries, 2018–2020 average

Source: FAO

Dairy

In general, processed dairy products are usually in higher demand in high-income countries, while fresh dairy products are more popular in low/middle-income countries.

Fresh dairy consumption in sub-Saharan Africa was estimated at 3 kg per person per year (2019–2021 average) by the OECD/FAO and is forecast to increase to 3.3 kg per person per year by 2031. Demand for fresh dairy products in the region was a third of the average global figure (2019–2021 average).

Per capita consumption of processed dairy products is even lower, at 0.6 kg per person per year (2019–2021 average) and is forecast to grow only slightly to 0.7 kg per person per year by 2031. (Global consumption per capita of processed dairy products is estimated at 4.3 kg per person per year.

Despite the relatively low levels of consumption, sub-Saharan Africa is highly likely to be reliant on imports to satisfy demand, as domestic production is expected to fall short of consumption levels.

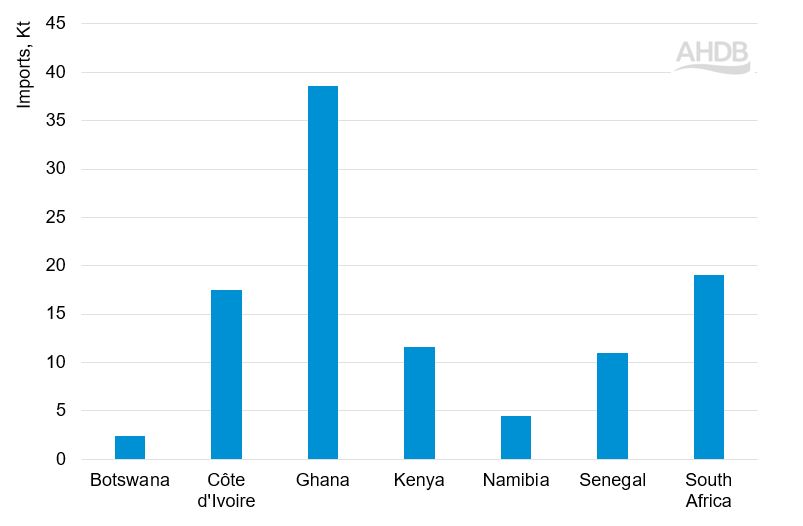

Trade data for sub-Saharan African countries is limited. For this analysis, data was available only for Botswana, Côte d’Ivoire, Ghana, Kenya, Namibia, Senegal and South Africa.

Figure 6 shows milk powder imports in selected countries of sub-Saharan Africa. Ghana imports twice as much as the next highest. Most of these imports to the region are from EU countries, though New Zealand, Malaysia and Saudi Arabia are also important origins. The UK has exported milk powders to these countries but in small quantities.

Figure 6. Milk powder imports in selected sub-Saharan Africa countries, 2019–2021 average

Source: Compiled by Trade Data Monitor LLC

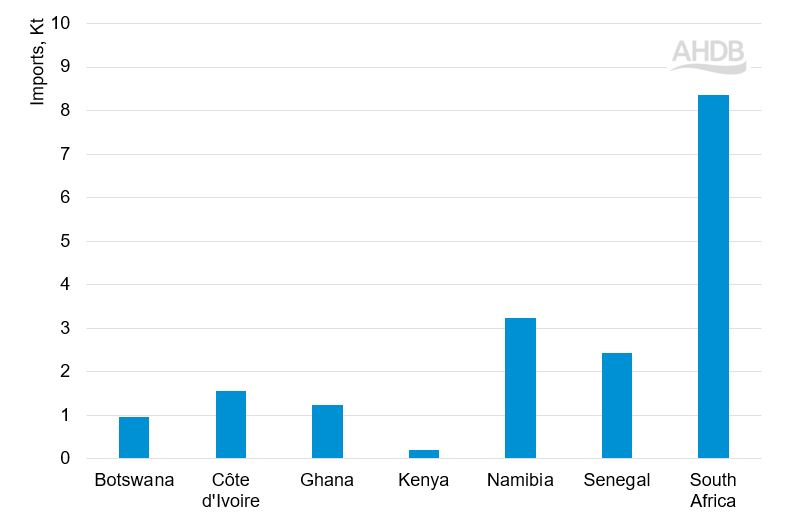

Cheese and butter imports are considerably lower than those of milk powders. Out of the cheese-importing countries shown in Figure 7, South Africa imports by far the most. The most growth in cheese imports in recent years has been seen in Ghana and Senegal.

Figure 7. Cheese imports in selected sub-Saharan African countries, 2019–2021 average

Source: Compiled by Trade Data Monitor LLC

Continue reading about the sub-Saharan Africa market

Market access and barriers to trade

Back to

Prospects for UK agri-food exports: home page for the sub-Saharan Africa market