- Home

- Markets and prices

- Dairy markets - Supply and demand - Dairy production - Global milk deliveries

Global milk deliveries

Updated 24 April 2024

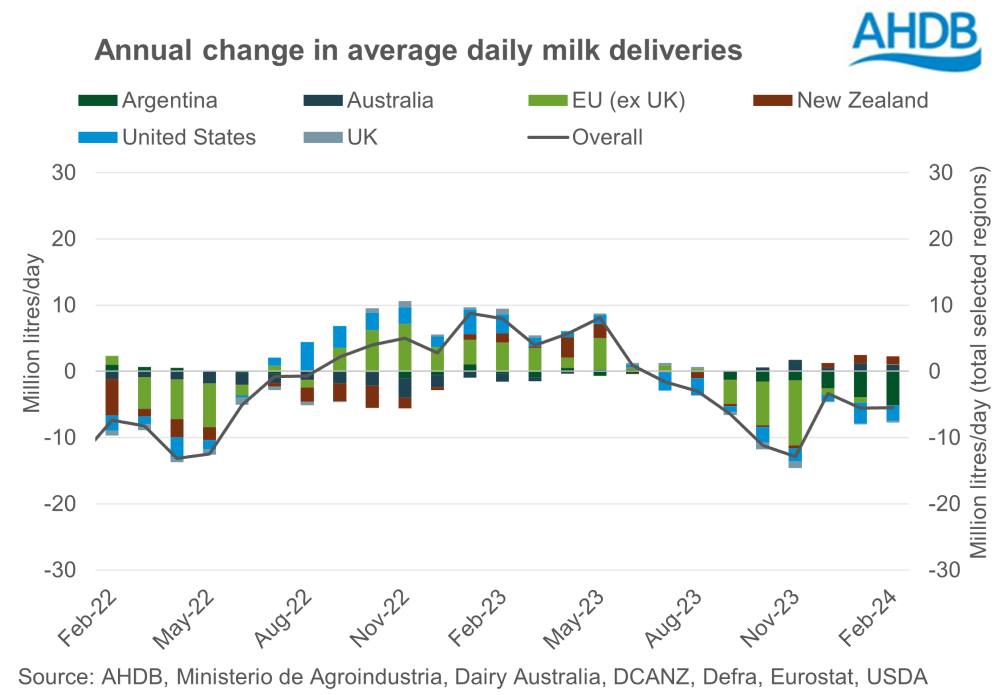

Trends in global milk supplies impact on prices. Deliveries in the six key exporting regions are tracked to provide an overview of current production levels and trends in global milk supplies.

The milk production regions included are the EU-27, UK, Argentina, Australia, New Zealand and the United States. Combined, they account for more than 65% of global cow's milk production and around 80% of global exports of dairy products.

Overview

- Global milk deliveries averaged 813.0 million litres per day in February, a decline of 5.5 million litres per day (-0.7%) across the selected regions, compared to the same period last year. Australia and New Zealand recorded year on year volume increases, EU was stable, and Argentina, UK and the US declined.

- Milk deliveries in the EU averaged 387.2 million litres per day in February, with negligible change compared to the same period of the previous year.

- Looking at this EU figure in greater detail, we saw the greatest year on year volume change in German milk production, up 81.0 million litres (3.3%). Production in France was also up, by 74.8 million litres (4.0%) and in Poland by 73.3 million litres (7.4%), on the previous year. On the contrary, Irish production continued to see significant falls year on year, down 50.6 million litres (13.3%).

- UK daily deliveries averaged 40.9 million litres per day in February, down 0.6% on last year. The decrease in production can be attributed to lower yields per cow. Lower milk prices in 2023 compared to the previous year combined with high input costs meant that producers were not incentivised to push production, resulting in a lower milk yield.

- US production was down 0.8% year on year, with a 2.4 million litre per day decline on the average deliveries in February, compared to the same month last year. Herd numbers are back significantly on the year, following a period of high culling.

- Australia recorded an increase in milk production, with deliveries up 1.0 million litres (5.0%) compared to last year, to sit at an average of 20.8 million litres per day.

- New Zealand deliveries were also up 1.2 million litres per day on last year’s figure, with February’s average daily deliveries at 64.1 million litres per day. Market reports suggest that yields were bolstered by warmer and wetter than anticipated weather conditions, which led to good pasture growth.

- Argentina’s production further declined in February, down 5.1 million litres per day (17.8%) versus last year. Economic challenges teamed with extremely high temperatures coupled with high humidity negatively impacted cow performance, which amplified the declines in production seen throughout the season.

Additional information

- The tracker is a baseline for comparing against actual production, not a forecast of milk production.

- The baseline is calculated using historic month-on-month movements in milk production, providing information on a typical milk year in each of the key regions.

Download dataset

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.