- Home

- Knowledge library

- Opportunities to raise the reputation of red meat in the dining out market

Opportunities to raise the reputation of red meat in the dining out market

This analysis examines opportunities for the UK foodservice industry to elevate its red meat offering through communication on menus.

Pinpointing the opportunities

The out of home market remains an important area for red meat accounting for between 6 and 13% of beef, lamb and pork volumes, according to AHDB volume estimates. In addition to this, popular trends and dishes that emerge via the foodservice market often eventually filter through to what consumers cook in-home, so it is important red meat is in the consideration set out-of-home (OOH). So how can UK eating-out establishments elevate their red meat offering to encourage choice when dining out?

Who is this analysis for?

We aim to help restaurants and other eating out establishments to capitalise on opportunities to maximise sales of red meat. This benefits levy payers by improving the reputation of red meat among consumers and increasing demand in the market.

Key findings

Part 1 - Get the menu and dish choices right for your diner. Click for evidence

- Getting the menu right, and therefore the red meat offering, is key to venue choice

- Establishments must meet consumer meal occasion needs as they influence venue and meal choices

Part 2 - Communicate red meat quality, taste and reputational credentials. Click for evidence

- Quality drives enjoyment. Quality cues for red meat on menus are beneficial, such as signalling British or local sourcing, and accreditations

- Sustainability reassures but isn’t top of mind when selecting a dish from the menu, communicate off menu

- Foodie images and dish descriptions on menus around preparation and cooking methods, as well as flavour and eating experience, bolster red meat quality and taste perceptions

- Health messaging takes lower priority on menu but should still be utilised elsewhere such as the restaurant website

Part 3 - The positive impact on red meat and other opportunities. Click for evidence

- The more descriptive the menu the more long-term red meat perceptions are improved, also driving sales

- A strong menu featuring red meat can be supported by other touchpoints such as knowledgeable staff

Conclusion

Pubs/restaurants have a role to play in promoting the consumption of red meat and menus are a key source of information (alongside the website and more general information boards). Red meat is a popular choice for diners out of home and is very much perceived as a tasty treat.

Menus that talk about and promote taste also raise quality perceptions and vice versa - dishes that promote quality generally raise taste expectations. Descriptors, accreditations, and logos on the menu generally reassure diners about their choice. More descriptive menus can reassure consumers and boost perceptions of British red meat as tasty and nutritious, as well as more sustainable than red meat sourced from other countries.

Pubs/restaurants and menus (in particular) therefore have a role to play to support the reputation of red meat and wider industry messaging moving forward.

Background

The foodservice market has faced its most challenging period in recent history, with market turnover hugely impacted by the coronavirus pandemic, and is now facing challenges from the cost-of living crisis. However, while there is an immediate challenge, the longer-term picture means that red meat’s reputation will be key. More than two thirds of out of home consumers say they are very sustainability conscious (Lumina Intelligence), while health and animal welfare are also considered.

However, the OOH market is still very much driven by indulgence and an enjoyment. This is an area red meat can capitalise on due to its strong taste perceptions.

Communication on menu provides an opportunity to ensure red meat maintains its appeal and the long-term reputation of the industry is protected. Following research into red meat reputation in the retail environment, both in-store and online, AHDB commissioned independent market research agency The Nursery to explore similar themes, via focus groups and menu testing/eye tracking, in the dining out market. Due to the complex nature of the market, this research focussed on mid-range pub/restaurant dining, however some findings are likely to be relevant to other parts of the foodservice market.

Utilising a two-stage mixed methodology*, the research set out to answer these objectives:

- Do reputational keywords, logos/accreditation and imagery on menus improve attitudes towards the red meat industry, the food itself and the pub/restaurant?

- Does it improve sales? Does it convert people to beef, lamb and pork and encourage them to choose red meat more often?

- Will people pay more for the red meat dish?

The research programme utilised a two-stage mixed methodology:

Qualitative workshop

A qualitative workshop took place at the start of December 2022, with 16 respondents aged between 18 and 60. All were non-rejectors of beef, lamb and pork and ate red meat (at least two of the following red meat types: beef, lamb and pork) at least once per week. They also all to ordered a red meat dish when dining in a restaurant a minimum 40% of the time.

This workshop covered a range of territories, including health/wellbeing, provenance, sustainability and meat preparation and aimed to understanding the influences and factors which encourage people to choose a restaurant serving meat. It also delved into reputational keywords, logos and accreditations and what might consumers to choose a beef, lamb or pork based meat dish and/or potentially pay more for it.

Quantitative survey

Taking place in February 2023 (in order to avoid Christmas and Veganuary), the stage tested findings from the qualitative stage with 1,034 respondents in an online survey. They were people who do not rule out any type of red meat (beef, lamb or pork) and who eat out in restaurants once a month or more. Otherwise, the sample was nationally representative.

Findings from the qualitative research enabled us to develop a creative brief to steer the design of two menus, which were professionally created and designed in the style of a mid-range pub / restaurant. This allowed us to test the impact of the two menus (A/B tested) and more specifically identify the keywords, images and logos on these menus that are more likely to affect and influence consumer attitudes and choices. While the survey was focussed around the menus, it also captured broader attitudes and opinion related to red meat in the dining out market.

- The foodservice market is vast and highly complex. For the purposes of this research, we focused on a mid-range restaurant/pub, getting our respondents into the mindset of this sort of venue for their stipulated meal occasion. Given that the research highlights the subconscious role of icons and logos, some findings are likely to be relevant to other parts of the foodservice market.

- In addition to this, we homed in on the role of the menu, with findings from this research showing how important it can be. However, the role of other touchpoints was not explored in depth. Our research showed the importance of a pleasant atmosphere when dining out and therefore the full path to consumption (not just the menu) should always be considered.

- People choose to dine out for a range of reasons. We chose three core occasion types as part of this research – a romantic meal, a celebration with friends, and a family meal out. There were commonalities across these occasions, but each had some nuances, highlighting that any future research or implementation of findings should be considered within the occasion the venue is targeting.

Key graphics

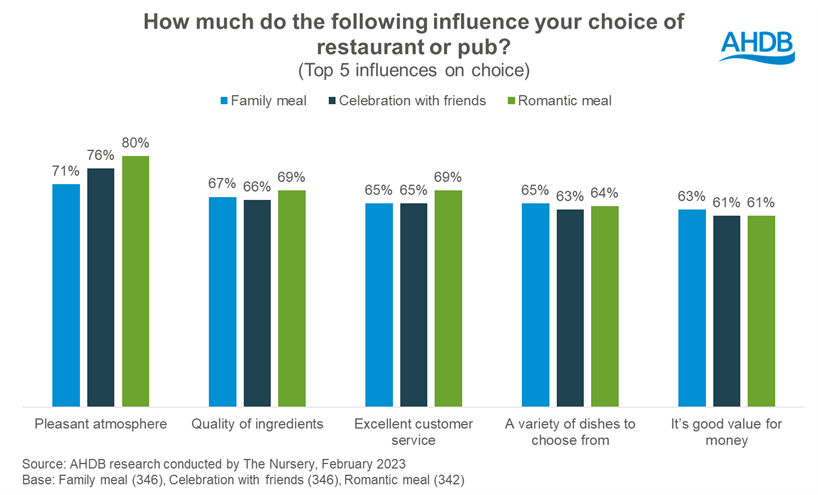

There is a common rank to the top influences on pub/restaurant choice. A pleasant atmosphere is most important, while the quality of ingredients ranks second.

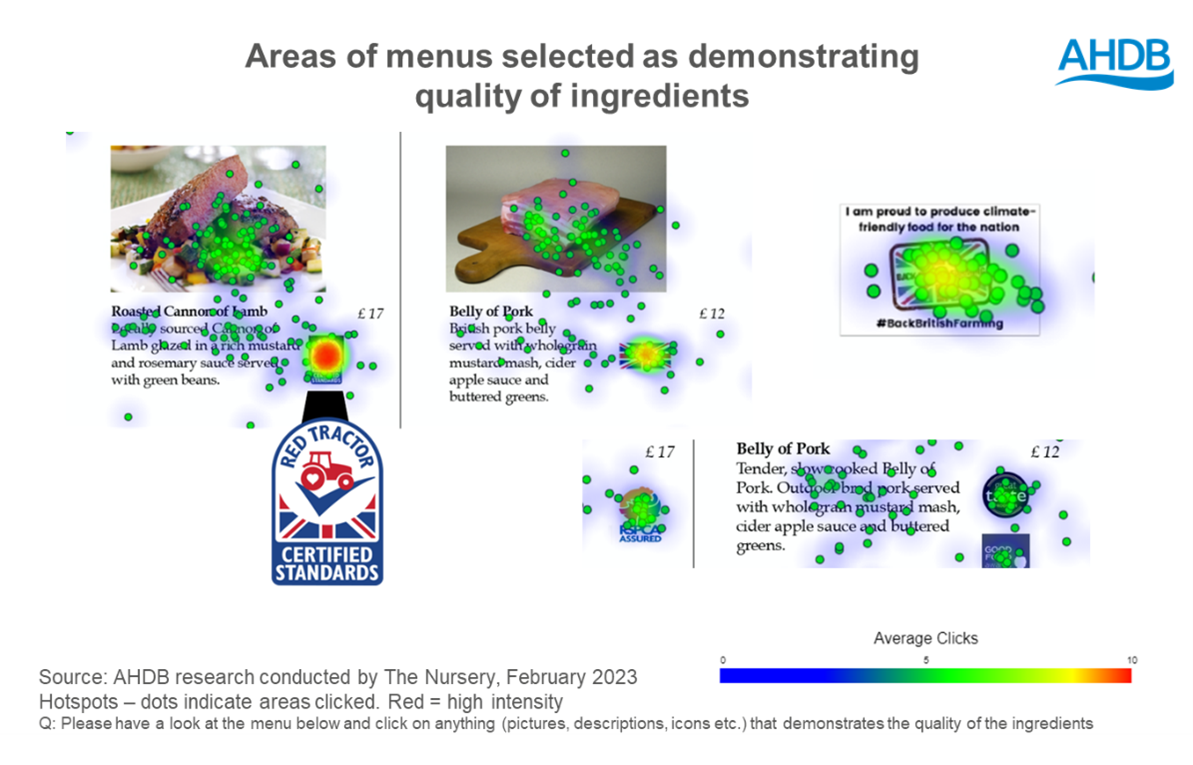

When presented with mock menus and asked to select which areas signalled meat quality to them, logos and accreditations were clear indicators.

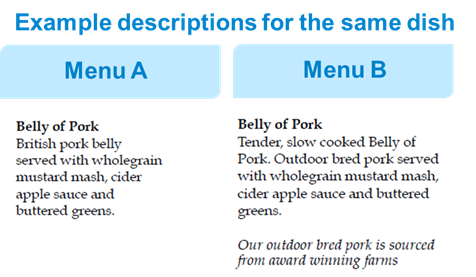

In our mock menu testing, one menu (A) had simpler descriptions, while the other (B) contained more dish descriptors.

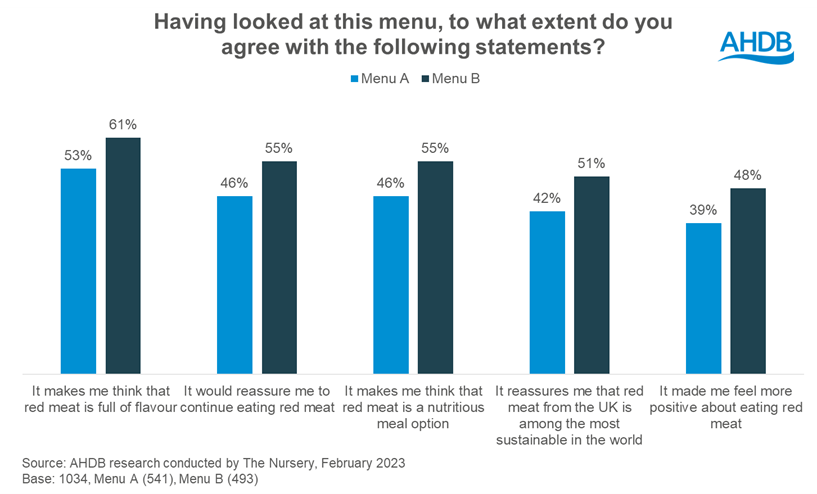

It was clear in the results that the descriptive menu (B) conveys the messages more strongly than the simple menu and leads to a higher level of reassurance around red meat consumption.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: