2023 dairy trade review: improved balance of trade

Thursday, 22 February 2024

Key trends

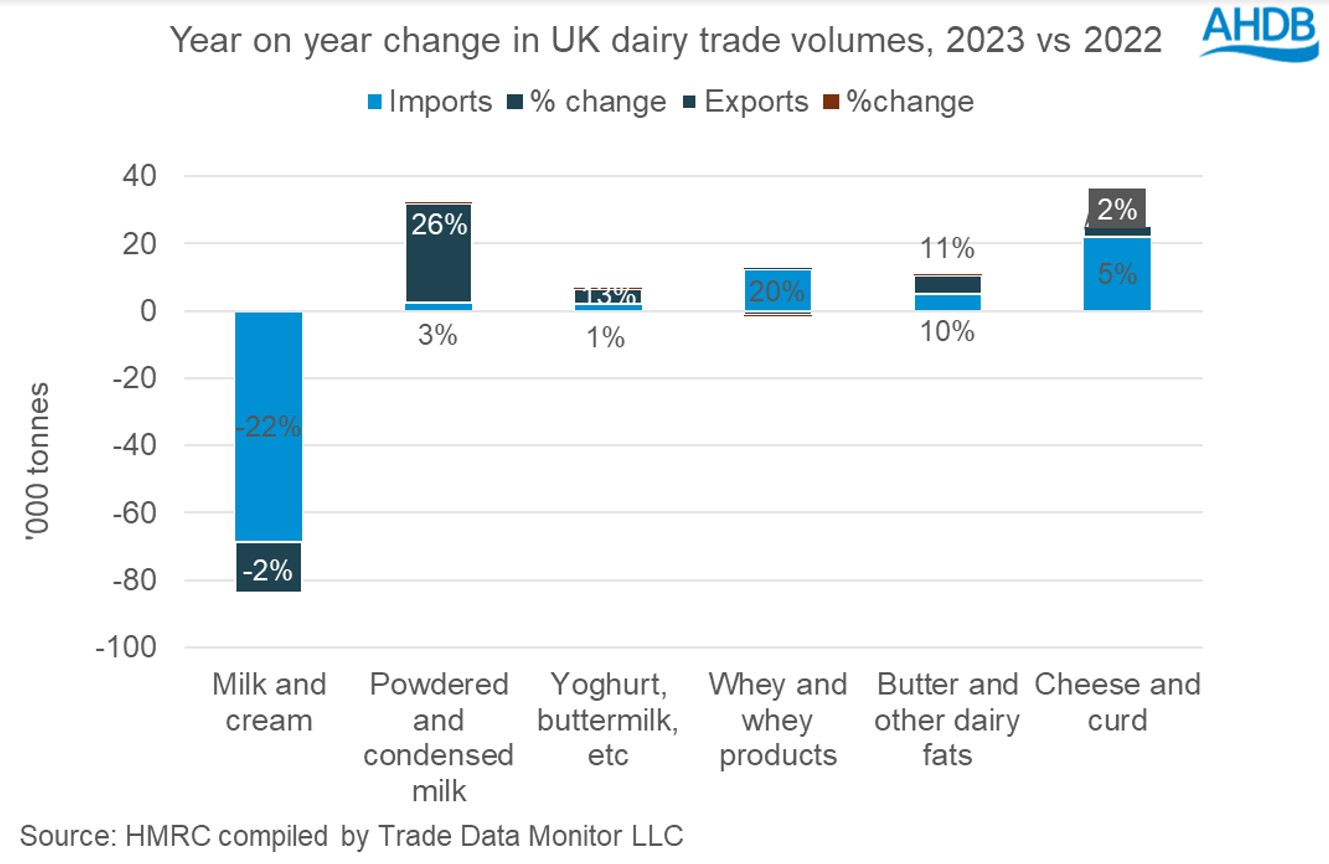

- Total UK dairy export volume for 2023 was up 2.2% on 2022 to 1226.8 Kt.

- Total UK dairy import volume for 2023 was down 2.1% on 2022 to 1149.8 Kt.

- Powdered and condensed milk exports were the hero product, recording an increase of 26.4% to 140.3 Kt.

- Changing market conditions, weather patterns and global economic trends will be vital in shaping trade flow.

Yearly

Over the course of 2023, exports saw a steady increase compared to the previous year, whilst imports declined by a similar margin. The EU continues to remain the most important market for dairy trade, despite Brexit.

Exports

Total export volume for 2023 was 1.23m tonnes, an increase of 25,800t (2.2%) from 2022. While the level of exports to the EU declined marginally by 3100t (-0.3%), encouragingly, exports to non-EU destinations picked up during the year. Powdered and condensed milk saw the largest increase in export volumes, up by 29,300t. This was followed by butter and other dairy fats, yogurt and buttermilk, and cheese and curd increasing by 5,500t, 4,200t and 3,200t respectively. Milk and cream, and whey and whey products were an exception to the basket with exports declining by 15,100t (-1.9%) and 1,300t (-1.8%) respectively.

The significant increase in exports was driven by Bangladesh 5,100t, Egypt 4,400t, Nigeria 3,300t, United Arab Emirates up by 2,300t, South Africa 1,900t, Morocco 1,800t, Libya 1,700t, Bahrain 1,100t and Lebanon 1,100t. However, exports to China, one of the major drivers of world dairy trade, dipped in 2023 by 1,400t (-16.5%) which held back overall volumes.

Imports

Total import volumes are down over 25,000t (-2.1%) from 2022 levels to 1.15m tonnes. This was predominantly driven by a decline of 22,200t from EU nations which make up the vast majority of our imports. Major EU nations contributing to the decline are France down by 24,200t, Netherlands 5,600t and Poland 2,300t.

The most significant decline was in milk and cream imports by 68,600t (or-22.4%) Conversely, imports of whey and whey products saw a noticeable increase of 12,400t (20.4%), butter and other dairy fats up by 5,100t (9.7%), cheese and curd 22,100t (5.4%). Powdered and condensed milk and yogurt imports saw a minimal change from 2022 levels up by 2,500t (3%) and 2,100t (0.8%) respectively.

Fears of a flood of New Zealand imports have not yet materialised with imports from that destination declining by 26t, or 14% since 2022.

Quarter 4

Exports

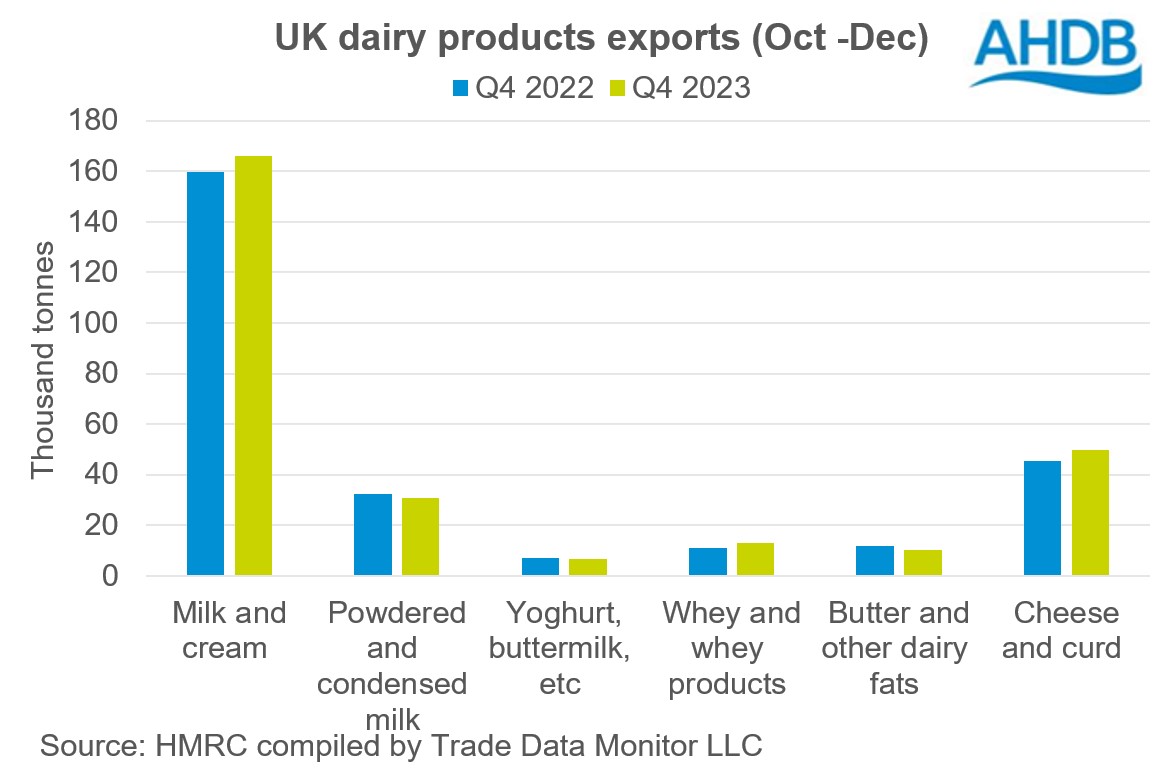

Export volumes of dairy products continued the upward trajectory in the fourth quarter year-on-year. Total export volumes for Q4 2023 were 276,300t, an increase of 9,000t from Q4 2022. The level of exports to the EU, our biggest trading partner by far, increased by 6,200t while that to non-EU destinations increased by 2,900t.

Exports of milk and cream increased by 4.0% (6,400t) and cheese and curd increased by 9.6% (4,400t). However, declines were noted in other products: butter and dairy fats dropped by 1,600t (-13.3%), powdered and condensed milk down by 1,700t (-5.2%), and yogurt declined by 700t (-9.1%).

In the export basket, EU nations constitute nearly 90% of the total exports. In other regions, some of the most significant exports have been to Middle East – exports to Egypt up by 2,500t, Nigeria 900t, Bahrain 500t, Lebanon 629t. However, lower exports headed to Morocco, Libya and Algeria compared to Q4 last year.

Imports

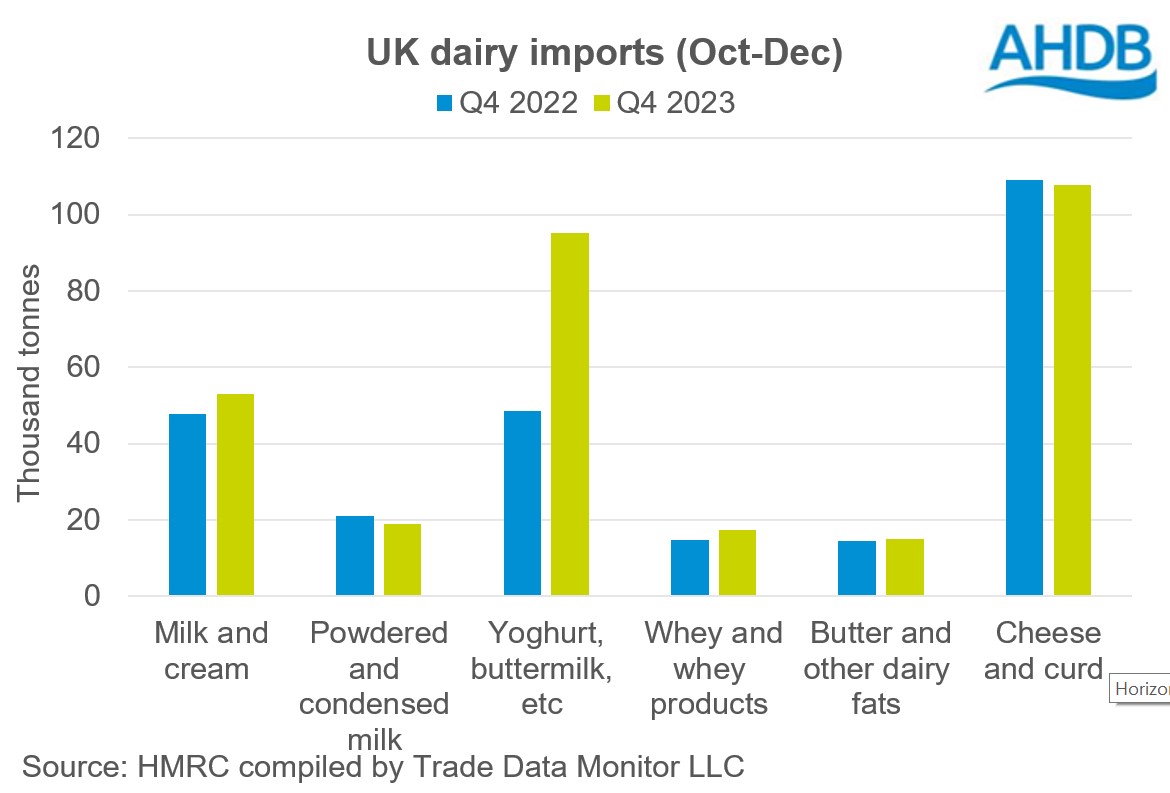

Total import volumes increased by 20.1% (51,500t) in Q4 2023 compared to the same period last year, driven by the EU.

Q4 imports of yogurt and buttermilk have almost doubled since Q4 2022 at 95,300t, up by 46,600t. Imports of milk and cream, whey and whey products, butter and other dairy fats have gone up by 11%, 17.4% and 2.9% to 53,200t,17,300t and 15,000t respectively on Q4 2022. Powdered and condensed milk and cheese and curd were an exception declining by 2,100t (-9.8%) and 1,300t (-1.2%) respectively.

With the government having committed in May to a new £1 million programme of support to aid British dairy exporters, focus on exports of value added products like cheese which could help support domestic prices will be welcome. Looking beyond the EU to more emerging markets where there is a growing appetite for dairy products could yield dividends in the longer term.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.