2023 Pork trade review

Thursday, 29 February 2024

Key points

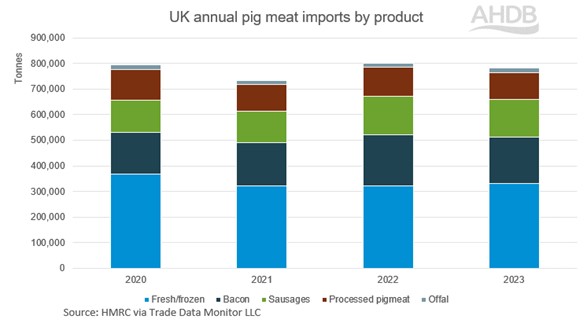

- Total pig meat import volumes back 2.5% compared to 2022, with declines driven by reductions in bacon volumes

- Import reductions led by the Netherlands and Germany, as Denmark’s import levels remain static on the year

- Export volume declines reflect the challenging export arena both inside Europe and further afield

Imports

In 2023, key product categories remained finely balanced, with annual import volumes seeing two distinct trends. January to April trade flows were back on 2022, driven by a range of factors, including a tight price differential with EU product limiting import volumes. From May onwards, a greater price differential alongside tight domestic supplies enticed larger pig meat volumes from the continent, as we discussed in 2023. This mixed market dynamic throughout 2023 resulted in total imports being back 2.5%, when compared to 2022, at 781,600 tonnes.

When looking into the detailed category breakdowns, the total fresh/frozen category saw increases of 3.4% to 331,500 tonnes. Meanwhile, bacon saw the greatest reductions in import volumes, back 10.2% on the year to 180,300 tonnes, this being the dominant driver in the overall decline. Interestingly, this has moved the dial on our overall UK import profile, with fresh and frozen product increasing its market share at the cost of bacon.

Denmark and the Netherlands remained our key suppliers in 2023, with most countries remaining relatively static in terms of import volumes. The biggest movement seen was from Germany, which saw a 11.8% drop in pig meat volumes sent to the UK throughout 2023.

According to data from December, most categories of pig meat echoed the annual trends discussed above, with the exception of the fresh/frozen pork category, which saw a 1.9% increase YOY.

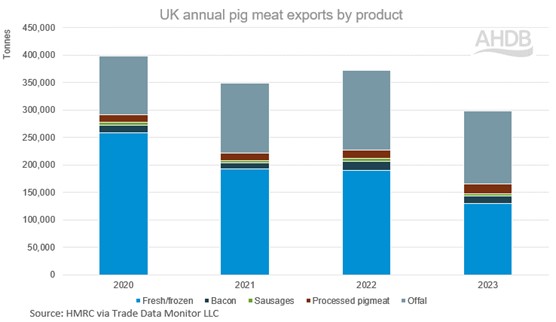

UK annual pig meat exports by product

Source: HMRC via Trade Data Monitor LLC

Exports

Meanwhile, exports of pig meat remain low compared to previous years as the export marketplace continues to present challenges, with price differentials, less available product and subdued demand in Europe and further afield all playing a role. For the full year 2023, exports of pig meat were down by 20%, when compared to 2022, to 298,300 tonnes.

Total fresh/frozen product volumes witnessed the biggest decline in export volumes, down 31.3% in the year, with supply challenges and price points playing a prominent role in this decline. The one category to see some small increase was processed product, with volumes up 6.4%; however, these volumes are from a small baseline.

While the offal category was also under pressure, this category has remained resilient, down by just 8.3%, with these exports continuing to remain a crucial factor for carcase balance through 2023.

From a country perspective, all key trading partners saw volume decreases compared to 2022, with exports to the EU27 seeing declines of 21.6% and a reduction of 36,100 tonnes of product. Meanwhile, exports to China equally saw reductions, which were down 11.4% (14,500 tonnes) on the year.

We explore how these trading dynamics are set to impact the marketplace as we move into 2024, including some new opportunities for exports, in our latest Agri Market Outlook.

UK annual pig meat exports by product

Source: HMRC via Trade Data Monitor LLC

To see individual category volumes and values, please look at our pig meat trade dashboard.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.