Q2 2023 Dairy market summary

Wednesday, 16 August 2023

The second quarter of 2023 has been dominated by falling milk prices. In most cases, input cost inflation has slowed and gone into deflation however input costs remain well above 2020 levels putting a lot of pressure on farm margins. Continuing lack of demand, both locally and globally, has put a brake on prices, even as retailers return to price cuts on milk. Despite this, production remains up with strong grass growth encouraging farmers to retain stock. How low will prices fall?

Milk production

Production in July is estimated to have totalled 1,028 million litres, ending the month at 0.8%, or 8.6 million litres, ahead of July last year. This is unsurprising when you consider that in July 2022 we were in the midst of a prolonged drought period, whereas July this year was one of the wettest on record.

High input costs and low milk prices ought to be a deterrent to milk production but for now, with forage being readily available, production has stayed afloat. Our latest forecast for the 2023/24 milk season estimates that GB milk production will be flat compared to last year, with production likely to begin to falling after August.

Organic production is already falling as the factors of falling demand, higher costs and lower prices are exaggerated and felt more keenly in the organic sector.

Much will hinge on cow numbers. The rate of decline in the GB milking herd has been slowing according to BCMS data, only declining by 0.5% in April, or 8,900 head per annum. However, with pressures on margins we may see this accelerating in the Autumn. Unseasonably high grass growth is supporting cow numbers for now but farmers may need to act soon to take advantage of high cull cow prices. Current market signals are for beef prices to fall going forwards.

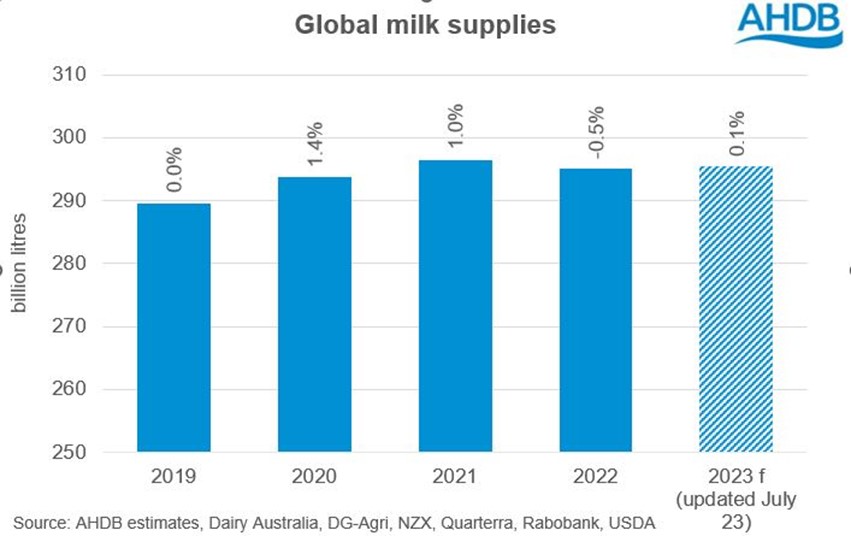

Global production is not helping matters. Estimated global milk deliveries for May (the latest available data period) in our key production regions indicate production growth of 1.1% year-on-year. According to latest forecasts, however, estimated global milk production is expected to flatten off in 2023 to end the year at only 0.1% up.

Product availability

Product availability has outstripped demand in some cases leaving full inventories of butter and cheese in the EU for Q1 with increased production and reduced imports and exports. Available supplies of butter, cheese and whole milk powder (WMP) increased year-on-year whereas that of skimmed milk powder (SMP) has declined. Availability of SMP supplies declined by 20.6% year-on-year in Q1 2023 due to a 32.6% growth in exports.

Farmgate prices

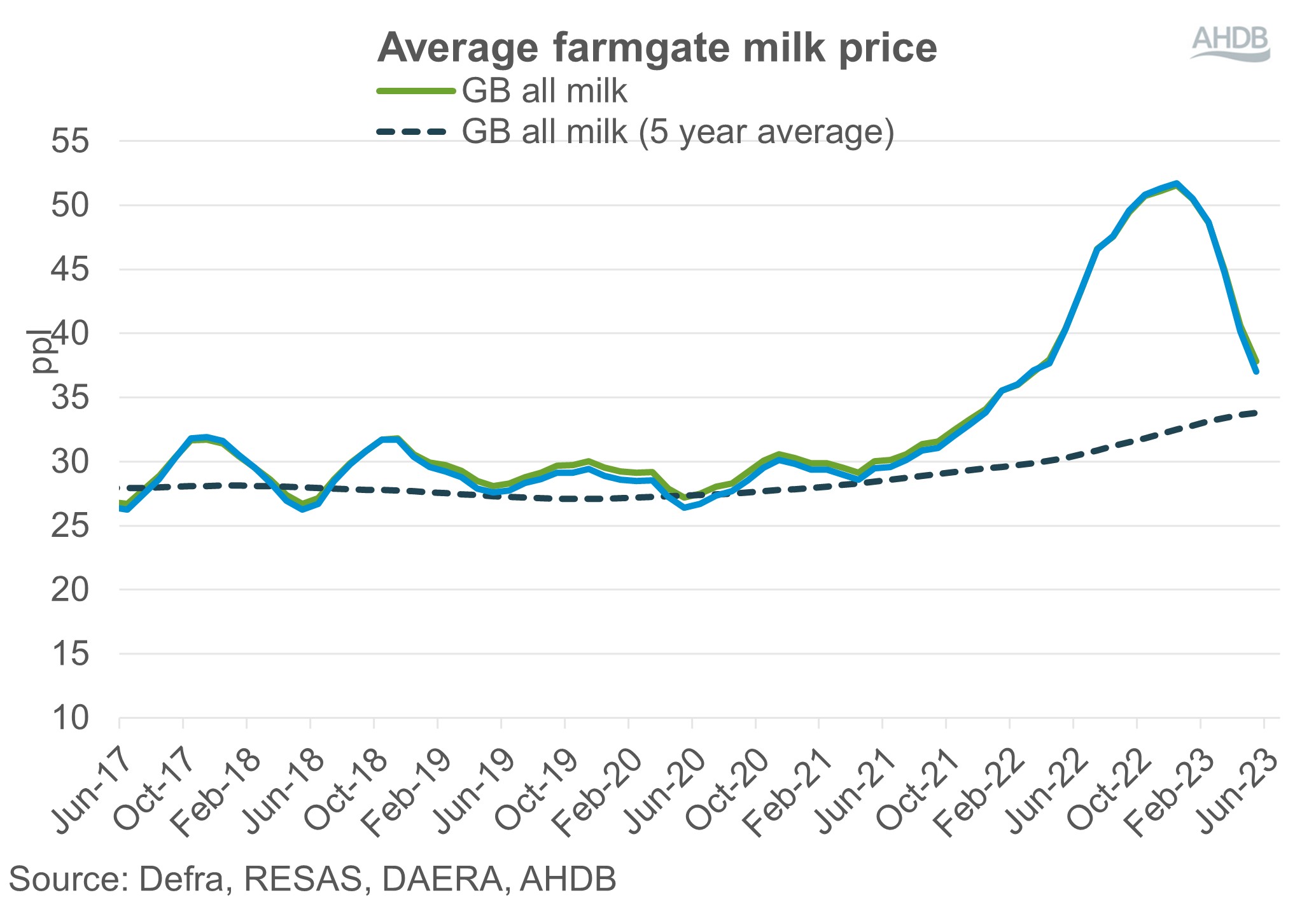

Suppressed demand and increasing supplies continued to push farmgate prices on a downwards trajectory. After the peak seen in January 2023, prices have been consistently falling: in June the average farmgate milk price reached 36.48 ppl according to Defra. Since then, announcements for July and August have continued to fall, although August was a more stable month. There were a continuation of falls in aligned contracts in August with all retailers dropping their prices.

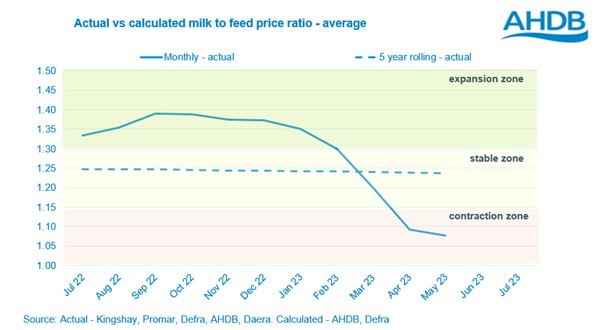

This is decreasing margins for farmers and the milk-to-feed-price ratio is now falling into the contraction zone. This would indicate that there is no incentive for farmers to push production and typically we would expect milk supplies to begin to contract in response.

The big question on everyone’s lips is, "have we reached the bottom of the price reductions?" Currently we are at the mercy of the markets. The biggest driver at present is a weak demand and there are no signs of this returning in the short term. Globally, most economies are still challenged by high inflation and, given their growth in domestic supplies and weak economic growth, there is no sign of Chinese demand coming back online. Latest predictions by StoneX indicated the GDT could have another 7 or 8% downside to go. This was borne out by the auction of 15 August 2023 that ended 7.4% down on the previous event. There may still be further falls before the market begins to recover.

Although input costs have come down, they remain well above typical values. This is putting farm margins under increasing pressure and casting doubt on the safeguarding of future production. Manufacturers hands may be tied – increasing prices necessitates the ability of manufacturers to recover appropriate returns from the market but, with demand so limited, the recovery will take a little longer yet.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.