Arable Market Report - 15 April 2024

Monday, 15 April 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

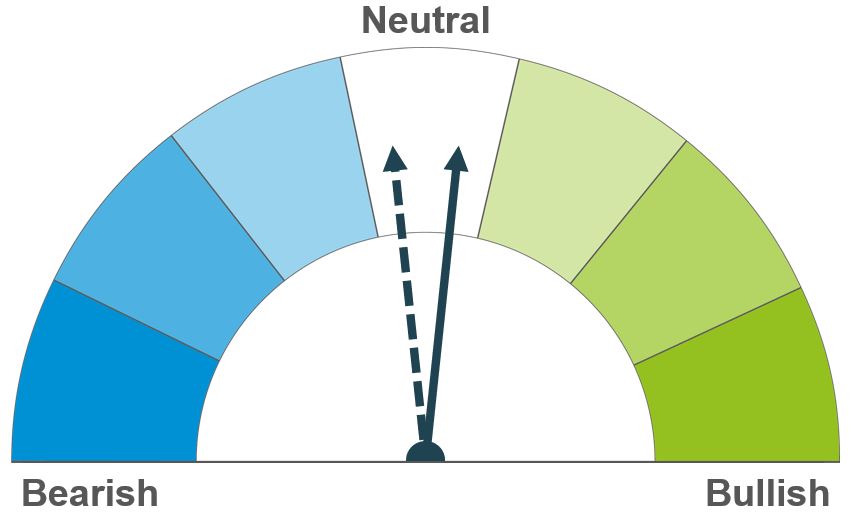

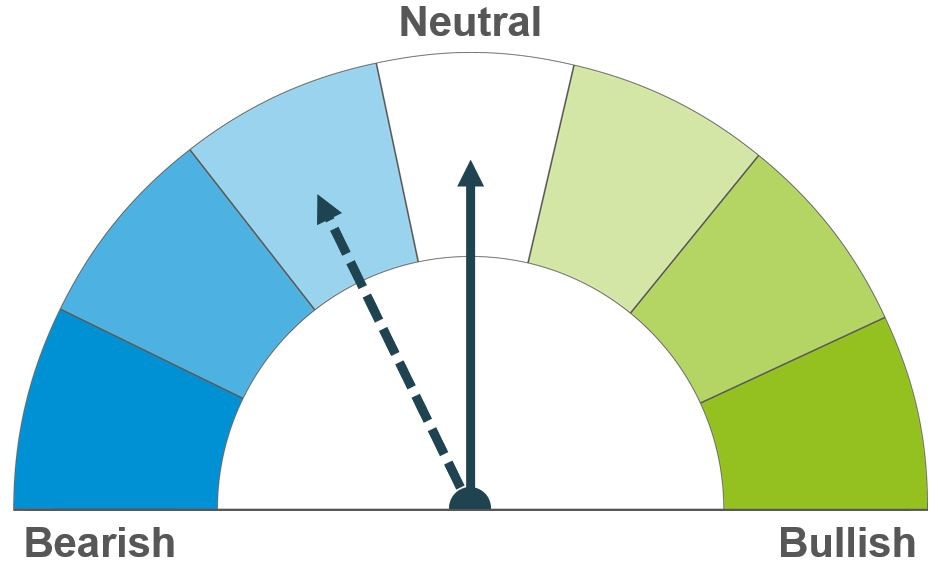

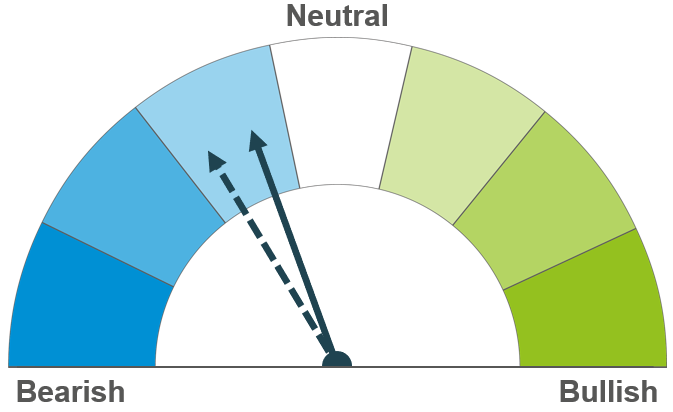

In global wheat markets, weak export demand for US and EU wheat, contrasts with record Black Sea export rates. With mixed global crop conditions, weather will remain a key watchpoint.

Global maize supply forecasts appear to show a well-supplied picture, however South American crop conditions remain uncertain. European planting is due to begin this month.

Concerns about European crop potential due to wet weather are a supportive factor for barley, though French spring planting is now into the latter stages. Conditions in other key producers will also be important to the longer-term price direction.

Global grain markets

Global grain futures

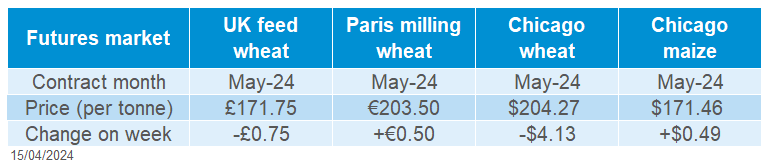

Global grain price movements were mixed again last week (Friday 5 April to Friday 12 April) but moved in the opposite direction to the week prior. UK and Chicago wheat markets saw declines in prices over the week, but Paris wheat futures strengthened over the same period. Maize futures also saw some strengthening over the week, with rises in both US and Paris futures prices.

Uncertainty regarding South American crop conditions is growing and this supported maize prices. The condition of the Safrinha maize crop in southern Brazil has declined over the past two weeks, impacted by unfavourable hot and dry weather conditions in the Paraná region. The region’s Department of Rural Economics rates 72% of the crop in Paraná as good, down from 81% last week. This dry spell comes as the crop is at its peak level of water demand, with revisions to crop production estimates expected.

Concerns over the Argentinian maize crop are also mounting, with reports of disease and insects pressure. As a result, Buenos Aries Grain Exchange reduced its production estimate down.

Chicago wheat futures also saw pressure last week as the US dollar strengthened. The euro and sterling fell to their weakest level in comparison to the US dollar since November, making US exports more expensive and less appealing for foreign buyers.

The USDA’s World Agriculture Supply and Demand Estimates, released on Thursday, included few changes. It appears to have had a minimal impact on the market.

Traders are continuing to monitor ongoing tensions between Russia and Ukraine, with concerns that it could disrupt Black Sea trade. Repeated attacks from Russian have been seen on Ukrainian energy infrastructure, however at presents grain continues to flow of out of both countries.

The state of the of French soft wheat has declined slightly for a second consecutive week, according FranceAgriMer. 64% was rated good or very good on 8 April, down from 65% a week earlier. The French soft wheat crop is in its poorest condition in four years after being continually hit by heavy rain.

UK focus

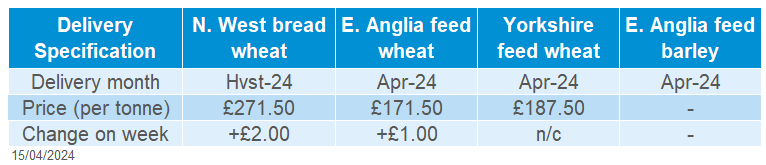

Delivered cereals

Echoing minimal movement in global grain markets, domestic wheat futures saw little change on the week (Friday-Friday). UK feed wheat futures (May-24) were pressured by £0.75/t, closing on Friday at £171.75/t. The Nov-24 contract fell £0.25/t over the same period, ending Friday’s session at £195.05/t.

UK delivered prices followed futures price movement Thursday to Thursday last week. Feed wheat delivered into East Angia for April delivery was quoted at £171.50/t on Thursday, up £1.00/t on the week. New crop milling premiums remain elevated with concerns over the size of next season’s crop. Bread wheat delivered into the North West at harvest was quoted at £271.50/t, up £2.00/t on the week.

Last week, AHDB published the latest GB fertiliser prices. Imported AN (34.5%) for spot delivery in March averaged £342/t, down from £347/t a month earlier. However, this remains well above pre-Ukraine war and energy crisis levels. Between 2017-2021 spot delivery of imported AN in March averaged £243/t. Find more analysis on this here.

HMRC UK trade data was updated last week, including data up to the end of February. Firm wheat imports continued, with imports this season to date (Jul-Feb) now up 59.4% on the same period last season.

Oilseeds

Rapeseed

Soyabeans

Bearish sentiment from the advancing South American harvests is tempered by some uncertainty over crop forecasts. That said, global supplies still look comfortable, with a larger US area also expected to be planted.

Rapeseed’s price premium over soyabeans has extended further as prices resist bearish tone from soyabeans. Longer-term, crops sizes will be key. Northern hemisphere concerns contrast with the potential for a larger Australian crop.

Global oilseed markets

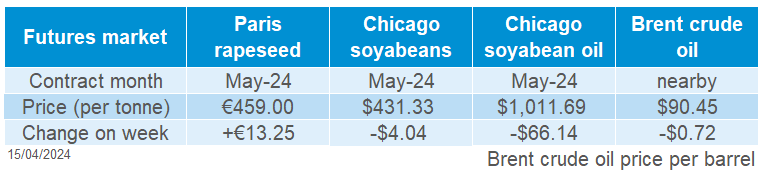

Global oilseed futures

Soyabean prices fell last week due to comfortable global supplies, the ongoing Brazilian harvest and a stronger US dollar.

There were few changes in the latest USDA World Agricultural Supply and Demand Estimates (WASDE), out Thursday. The USDA continues to show a comfortable 2023/24 global soyabean supply against demand, with a 15.7 Mt surplus. Ahead of the WASDE’s release, the market had expected the USDA to trim its estimates of the Argentinian and Brazilian soyabean crops. But the USDA left them unchanged at 50.0 Mt and 155.0 Mt, respectively.

Combined, the USDA’s soyabean crop estimates for Brazil and Argentina are now around 7.5 Mt above Conab and Buenos Aries Grain Exchange. This raises questions about if the 2023/24 global supply is quite as comfortable as the USDA indicates. The uncertainty, along with bargain buying by speculative traders, helped soyabean prices recover a little on Friday.

Safras & Mercado increased its Brazilian soyabean crop estimate by 2.7 Mt to 151.3 Mt on Friday, with harvesting 85% complete (Patria Agronegocios). The Argentinian harvest was 11% complete on Thursday (Buenos Aries Grain Exchange).

The dollar index hit a five-month high last week due to higher-than-expected US inflation in March; this led to speculation that the US Federal Reserve will delay cutting interest rates.

Today, US crush data is expected to show record demand in March (LSEG), while US planting conditions also come into focus. The USDA expects to start reporting on national planting progress tonight.

Rapeseed focus

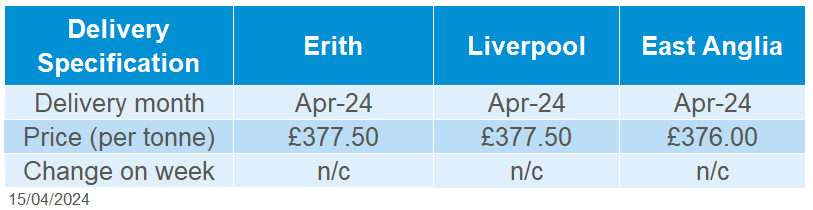

UK delivered oilseed prices

Paris rapeseed futures rose last week, extending its premium over soyabeans. Rapeseed prices are supported by ongoing concerns for European 2024 crops, plus stronger rapeseed oil prices.

Paris rapeseed options for May-24 expire today, ahead of the futures contract finishing trading on 30 April.

May-24 Paris rapeseed futures gained €13.25/t over the week to close Friday at €459.00/t (approx. £392.00/t). The Nov-24 contract rose €9.00/t over the same period to €469.00/t (approx. £400.50/t).

Closer to home, rapeseed delivered to Erith (May-24) was reported at £378.50/t on Friday. No week-on-week comparison is available. But Friday’s price is up £6.00/t (1.6%) from 28 March, less than the 4.8% rise in May-24 Paris futures over the same period.

Sterling lifted sharply against the euro last week, likely offsetting some of the rise in Paris futures. Sterling rose as the UK economy grew 0.1% in February (Office for National Statistics), leading to speculation that the UK could be emerging from recession.

Australia could harvest 6.5 Mt of canola (rapeseed) in 2024/25 according to US attachés. This would be a 14% rise year-on-year and the third largest on record. A larger area and higher yields are both expected.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.