Brazil pork market update: production increases drive export growth

Tuesday, 9 April 2024

Key points:

- Brazil’s pork production is expected to grow by around 2m tonnes in 2024.

- Domestic pork consumption is forecast to increase 3% as consumer prices fall.

- Exports will continue to grow, up 3-5% for 2024, as China and the wider Southeast Asian region remain the largest destination.

Overview:

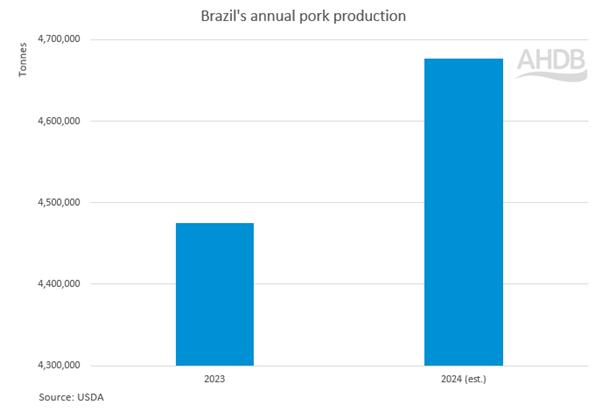

Brazil’s pork production totalled 4.5m tonnes in 2023 and is predicted to increase to 4.7m tonnes in 2024, another record year. However, this is lower than previous USDA estimates by around 20,000 tonnes, as feed prices are set to be higher, with availability poorer than expected. Rabobank note that El Nino weather patterns are set to further destabilise feed availability, impacting on pricing and net margins. Slaughter levels are predicted to reach 47.6m head, an increase of 1.6m head from 2023 (USDA).

Brazil's annual pork production

Source: USDA

Pork consumption in Brazil is projected to increase by around 3% according to the USDA, as pork becomes a cheaper form of protein, making it more competitive against beef and chicken. The forecast growth in consumption comes from its relatively low price point compared to beef, however it is still more expensive than chicken.

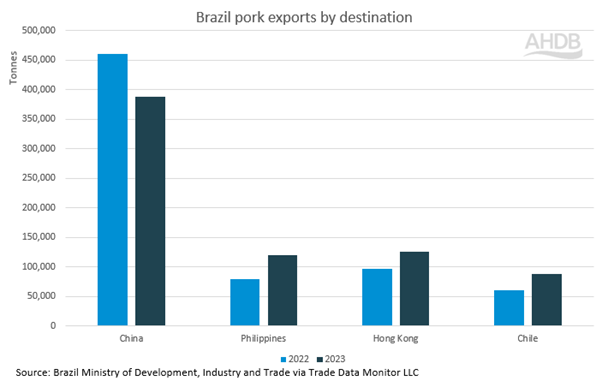

Brazil’s pork exports (including offal) continued to grow for 2023, up to 1.3m tonnes. This was growth of 5% from 2022, with an uplift in volumes to nearly all key destinations, including the Philippines, Hong Kong, and Chile. Volumes exported to China did fall by just under 72,000 tonnes from 2022, but China remains the largest destination for Brazilian pork, totalling 388,000 tonnes in 2023. Whilst the EU-27 as a region remains the largest overall exporter into China, higher pricing has reduced the regions competitiveness on global markets and has proved beneficial to Brazil. Brazil’s ability to produce lower priced pork has helped cement itself as the largest individual country in volume terms to China. Volumes exported to the Philippines grew by just over 40,000 tonnes (51%) year on year, to 119,000 tonnes, Brazil’s second largest destination.

Looking into 2024, the USDA predict that pork exports will represent 32% of its total production. Export volumes are forecasted to increase between 3 – 5% from 2023 levels, according to Rabobank. In the trade data so far this year (Jan – Feb), Brazil’s global pork exports have increased by 12% year on year at 208,000 tonnes, and with boosted production, will likely exceed record export levels this year.

Brazil pork exports by destination

Source: Brazil Ministry of Development, Industry and Trade via Trade Data Monitor LLC

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.