China’s dairy imports lower in 2022

Wednesday, 20 July 2022

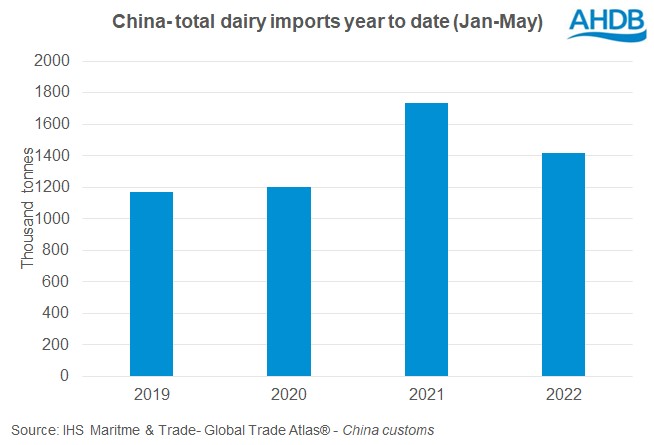

China’s dairy imports in the first five months of 2022 are down by 18% from the record high volumes seen in the same period last year. The reduction in import demand is likely linked to high inventories, strong domestic milk production and reduced consumption on the back of continued lockdown restrictions to deal with Covid outbreaks.

The record high imports in the Jan-May period in 2021, which were 44% higher on the previous year, were a response to China’s desire to build up security stocks to deal with concerns over food security and complications with shipping.

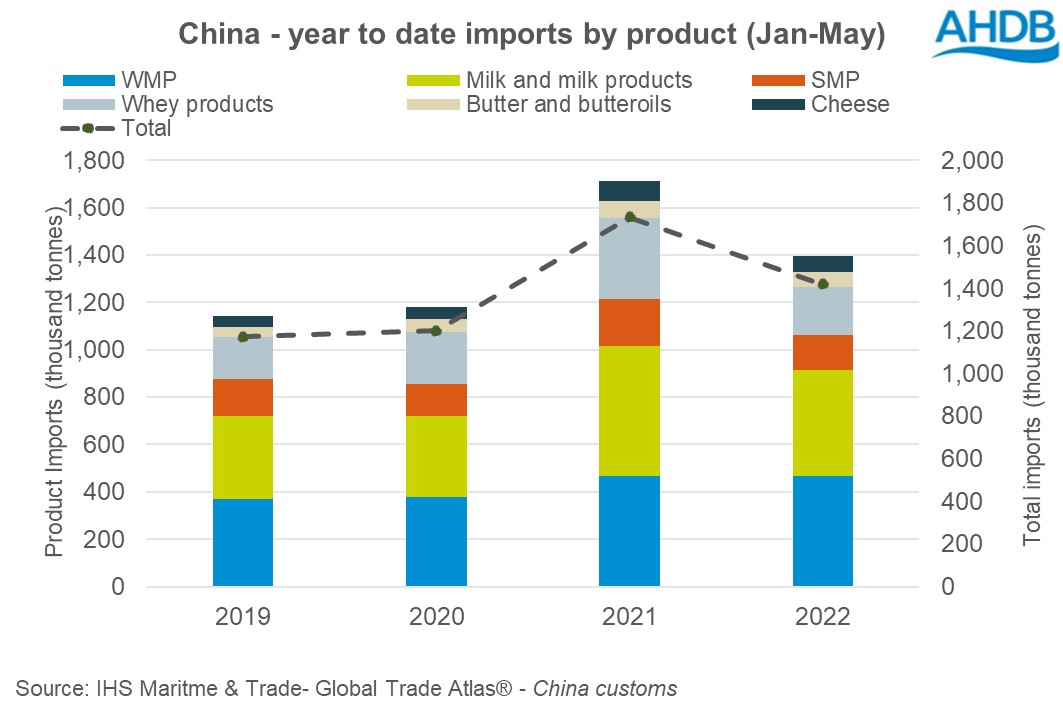

The products which saw the largest jumps in import volumes in 2021 (Jan-May) were liquid milk & cream and whey products. The higher demand for whey (+57% year-on-year) can be linked to the rebuilding of its pig herd. For liquid milk and cream, government messaging around the health benefits of milk consumption was likely behind the strong upswing in imports, which increased by 62%.

From these high levels, Jan-May 2022 imports have moved back down, and it is declines in these same two products which accounts for most of the annual drop in dairy import volumes, although there was also a drop in SMP imports.

Imports of whey products in the first five months of the year were down 41% year on year, bringing them down to more typical levels as the nations’ pig herd stabilised. In comparison to the same period in 2020, whey imports were down 8%.

Fresh milk & cream volumes for the year to date (Jan-May), are down 19% compared to the same period last year. While this was a significant drop in volumes year on year, total imports remained at high levels, 30% higher than Jan-May 2021.

SMP imports have been lower in each month so far this year apart from in February. Cumulatively, volumes are 24% lower year-on-year.

WMP imports for the five months Jan-May have remained stable in 2022 compared to 2021, with record high levels imported in the first two months. However, since then, each month has recorded a significant drop in import volumes.

Looking forward, China’s import demand for the remainder of the year remains unclear. Lockdowns continue to restrict demand, with questions remaining over the potential for further lockdowns. Milk production continues to grow, The security stocks built in 2021 will also impact on future import volumes, particularly if the enhanced stock levels are no longer deemed necessary and start to find their way to markets.

While milk supplies from the main dairy regions are expected to be lower this year, supporting dairy product prices, declining import demand from China would have the opposite impact.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.