Baking in 2023: Cakes are the rising star

Monday, 5 February 2024

The trend for home baking has recovered during 2023, with a return to sweet home baking proving most popular. With consumers still watching their spend, home baking provides a cost-effective way to deliver delicious treats, be that cake, pizza or muffins.

Consumer trends

As consumer confidence has started to improve, we have begun to see a reduction in the number of meals eaten in the home, with consumers starting to enjoy meals out of home again, particularly for those more expensive and special occasions (Kantar Usage Panel, September 2023).

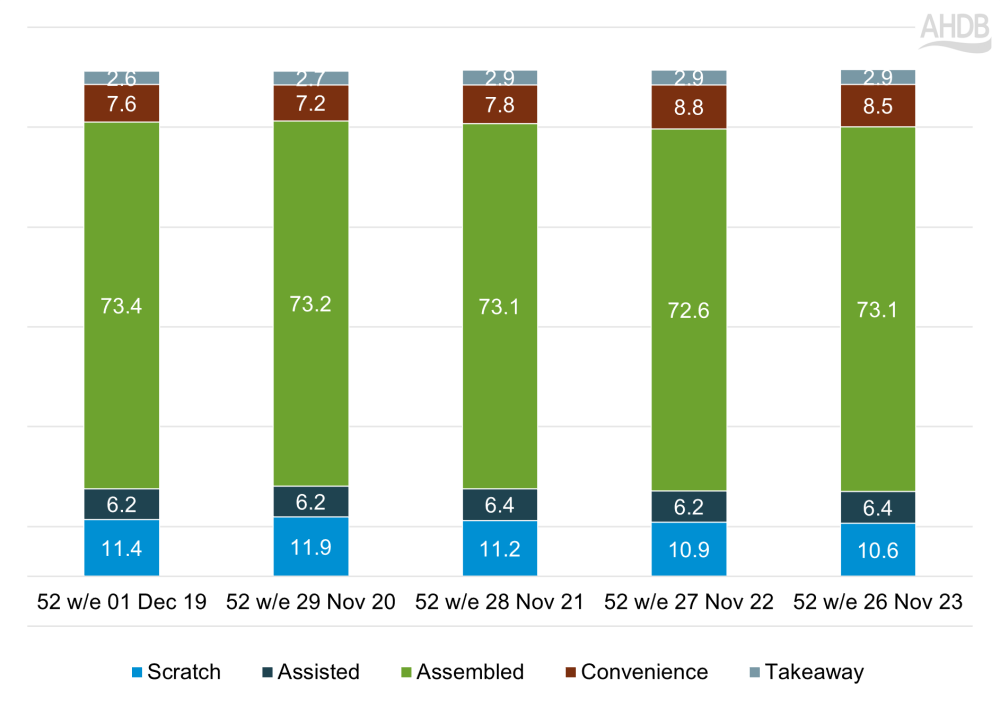

There has also been a shift in cooking behaviours. After a prolonged period of growth, convenience cooking, such as ready meals, has slipped into decline, with the share moving towards assembled cooking (where several individual items are combined on a plate). This likely reflects consumers opting for a cheaper option, while maintaining low-effort cooking. Alongside this trend, we see a continued steady decline in scratch cooking post the pandemic peak in 2020, due to consumers spending more time away from home (Kantar Usage Panel, September 2023).

Percentage share of consumption occasions by preparation method

Source: Kantar Usage, 52 w/e 26 November 2023

Trends in baking

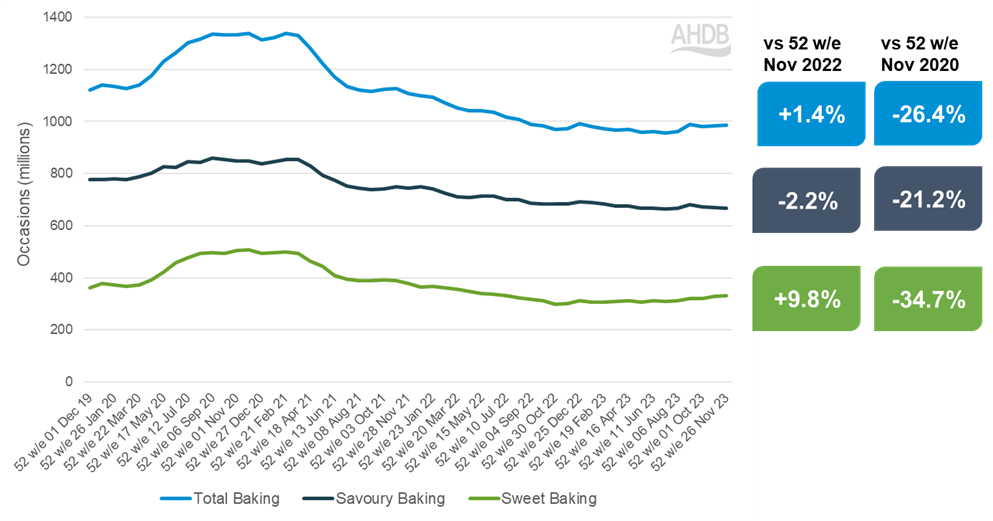

Overall, baking occasions increased by 1% (13 million occasions) in 2023, versus the previous year. This increase was driven by an increase in sweet home baking, up 29 million occasions, while savoury home baking fell by 14 million occasions (Kantar Usage, 52 w/e 26 November 2023). This growth in sweet baking was driven by consumers baking more often, especially among middle families (children 5–9) and the older generations. Baking is still very much an activity to be enjoyed amongst all ages, with many looking to digital channels such as TikTok and Instagram for their sources of inspiration.

Home baking occasions

Source: Kantar Usage, Rolling 52 w/e 26th November 2023

Key baking dishes

Delving into the different categories within baking, we’ve seen differing performances; with some showing significant growth, while others have experienced considerable decline. Chocolate cake was the star contributor with an impressive increase of 11 million occasions (+63%) between 2022 and 2023.

In contrast, savoury pies fell by 20 million occasions (-5%) over the same period (Kantar Usage, 52 w/e 26 November 2023). This highlights an opportunity for recovery in savoury pies, where fillings are likely to contain meat, fish or poultry.

Year-on-year change in consumption of key baking products, 2023 versus 2022

Source: Kantar Usage, 52 w/e 26 November 2023

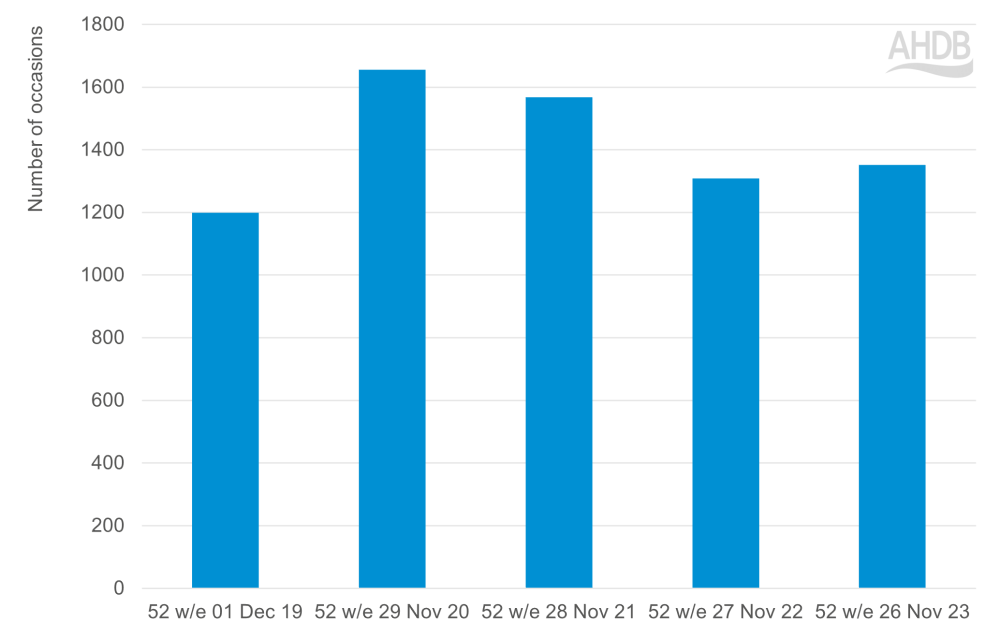

Pre-packed flour sales

According to Kantar Usage, pre-packaged flour featured in a total of 1,351 million occasions in the 52 weeks ending 26 November 2023, up 3% year-on-year and up 12% versus 2019. This suggests that we have reached a stable level of flour usage, post pandemic, which is above pre-pandemic levels, as more people are consuming flour now than previously, especially in baked goods.

Flour consumption

Source: Kantar Usage, 52 w/e 26 November 2023

Meanwhile, total spend on flour increased by 12.9% year-on-year to £124 million (52 w/e 24 December 2023). This increase was due to rising prices as seen across the industry, due to the cost-of-living crisis (Kantar Usage, 52 w/e 26 November 2023).

Insights show that flour usage sits mainly in the evening meal. However we have seen an increase in breakfast occasions in the last year (Kantar Usage, 52 w/e 26 November 2023). This presents an opportunity for growth in flour, by promoting use in ‘treaty’ breakfast dishes such as pancakes and muffins.

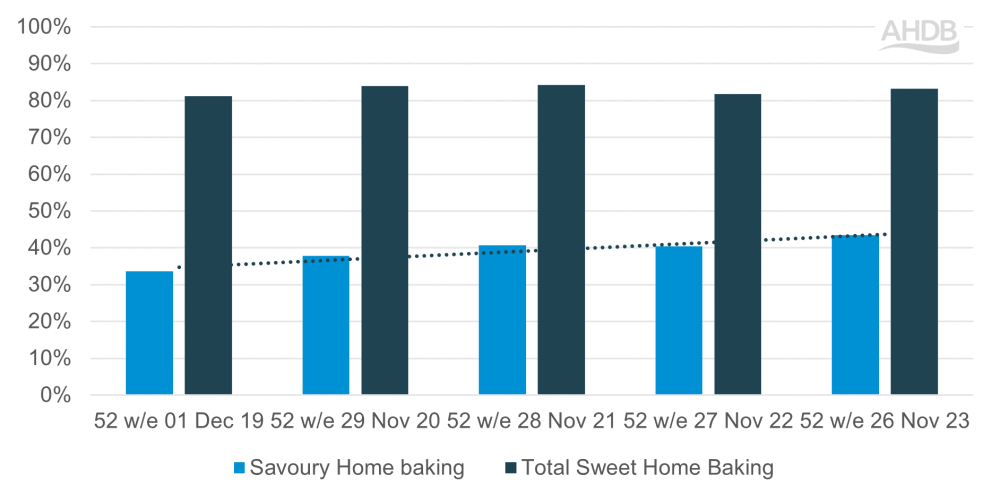

Dairy

Dairy products are key ingredients in baking, with 83% of sweet baking occasions and 43% of savoury baking occasions featuring dairy in 2023 (Kantar Usage, 52 w/e 26 November 2023). Over the last few years, we have seen steady growth in the proportion of savoury home baking including dairy, whereas in sweet baking it has remained at a fairly stable level.

Proportion of baking containing dairy products

Source: Kantar Usage, 52 w/e 26 November 2023

Looking in more detail at the breakdown of different dairy products, we see an increased abundance of cheese in savoury baking, with 27% of occasions featuring cheese in 2023, compared to only 18% in 2019 (Kantar Usage, 52 w/e 26 November 2023 vs 52 w/e 1 December 2019). This increased consumer demand for cheese highlights the desire for tasty, versatile and economic dishes that can be prepared in the home, such as cheese scones or quiches.

Opportunities and recommendations

- Remind consumers of baking as a leisure activity, particularly families. Reframe the cost versus an out-of-home activity or fun occasion

- Increases in homemade pizzas present growth opportunities for both cheese and red meats as staple toppings. This could be supported by ‘meal deal’ promotions on ingredients in stores

- Increased occasions of sweet baking dishes, such as cakes and muffins, are likely to support demand for dairy essentials such as milk and butter

- Encourage growth in flour, by promoting use in ‘treaty’ breakfast dishes such as pancakes and muffins

Looking forward, are we seeing a new normal level for baking post-pandemic? Movement away from scratch cooking would suggest that savoury baking is likely to continue to suffer. On the flip side, sweet baking fulfils the want for a treat and maintains its appeal as a relatively low-cost yet fun activity, so may hold its share in the coming year as consumers look to minimise costs.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.