Consumer attitudes to pasture reared livestock

Tuesday, 13 July 2021

Sustainable agriculture has become something of a buzzword in the media at the moment. Issues such as deforestation in the Amazon for feed-crops such as soya are becoming a more salient concern for consumers. Therefore, identifying consumer attitudes towards and understanding of grass-fed or pasture reared livestock is crucial, as a ‘grass-fed’ claim could become a point of difference to shout about.

But how important is this to consumers and how much of a premium can it command for meat and dairy producers?

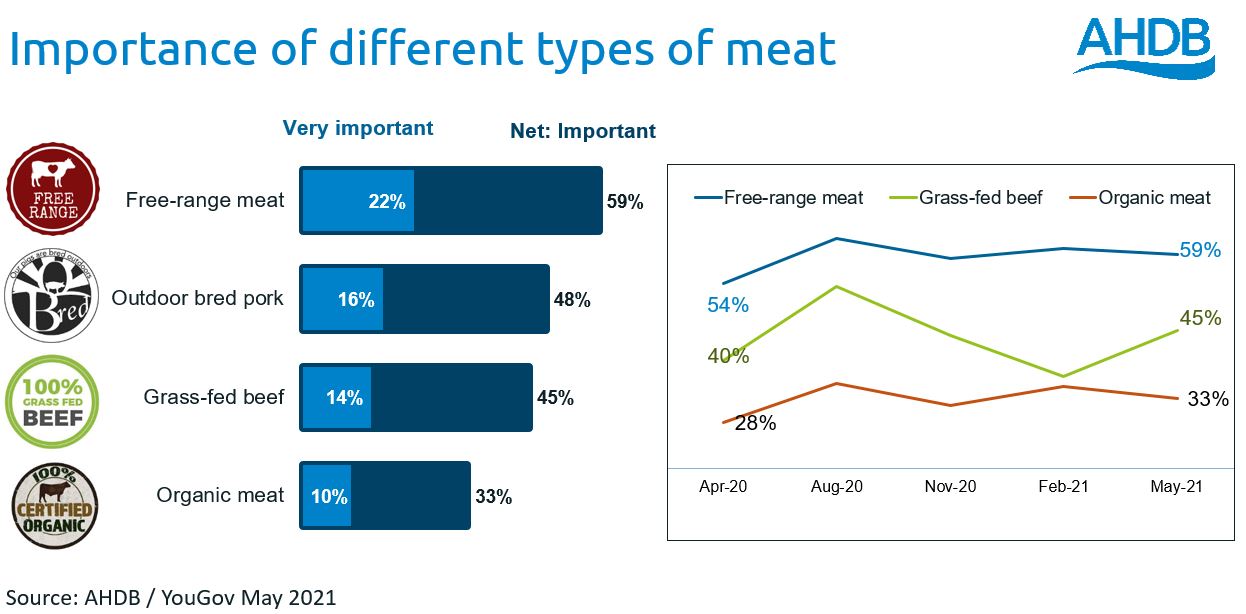

Consumer understanding of the terminology used for system of production labelling is hazy at best. Terms such as ‘grass-fed’ beef or ‘pasture promise’ dairy may be confusing to some consumers who may believe that all cows eat grass. There is clearer appeal of the term “free-range meat” (even if there are no clear definitions for ruminants) as the term if better understood from the poultry and egg sectors. 59% say that free-range is important to them when buying meat, where 45% say grass-fed is important to them (AHDB/YouGov, May 21).

We see a similar pattern for dairy where there is much more awareness of the term free-range milk (60%), as opposed to the term ‘pasture promise’ (15%) (AHDB/YouGov, Feb 2020).

For consumers access to the outdoors seems to trump feed requirements.

Can pasture-raised signify quality?

Quality is an important driver for consumers – 68% say they would be willing to pay extra for better quality meat (AHDB/YouGov, May 2021). However, this generally manifests in consumers opting to buy standard tier as opposed to the basic ranges and only 35% claim that they regularly buy premium range red meat when buying meat in the supermarket (AHDB/YouGov, May 2021). According to Kantar data, premium tier represents around 10% share of the red meat market depending on protein.

But when asked about buying premium meats specifically, Britishness is most important, followed by appearance in terms of coloration or amount of fat, followed by quality assurance. Next in the hierarchy comes free range/outdoor reared with grass fed a little lower with 29% saying it is important to them (AHDB/YouGov, May 2021). Therefore, to make the most of these claims, it is important to emphasize days spent out at pasture and the animal’s access to the outdoors alongside the grass-fed claim.

Traceability of feed and sustainability

However, the environment is becoming a bigger driver for consumers. Issues such as deforestation in the Amazon for feed-crops such as soya are becoming a more salient concern, with Greenpeace running a campaign highlighting the issue. In our consumer tracker 27% agreed that animal feed used in beef and lamb farming contributes to deforestation, a figure higher than for pork at 21% (AHDB/YouGov May 21). This is likely to result in demands for more traceability in the supply chain and for retailers and producers to ensure their feed comes from more sustainable sources. A heavier reliance on pasture feeding on the farm avoids these issues and may give grass-fed beef and lamb a point of difference worth shouting about.

Conclusion

As pressure towards farming and the environment (particularly for the ruminant sector) intensifies there are opportunities to present grass-fed beef and lamb, and dairy produce as a positive and unique selling point for British produce. However, consumers understanding of the benefits of grass-feeding specifically are quite limited. The more positive attributes for consumers fall around access to the outdoors and so it is important to carefully position rearing methods to highlight this for the most benefit. Additionally, sustainable sourcing and traceability right the way through the supply chain is set to be a bigger issue in future and, here too, grass-fed has a role to play.