Consumer desire for outdoor bred pork hindered by cost-of-living crisis

Thursday, 28 September 2023

Over the last few years, outdoor bred (ODB) pork and pigmeat has outperformed the total pork market. However, this year the trend appears to have reversed.

Until recently, primary pork had been the best performing red meat due to its relative affordability. However, consumers are now having to find other ways to scale back their spend at mealtimes. This has ranged from reducing the number of main meals which contain meat as a means to save money, to trading down proteins or cuts within a protein, as we have seen the cost-of-living crisis continuing to impact on consumers. This appears to be negatively impacting both primary pork and OBD pigmeat products performance.

Alongside organic, ODB is considered to be a premium tier within pigmeat. During Covid lockdowns with more time at home and more interest in experimentation and treating with food, OBD pigmeat offered an opportunity for those wanting to trade down proteins from beef and lamb to save money but still have the premium quality experience. During this time, ODB accounted for 14% of volumes of the total pigmeat sold in the 52w/e 12 June 2022, up from 12% in the same period in 2021 according to Kantar. However, in the 52 w/e 11 June 2023, volumes of ODB accounted for just 8% of the total pigmeat market. Year-on-year, ODB pigmeat has seen a volume reduction of more than 11%. This decline is faster than seen for both total pigmeat and primary pork which have seen a much smaller 3% and 4% decline year-on-year respectively (Kantar, 52 w/e 11 June 2023). ODB pigmeat is however outperforming organic pigmeat which has seen a 17% volume reduction over the same period.

Unsurprisingly, price, and price increases, are likely a deciding factor in the reduced performance seen by ODB products.

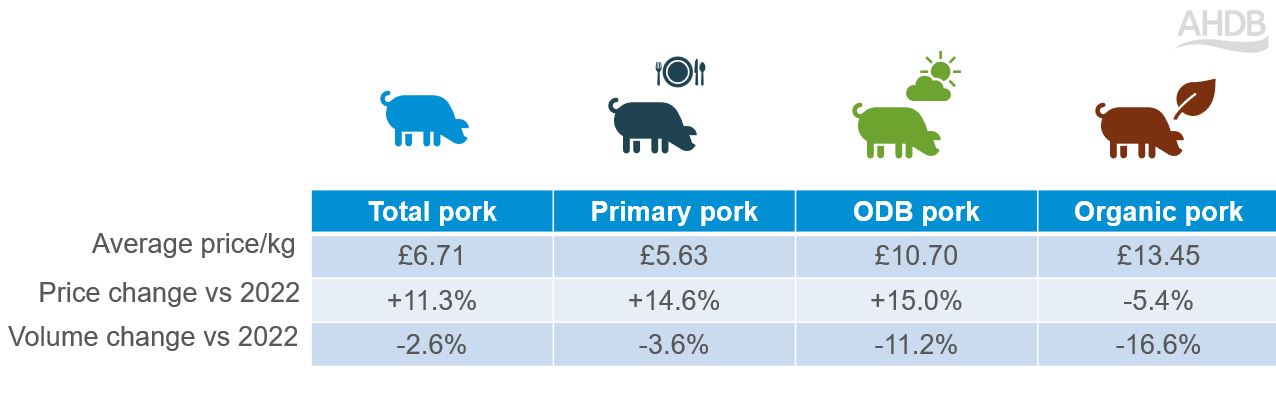

Price and volume changes

Source: Kantar, 52 w/e 11 June 2023

ODB saw prices rise by 15% to £10.70/kg in the 52 w/e 11 June 2023 (Kantar). While primary pork and total pork prices also saw similarly high price increase, their lower average price points at £5.63/kg and £6.71/kg and have meant that they have lost fewer shoppers. This is likely due to them being more favourably priced than overall MFP which was priced at £7.22/kg during the same period.

Conversely, organic pigmeat saw a price decrease of more than 5%. However, it is still the most expensive option at an average of £13.45/kg which appears to be the main driver for reduced volume sales.

Consumer perspectives

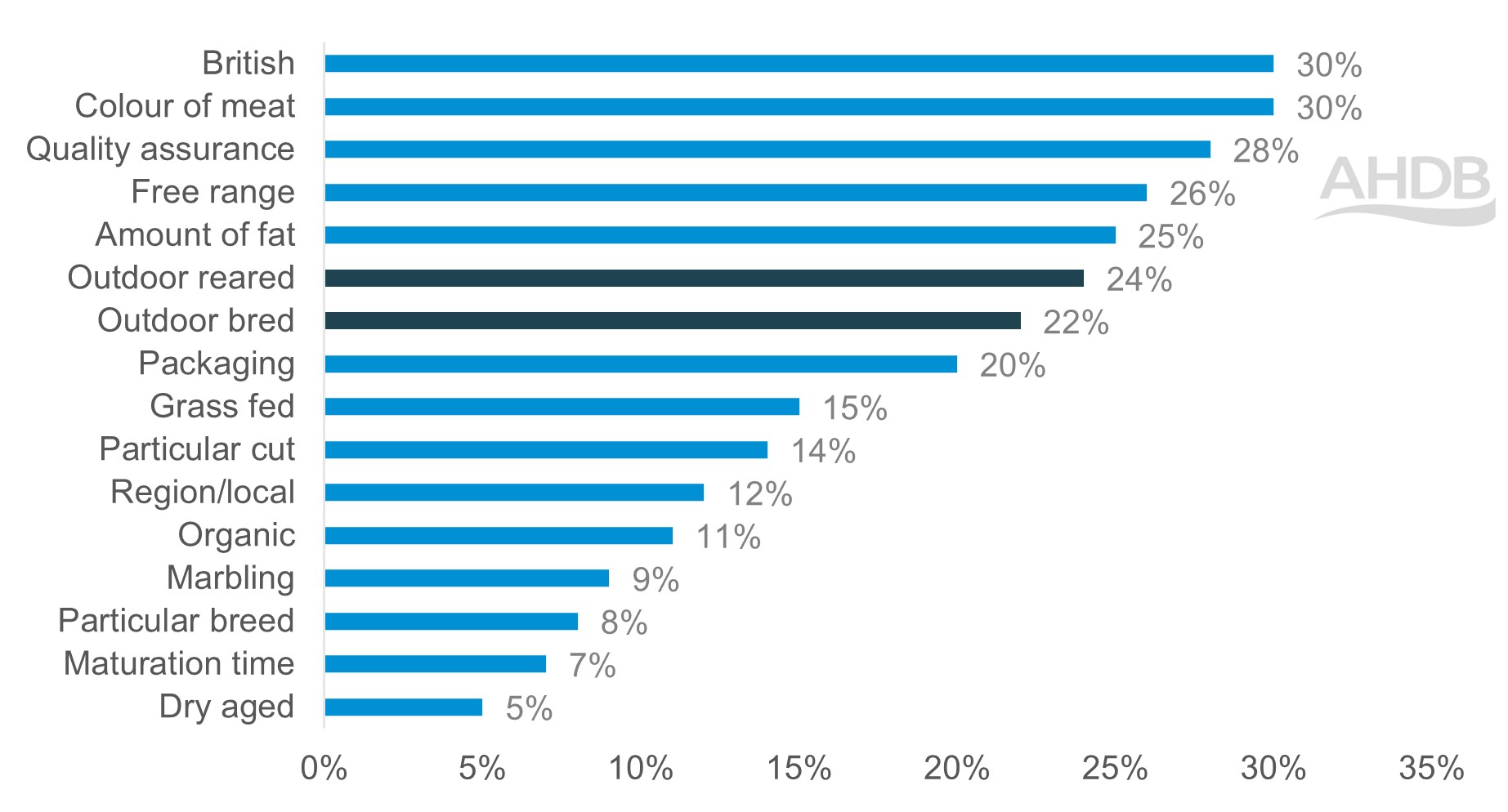

Outdoor bred claims have reduced in importance with consumers over the last couple of years. Data from research by AHDB and YouGov showed the only 22% of consumers say that outdoor bred claims are important to them when buying premium pork products (May 2023). Whilst only marginally down on last year (-1%) this is 7% lower than 2021. Interestingly, consumers consider outdoor reared, free range, British and quality assurances more important to them than cut type, whether it was local, organic status or breed, although these have also seen similar reductions in priority since 2021.

What are the most important factors when buying premium pork?

Source: AHDB/YouGov May 2023

As we have seen reflected in retail data, consumers are prioritising price as one of their most important factors when purchasing pork and pigmeat, with 40% saying that they will buy whatever is best price, and 13% saying that they would like to buy ODB pork and pigmeat but that they find it too expensive (AHDB/YouGov, May 2023). Though it varies by retailer, in general those who shop at major supermarkets are more likely to say they would like to purchase ODB but find it too expensive, as well as saying that they would purchase whatever pork is the best price. In contrast, those who purchase from more premium supermarkets were more likely to respond that they would always try to purchase outdoor bred pork and pigmeat products (AHDB/YouGov, May 2023).

Opportunities

Of those who do purchase outdoor bred pigmeat, older shopper groups, such as empty nesters and retirees, tend to purchase greater volumes. This is both when compared to other demographics as well as purchases of total pigmeat and primary pork volumes within their own demographic (Kantar). Families are less likely to purchase compared with all other demographics (Kantar) perhaps due to the higher price.

As such, opportunities to grow volume sales of ODB pork products are likely to vary by demographic. Similar to primary pork and pigmeat, offering promotions around products which would appeal to consumers with families, such as ODB sausages and bacon, which can create comforting family favourites, could help boost sales in these age groups. For those in older demographics, highlighting the treat appeal and premiumisation on a budget could help to maintain and grow ODB pork share, as they can offer a cost saving factor at mealtimes when compared to other premium proteins.

For all demographics it is clear that there is a level of appeal and desire to purchase ODB pigmeat products. However, currently the benefits of ODB are not enough to justify the higher price point with many consumers. Therefore, retailers should continue to highlight the standards, benefits, and premium quality of ODB pigmeat to communicate the value of ODB and as a means to inspire consumers to want to purchase them.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: