Finding new dairy shoppers

Thursday, 15 November 2018

Key take-outs

In summary, to sustain penetration growth within the market, dairy manufacturers need to:

- Understand and tailor product line-ups to different targets

- Build the right portfolio

- Capitalise on the out-of-home market

- Consider increasing health benefits

The background

Recently, AHDB attended a conference hosted by Kantar Worldpanel aimed at highlighting how the mature dairy category can find new shoppers. From their long-term observation of consumer behaviour, gaining new shoppers is one of the key tenets of brand growth. The presentations highlighted areas on which dairy manufacturers should focus their attention in an increasingly uncertain and ever-changing retail landscape, to add value to their businesses.

So, how should dairy find new shoppers?

Finding new shoppers isn’t easy – if it was, everyone would be adding to their shopper base. There are no simple solutions, but the easiest way to attract shoppers is through giving people more reasons to buy.

1. Tailor to your different targets

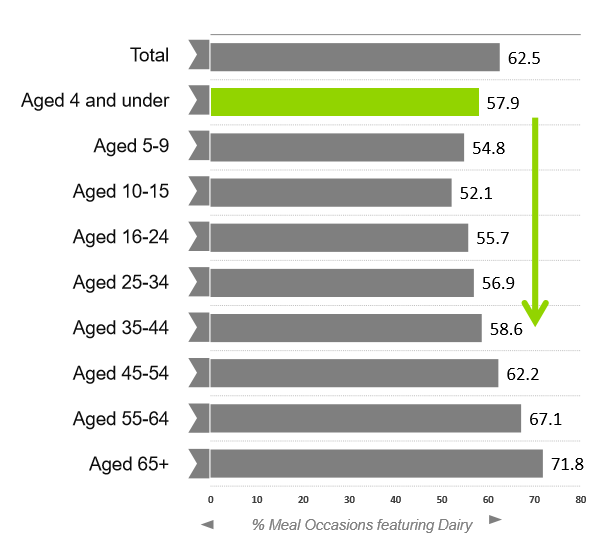

At present, 62.5% of meal occasions feature dairy. This differs by age and shows that the user base is not always the person who purchases the product, with children (particularly aged under 4), having one of the highest dairy consumption levels. This highlights the need to think about targeting the influential end user of a product as well as the shopper.

Currently, there is a lot of media attention around millennials. They are thought to be a key demographic group to drive growth as they are ‘the future’. Their consumption of dairy is lower than total market but this does not mean they don’t show potential:

- Millennials are 13% more likely to scratch cook. This is a potential upside for dairy, but they are actually 3% less likely to use dairy when scratch cooking. Therefore, an opportunity lies in increasing the relevance of dairy for millennial cooking habits

- Millennials are 19% less likely to be concerned with health. Despite this, they are 5% more likely to consume dairy alternatives. An opportunity lies in communicating the enjoyment and taste benefit of dairy to millennials

- Millennials are more likely to eat out-of-home. However, they are 45% more likely to take a lunchbox and 48% more likely to take dairy in a lunchbox. This shows an area of the market to capitalise on

Lastly, the value of the 55+ consumer age group should not be ignored. This is a group that has 203 more dairy occasions than millennials a year and adds £2.8bn more to the industry. Their dairy habits are key to understand, to help strategise for this group:

- 55+ are 25% more likely to snack; and it is 4% more likely their snack will feature dairy

- 55+ are 25% more likely to have a dessert; and it is 8% more likely their dessert will feature dairy

Manufacturers need to appreciate individual shopper groups and recognise the differences between them, targeting them at the right meal occasions to meet their needs.

2. Build the right portfolio

In a saturated and competitive market, we need a balance between personalisation and optimisation of the right number of variants/ranges. To drive success, manufacturers should not only understand who their shopper is, what they think and where they shop, but calculate whether their product portfolio is successfully meeting their needs. Across the Top 20 Dairy brands, 45% of products are attracting less than their expected share of buyers. Therefore, brands need to be focusing on rationalising their product ranges to the most profitable high-penetration products.

3. Opportunity for out-of-home

The out-of-home food and drink market shows continued high levels of growth. Dairy accounts for 11% of take-home spend but only 3% of out-of-home spend, highlighting an opportunity to grow the latter. The dairy out-of-home market is worth over £5bn. This is through dairy-based drinks, snacks and meals but there is a learning for each occasion:

- Dairy drinks are in decline as the prolonged hot summer has impacted coffee sales. Does this highlight the need for dairy drinks to be seasonality-proofed? More scope for the fast-growing iced coffee market

- Out-of-home snacking is declining due to expense and health concerns. Out-of-home dairy snacks are dominated by ice cream, admittedly booming due to the hot weather, but is there an opportunity for health-focused dairy snacks?

- Evening meal occasions are thriving, benefiting the dairy category, but can dairy maintain this momentum through innovative and creative dairy-based meal options?

4. Consider increasing health needs

Health now drives one-third of in-home consumption choices, with 73% of consumers claiming to ‘try to lead a healthy lifestyle’. Health can mean different things to different people, with health ‘benefits’, lower in fat/sugar/salt, and natural/less processed being prominent. This is impacting shoppers’ baskets, with healthier baskets growing over the past five years. But they are still a long way off meeting dietary guidelines. This means that, as Government action intensifies, manufacturers will need to forward plan their innovation pipeline with healthier options, functional benefits, such as gut health and product reformulations that target more than simply sugar content.

Figures provided by Kantar Worldpanel 2018.