In-home eating trends: Meal planning and pester power

Thursday, 28 March 2024

Consumer eating habits have experienced dramatic changes during the last five years due to Covid lockdowns and more people working from home, but how are consumers eating habits transpiring now?

The number of meals eaten within the home in 2023 remained above pre-pandemic levels due to the increased cost of living and the number of adults working from home or hybrid working.

Within the home and across both lunches and evening meals, consumers are looking for meals that are easy to prepare and clear up. As a result, despite the rise in food prices, the trend for convenience cooking, at £2.50 per occasion, increased in popularity compared with scratch cooking, at £1.80 per occasion (Kantar Usage, 52 w/e 26th November 2023). This suggests that consumers are willing to spend a little more, in order to save them time in the kitchen.

Kantar Usage reports that meals within the home are becoming more functional in nature. As a result of the cost-of-living crisis, consumers are continuing to look at ways to save money; they are increasingly using up cupboard stocks and are pre-planning their lunch and evening meals to avoid wastage. (Kantar Usage Panel, In-home/carried out meal occasions, 52 w/e 24th December 2023 vs December 2019).

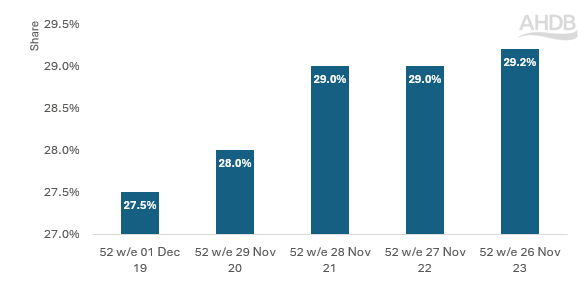

With consumers considering food purchases more closely now, there is an overwhelming desire for their meals to be filling, which has increased from 27.5% to 29.2% (Kantar Usage, Lunch and Evening meal, 52 w/e 26th November 2023 versus previous four years). Consumers are increasingly choosing cheaper carbohydrates, like rice and pasta to bulk out their meals.

%Share of servings picked for ‘Filling’ at Lunch and Dinner

Source: Kantar Usage, Total lunch and evening meal food, 52 w/e 26 November 2023 vs previous four years

Although consumers are now more cost conscious, according to Kantar consumers are choosing their food more for taste (69.3% up 2 percentage points on 2019, 52 w/e 26th November 2023) and pester power (asked for by family) is at a 5 year high at 10.1% of servings, proving that consumers really want tasty treats for the whole family to enjoy. More consumers are now enjoying ‘fakeaways’ (tasty treaty meals) at home designed to replicate out-of-home takeaway classics.

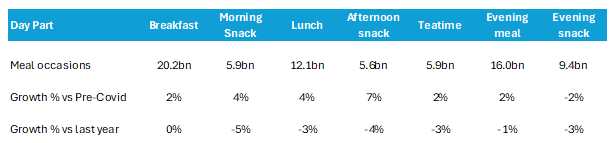

Meal dynamics

Over the last five years, consumers have chosen to have more hot meals during the day, with more consumers having hot breakfasts (+1.4 percentage points) such as fried breakfasts or omelettes, and hot lunches (+3 percentage points) such as soup or pasties, than in 2019. With more consumers working from home, breakfasts are now consumed later in the day (after 8am), whilst 87% of lunches are now consumed at home.

On a sociable level, all mealtimes are now more convivial as they are increasingly involving 4 or more people compared to 2019.

Source: Kantar Usage-movement % 52w/e Dec 2023 vs. 52w/e Dec 2019, 52w/e Dec 2023 vs. 52w/e Dec 2022, In-home occasions

In terms of changes experienced in the last year, there has been a slight shift to fewer meals taken in-home. Daytime and evening snacks have experienced the largest decline, between 3-5%, as consumers are cutting back on unnecessary items for cost or health reasons. Breakfast occasions have remained consistent due to more time pre-work if hybrid/flexible working and due to cost, an average breakfast costs £0.80 versus lunch at £2.08 (Kantar Usage, 52 w/e December 2023). This suggests that consumers are looking to have a filling breakfast rather than snacking throughout the day to stay full.

For more information on consumer eating trends for red meat, please see our article - Meat is a winner for family dinners.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.