Outdoor pork performs well – can it continue?

Monday, 25 July 2022

Estimates suggest that in the past year, 14% of primary and processed pork volumes had an outdoor claim, according to Kantar data.

Sales have outperformed the total pork market over the past year, in spite of the outdoor price premium. But as the cost-of-living crisis deepens and a growing number of shoppers say they buy whatever pork is the best price, how could these more premium products fare?

66% of households bought pork or a processed pigmeat product (such as sausages) with an outdoor claim, in the year ending 12 Jun 2022 (Kantar). This is up 0.9 percentage points (%pts) versus 2019. By comparison, the proportion of households buying total primary and processed pork declined by 0.7%pts over the same period.

Outdoor bred has been the main driver of this, with volumes up an estimated 8% compared to 2019 and accounting for 95% of the outdoor market. This share has increased as both outdoor reared and free range have declined.

At an average of £8.93/kg paid for outdoor claimed pork in British supermarkets, it has outperformed the market despite a considerably higher price point, with the average price paid for pork at £6.23/kg. The price premium does appear to have reduced slightly when compared to previous years, but is still significant.

Price challenge

This is a particular risk during the cost-of-living crisis, where shoppers are having to reconsider their household budgets and may be deprioritising premium products like outdoor pork.

Some shoppers do want to purchase outdoor pork, with 28% claiming they at least try to buy outdoor bred pork (AHDB/YouGov, May 2022). However, price is a key consideration for most shoppers, and more people (40%) say they just buy whatever pork is the best price. This has increased from 34% in February 2020, just prior to the pandemic. Communicating product value continues to be important, in order to command a price premium with those shoppers who are able to afford it.

Promotions prove pivotal

One factor that may help limit the likely negative impact on outdoor pork volumes is that a far higher proportion of product is sold on promotion – at 47% of volume, compared to 26% on average across total primary and processed pork. Data from the 2008/09 recession and the peak of the pandemic, showed that shoppers often buy more products on promotion to help manage their spending.

This could also influence the type of categories that shoppers choose to buy as outdoor bred. Sausages account for 39% of outdoor pork volumes, compared to just 24% of total pork. This is likely to be influenced by the significant and continued price promotions in the category, with 53% of sausages with an outdoor claim sold on promotion.

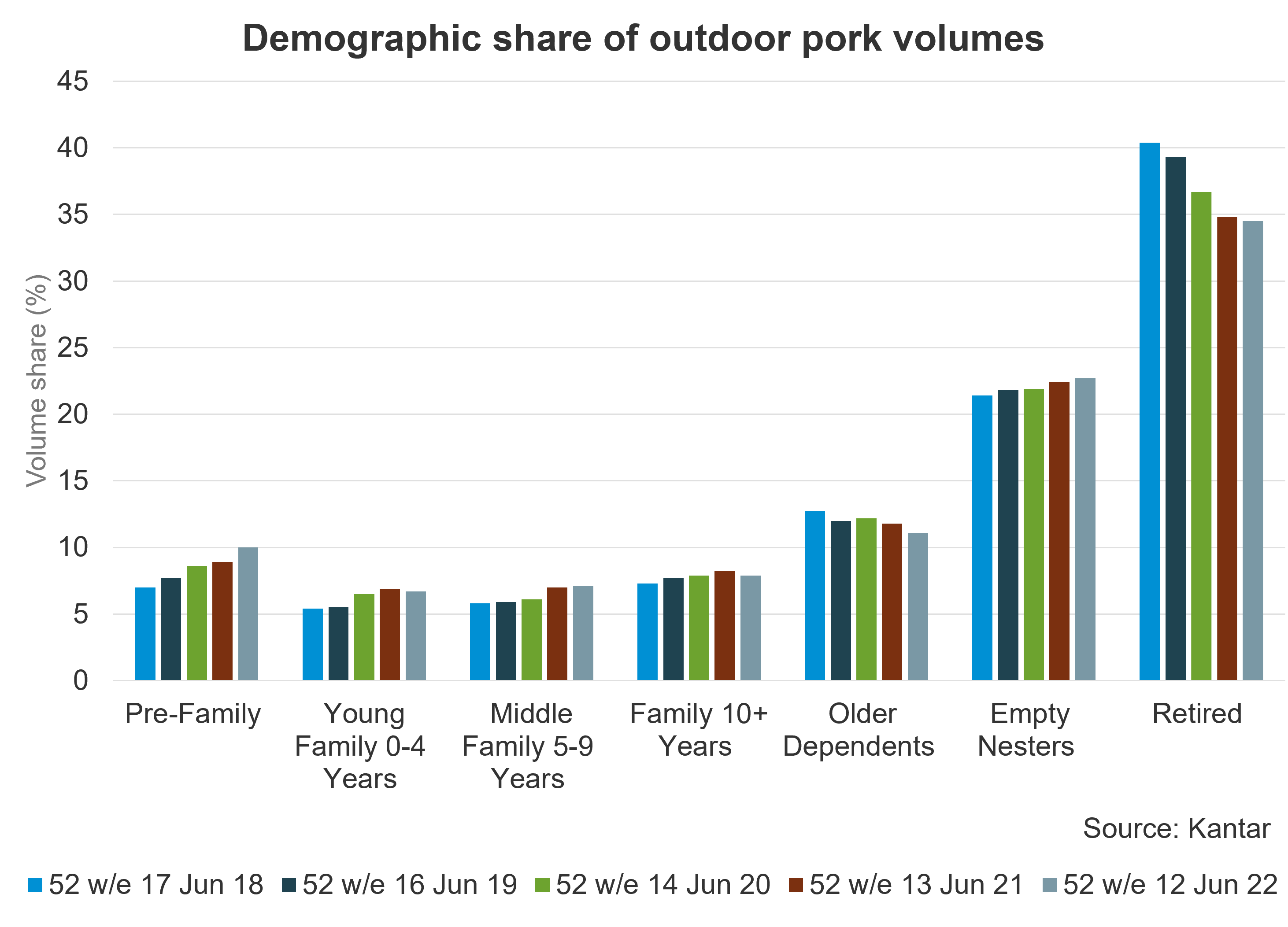

Changing demographics

Retired households account for 28% of total primary and processed pork volumes, but take a bigger share of outdoor pork volumes (35%). However, the pre-family group has gained share each year in recent times, up 1.1%pts vs 2021.

It may be that there is a further divergence in the market, with those who are able to afford premium products continuing to do so. However, it’s likely more people will be costed out as household budgets are squeezed. For those unable to afford these products, they may leave the category altogether. Cost has become a leading factor in people choosing to give up red meat, with 35% claiming they are eating less red meat because it has become more expensive. While it’s not only premium products at risk, but meat in general, it’s still important to communicate the value of these outdoor products to those who do have the income to maintain or increase the amount they purchase.

Notes

Processed pork includes sausages, bacon, sliced cooked meat, gammon and burgers

Outdoor claims include outdoor bred, outdoor reared and free range (includes organic).

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: