Price inflation rises, but food remains behind the market

Thursday, 16 September 2021

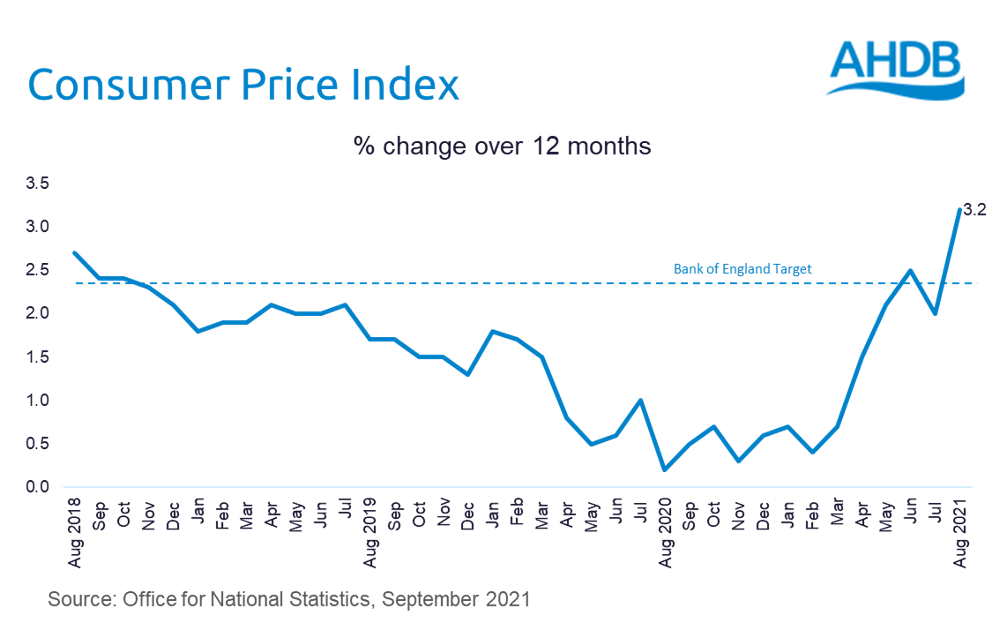

UK Consumer Price Inflation (CPI) rose to 3.2% in August, up from 2.0% in July. However, the Office for National Statistics (ONS) state the rise is likely to be temporary, due to the stark year-on-year comparisons between a nation in lockdown a year ago, versus a return to norm in summer 2021.

As highlighted in our previous update on CPI, this inflationary pressure comes from prices returning to pre-Covid levels and demand outstripping supply.

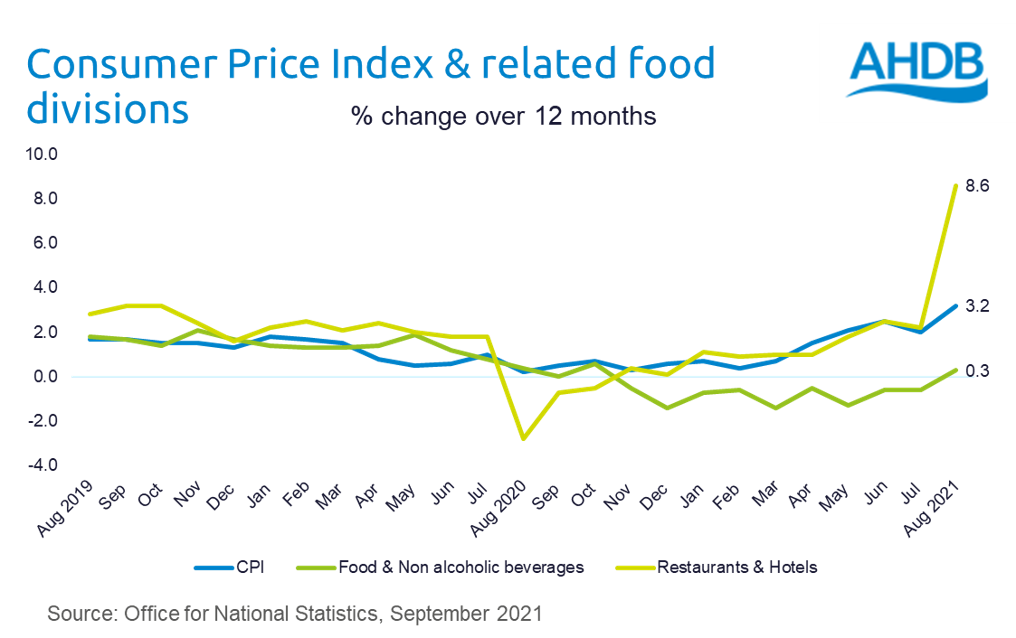

In this latest update from the ONS, much has been publicised about the influence of food and drink prices on this increase in CPI. However, food prices continue to see the lowest rate of CPI growth. At +0.3% increase, it’s far behind other areas of household spending such as transport (+7.8%). The biggest increase in CPI comes for the restaurant and hotels sector.

However, this increase for the sector masks some important caveats. A year ago, the country was just emerging from its first national lockdown in response to the pandemic. In order to stimulate demand in the out-of-home sector, the government launched its Eat Out to Help Out (EOHO) scheme. The scheme offered diners a 50% discount (up to a maximum of £10 per diner) on food and non-alcoholic drinks every Mon-Wed during that month. This generous discount, which helped encourage around two in five GB adults to eat or drink out of home, meant that the CPI for the restaurants and hotels sector fell back in August 2020, making price comparisons challenging in 2021. The ONS calculate that, had the EOHO scheme not taken place last year, the CPI for August 2021 would have been 0.4 percentage points lower than it is now.

In addition to this, there is a variable picture behind the headline trend for food prices. Overall, the CPI for meat was -0.8%, while flour and other cereals was -15.0% (in part reflecting the adjustment in demand versus 2020, when the nation took to home baking in an attempt to curb lockdown boredom). Within dairy, the CPI for cheese was -2.8%, butter +1.6%, whole milk +2.3% and low-fat milk +1.2%.

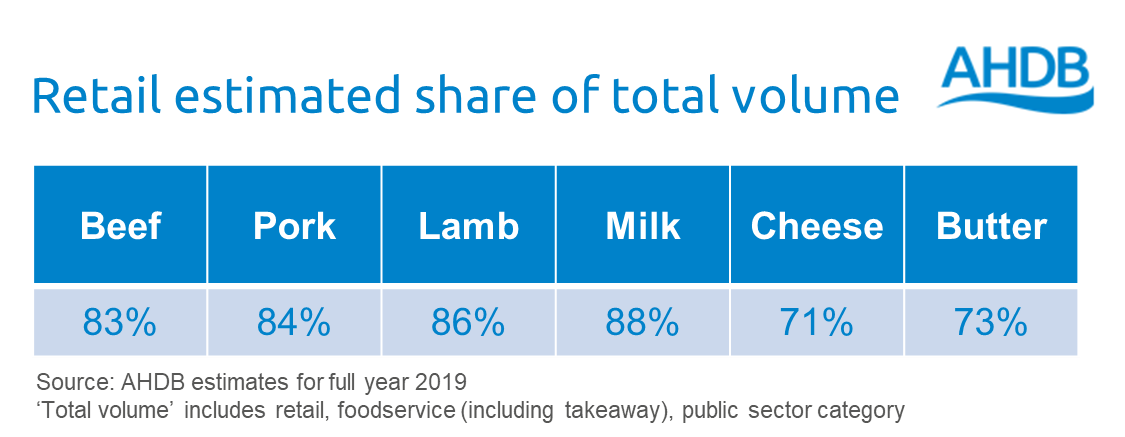

While the ONS highlight that stark year-on-year comparisons are having a big influence on CPI, they also acknowledge the reported issues with supply, including lack of labour and increased shipping. This will undoubtedly put pressure on those in hospitality in particular, although retail won’t be entirely immune. In 2019, a typical year prior to the pandemic, AHDB estimate the majority of meat and dairy volume was sold via retail. Therefore retail food prices, which still remain relatively subdued compared to other sectors within the CPI measure, are more likely to have a greater influence on supply chains, and ultimately producer prices.

Related content

Topics:

Sectors:

Tags: