Grain export corridor update, Russia resumes: Grain market daily

Wednesday, 2 November 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £289.25/t, down £0.20/t from Monday’s close. Nov-23 futures gained £0.05/t over the same period, to close at £270.05/t. This was despite more clear gains for US and Paris markets.

- Markets continue to react to news on the Ukrainian grain corridor. This morning Russia has said it will resume participation in the grain deal. Read more about this below, including price reactions.

- A factor in differing domestic movement yesterday to global contracts is the strengthening in the sterling against the euro (+0.19%) and US dollar (+0.12%).

- Paris rapeseed futures (May-23) gained €5.75/t over yesterday’s session, closing at €665.50/t. Today, prices for this contract were trading down €17.00/t, to €648.50/t (13:30).

- On Monday, the USDA’s first crop conditions were released for US planted winter wheat pegged at 28% ‘good’ to ‘excellent’ in data to 30 October. This is down from 45% ‘good’ to ‘excellent’ this time last year. Areas are struggling from dry conditions.

- Despite UK natural gas futures feeling pressure over the past few months, news on the Russia and Ukraine conflict has seen significant movement in recent days. On Monday, UK natural gas futures nearby prices jumped up 22%. Though yesterday dropped back 7% to close at 279.69p/therm. Looking forward to Feb-23 prices, the premium from nearby has narrowed in the last few days as nearby prices jump higher. Though at close yesterday, feb-23 prices stood 14% higher than spot. These forward prices are something to consider for new year fertiliser prices.

Grain export corridor update, Russia resumes

The Ukrainian export corridor continues to move markets.

On Monday, we saw grain and oilseed prices jump up on the news that Russia had withdrawn from the UN Ukrainian export deal on Saturday, in response to a drone attack in Crimea. UK feed wheat futures followed global movements on the back of this news, with the May-23 contract up £9.45/t on Monday, to close at £289.45/t. The highest close for the contract in over two weeks.

Today, Russia have announced that they will resume their participation in the Ukrainian grain deal after receiving written guarantees from Kyiv not to use the corridor for military operations against Russia.

As a result, global grain prices and as such UK feed wheat prices are falling against yesterday’s close. Today, UK feed wheat futures (May-23) were trading at £279.00/t (13:30) down £10.25/t. Nov-23 prices have fallen £10.05/t to trade at £260.00/t (13:30).

Markets remain volatile

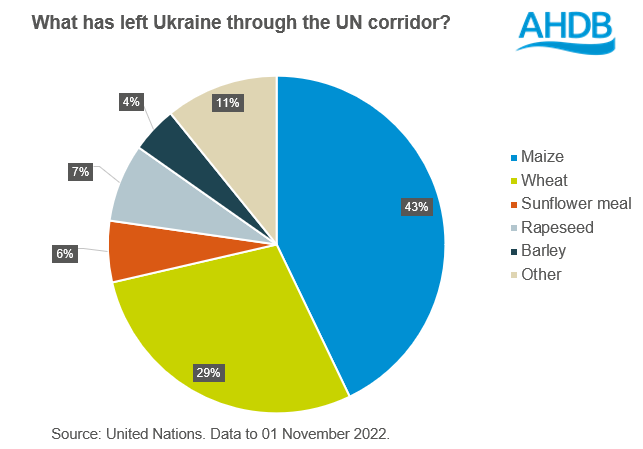

News on Ukrainian exports remains the key market driver across markets, how tight is global grain and oilseed supply? Since the establishment of the deal in July, 43% of total cargo shipped from Ukraine has been maize and 29% wheat. As such, a large proportion of wheat is still tied up in the Black Sea region, meaning we are seeing volatility especially in wheat markets.

Ships had still been leaving Ukraine – despite no new insurance cover

Despite Russia withdrawal from the deal for the short time, ships had continued to leave Ukraine.

On Sunday and Monday, a total of 12 ships were recorded by the UN to have departed from Ukrainian ports (Chornomorsk, Yuzhny/Pivdennyi and Odessa) of primarily maize and wheat to a variety of destinations EU to North Africa. Though this also includes 46Kt of rapeseed leaving Chornomorsk heading to the UK.

A further two ships left Ukrainian ports yesterday carrying wheat and sunflower meal to North African countries, according to UN data. Though Refinitiv sources say this number could be three ships leaving yesterday. Ship movements were reportedly agreed by Ukrainian, Turkish and UN deletions in Istanbul, with the Russian delegation informed.

No ships are planned to depart today, though loaded ships are expected to leave on Thursday according to the UN coordinator for the deal (Refinitiv).

This was despite reportedly no new insurance cover from insurers. Lloyd’s of London insurer Ascot, followed by Lloyd’s underwriters, had reportedly suspended cover for new shipments using the UN grain corridor until more clarification on the situation. Hull war cover, from war risk insurers, had reportedly risen to 1.5% of the cargos value, from 1% on Monday. Cargos are reportedly unlikely to get cover.

Reportedly, 65 ships remain stuck in Ukraine across various ports, including ports not in the UN deal, according to analysis from the International Chamber of Shipping.

With Russia now resuming the deal, this may bring the clarification needed for insurers for new cover.

What does this mean?

The conflict between Russia and Ukraine continues. Wide scale evacuation of Ukrainian people is on-going, and strikes continue, adding to uncertainty in markets.

Even though Russia has resumed participation in the UN corridor now, markets still await news on whether the deal will be renewed on expiry in just over two weeks’ time (late November).

It is believed Putin will use the extension of the deal as leverage in the G20 summit in Indonesia on 15/16 November. Putin too is concerned about Russian grain and fertiliser exports too, so could use this in negotiations.

As we hear news, expect volatility in grain and oilseed prices to continue.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.