June 2023 dairy market review

Thursday, 13 July 2023

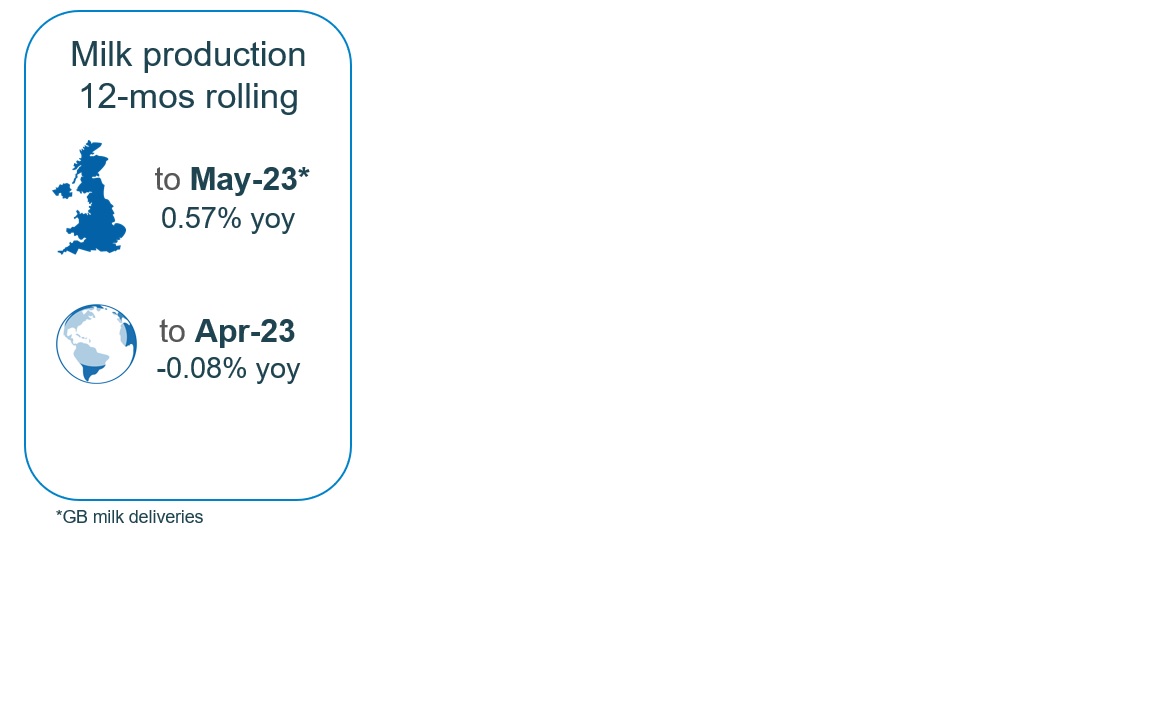

Milk production

GB milk deliveries continued to record year on year growth through June, albeit now slowing, with estimated volumes for the month up 0.4% on the previous year at 1,045m litres.

Grass growth rates dropped off significantly in late May and throughout June due to the hot dry weather. This will have impacted on milk yields, potentially encouraging some farmers to dry off thinner cows early to maintain welfare and remove culls from farm to reduce grazing pressure. The prolonged hot and dry spell may also have an impact on forage stocks later for in the year.

Agricultural inflation levels are now easing but many input costs remain at high levels and the continued declines in milk prices are impacting on farmers decision making with little appetite to push yields. In the first six months of 2023, farmgate milk prices have lost more than they gained in the last six months of 2022. The GB overall average increased by nearly 7.5ppl Jul-Dec22 but has declined by almost 12.0ppl Jan-Jun23.

The annual production forecast has now been revised downwards to reflect the latest data and expectations are that the milk year will end up flat at -0.01% compared to last year. However, this heavily depends on the extent of milk price declines and where they bottom out, as tightening farm margins plus difficult weather could potentially lead us to see higher destocking rates. The milk-feed price ratio is now edging into the contraction zone, indicating supplies could be challenged towards the end of the milk year.

The rate of the decline in the milking herd has now dropped to the lowest rate since 2018, now standing at 1.63 million head, losing only 0.5% since last year. There are signs of the herd becoming younger on average: BCMS data noted growth in the 2-4 year category but declines in those aged 6 or over.

Global milk production in April returned to growth by 4.7% year-on-year, averaging 835m litres per day. Growth in production was seen across all key regions except Australia. This returned the global picture to one of growth, following last month’s aberrant drop in production.

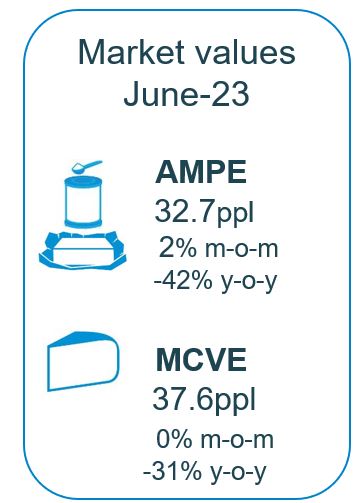

Wholesale markets

Overall price movements on UK wholesale markets saw signs of a slight recovery this month. Generally, trade remained light as the market waited to see whether we had indeed reached the bottom of the curve. Cream prices improved by £132/t, SMP rose by £20/t, butter up by £80/t with mild cheddar fairly steady up by £10/t.

Prices on global dairy wholesale markets have been mostly weakening in all key markets since the summer of 2022 but May was fairly mixed. Milk supplies have started declining in both the Northern as well as Southern hemispheres. Renewed buying interest from China and good export demand from Southeast Asia and the Middle East supported prices in Oceania. However, some demand resistance from other regions was reflected in prices. Butter was the only commodity to gain due to increased demand in retail and food service, but quite a steep drop for cheese losing 9.9% in value. Conversely, saw firming prices in May, particularly for butter with increased demand from South East Asia and the Middle East. EU product prices were anywhere from 32% to 45% lower year on year. The exception to this is in cheese prices, which have stabilised.

As of June, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements) continued to nudge down: in the UK are now 18ppl lower than a year earlier, with AMPE and MCVE down by 42% and 31% respectively. As a side note, he latest dairy market indicator calculations have been adjusted to reflect inflationary changes.

An outline agreement has been reached for the UK to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (or CPTPP), which may bring some opportunities for exports in the dairy sector, AHDB have modelled the opportunities for both butter and cheese.

Farmgate milk prices

The latest published farmgate price was for May, with a UK average of 37.6ppl. Since then however, market-related farmgate prices have continued to decline in response to the reduced market returns and higher milk availability.

Milk price announcements were more subdued in July than in previous months, albeit still negative for the most part. In the aligned liquid contracts Tesco and Waitrose continued to hold on their price in July, while M&S announced the largest drop of the month at -2.17ppl. Co-op and Sainsbury’s dropped their July milk price by -0.93ppl and -0.81ppl respectively.

On non-aligned liquid contracts most processors offered small price declines, with the exception of Payne’s and Graham’s. The announced changes to cheese contracts were in line with those from liquid contracts.

On average, contracts have fallen by 10.9ppl over the course of 2023, with 3.7ppl coming from the past three months. Looking at the snapshot of price changes that have been announced for August so far, it appears that we may begin to see some stability in milk prices as we approach autumn, however demand will remain a key watch point to support this.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.