Less milk for 2023 in the EU

Wednesday, 5 April 2023

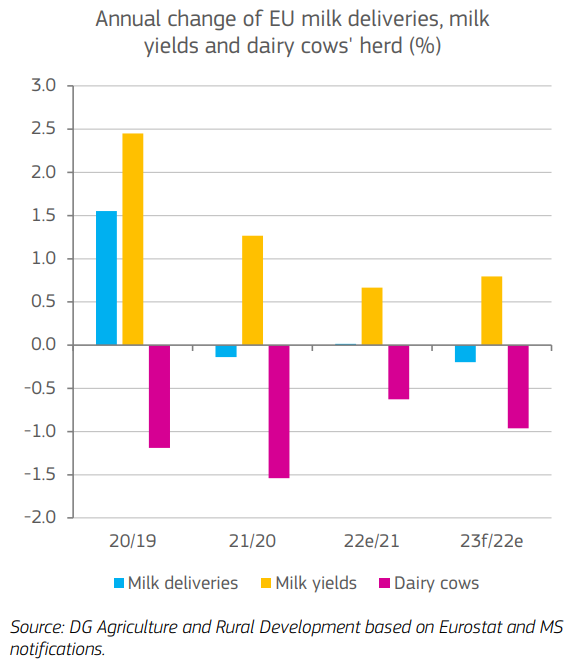

The European Commission has released its latest short-term dairy outlook, forecasting a drop of 0.2% in milk production for 2023. With a forecasted 1% increase in slaughterings, there will be less milk available in 2023 due to a declining dairy herd. This is especially the case for the second half of 2023 as declining milk prices could lead to some large drops in production. Milk yields are predicted to be up by 0.8% from last year (assuming more typical weather conditions), which could help to limit the production drop.

With feed and forage quality and availability expected to be greater year-on-year (yoy), it is assumed that milk fat and protein content will improve. This could keep dairy processing volumes steady despite the forecasted drop in production. Dairy processors are expected to target improved margins in 2023 by channelling milk into more profitable products, and with this, 0.7% more milk is expected to go into cheese and whey production in comparison to last year.

However, higher milk deliveries in Q4 2022 led to a build-up of butter and SMP stocks. They are now believed to be at sufficient levels to cover the projected increase to exports and domestic demand. Therefore, we could see less milk used for these products and production of both products decline by 0.2% yoy. WMP production is also expected to drop as both exports and domestic demand for more indulgent products are forecasted to fall by around 5%.

Overall, there has been a general shift towards the consumption of cheaper and lower quality dairy products in EU domestic markets due to the squeeze on consumer wallets from rising living costs and inflation. Therefore, the total value of EU dairy product consumption is forecast to decline whilst quantities should remain steady overall.

@ European Commission, 2023

@ European Commission, 2023

.png)

With regards to trade, the increase in cheese and whey production is expected to contribute to a 2% increase in dairy product exports in 2023. This assumes a recovery in Chinese demand following the easing of Covid restrictions and stable exports to the UK and US. Lower inflation across East Asia could promote demand for other dairy products such as SMP but may not be enough to offset domestic demand decline for fresh dairy products. Nevertheless, WMP exports are expected to continue to decline yoy, albeit slowing to 5% as production is set to fall.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: