No let-up in input cost inflation

Wednesday, 31 August 2022

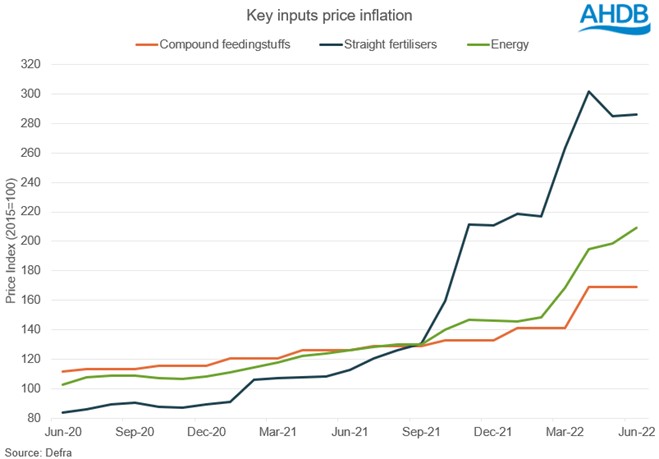

The latest Agricultural Price Index (API) [1] data clearly demonstrates the direct impact of the war in Ukraine on input costs. Prices of most key inputs for livestock farmers had been rising since the beginning of 2021, but then recorded a significant jump in the Autumn when wholesale energy prices soared on the back of strong demand and limited supplies. The end of 2021 and the early part of 2022 saw the rate of inflation slow until Russia invaded Ukraine on 24 February, at which point there was another exponential increase.

Fertiliser prices have seen the most dramatic climb, with costs in June 154% higher than a year earlier and 31% up on the beginning of the year. This latest jump happened predominantly in March and April, after which some pressure was removed as supplies improved relative to demand.

We anticipate the cost of fertilisers to rise again as domestic supplies tighten following the CF Industries announcement that they will ‘temporarily halt’ production of ammonia at their Billingham site. While the company has stated fertiliser production will continue using imports, there is limited availability of ammonia across Europe as capacity is reduced, which will add to the cost and push up prices.

The cost of energy in June increased 44% compared to the start of the year and continues to increase as global markets remain volatile. Uncertainty around access to Russian supplies, combined with strong demand and the push to fill storage ahead of the peak winter period, has kept pressure on energy prices.

Price inflation for compound feeds has been steadier compared to other input costs since the start of the year, rising 19% between January and June. However, volatility in global feed ingredient markets remain as supplies continue to be tight. While shipments of grain are now leaving Ukraine, hot dry weather in both the EU and USA has impacted maize production, keeping prices supported for most grains. Despite the relatively slower rate of price increases for feedstuffs, higher purchases over the winter, bolstered by potential forage shortages, will keep farm margins pressured.

[1] The agricultural price index reflects the change in the price farmers pay for goods and services in relation to the base year of 2015.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.