How might the EU-NZ trade deal impact trade? - Sheep meat

Friday, 26 April 2024

The EU-NZ Free Trade Agreement (FTA) will enter into force on 1 May 2024. Trade of goods between the two was worth almost 9.1 billion euros in 2022. The agreement provides improved access into the EU market for New Zealand products.

Improved access for New Zealand goods includes:

- 91% of NZ goods trade will enter duty free from day 1. This will rise to 97% after 7 years

- NZ$100 million tariff savings from day one. This will rise to NZ$110 million after 7 years.

- Increased Tariff Rate Quotas (TRQs) for beef and dairy products.

Potential impact on the EU

The sheep meat quota in the New Zealand-EU free trade agreement (NZ-EU FTA) gives New Zealand further access to the EU market. It currently has access under the World Trade Organisation (WTO) quota, which is New Zealand-specific, of 125,770 tonnes. The EU-NZ FTA allows for a further 38,000 tonnes of tariff-free access after a seven-year transition period, which is split by fresh and frozen product. This allows for total tariff-free volumes of 164,000 tonnes per year (Jan-Dec), at the end of the transition period.

In comparison the UK-NZ FTA, which can only be filled when the WTO quota hits 90% fulfilment, allows for spare capacity without the FTA being enacted. The quota size is 35,000 tonnes from Year 1 (2024), increasing to 50,000 tonnes in years 5-15 after which it becomes fully liberalised. This means that the UK will be able to act if there is a higher-than-expected volume of New Zealand lamb imports under existing access.

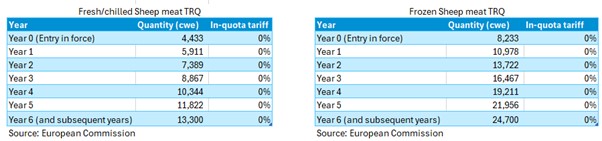

The fresh-frozen quotas for NZ/EU are divided 35%:65%, which reflects the rough split seen in recent years trade data. These quotas are based on volume (tonnes) exported in carcase weight equivalent (cwe), with 4,433 tonnes of fresh sheep meat and 8,233 tonnes of frozen sheep meat allowed in Year 0 (pro-rata May-December). The first full year of the trade deal, from 2025, allows 5,911 tonnes of fresh, and 10,978 tonnes of frozen sheep meat to enter the EU.

Sheep meat TRQ volumes allowed in the FTA

Source: European Commission

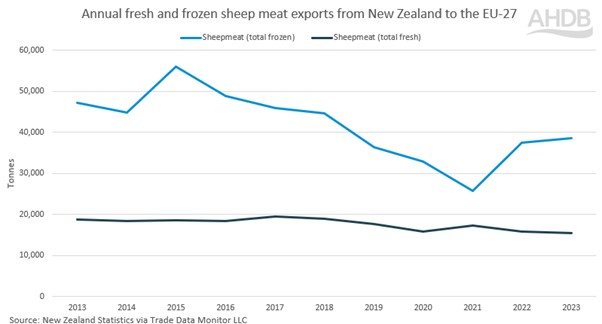

The EU is the second largest market for New Zealand sheep meat, just after the UK, as total sheep meat exports to the EU have averaged 59,400 tonnes across the past 10 years. Exports totalled 54,000 tonnes in 2023, which doesn’t take into account any quotas or tariff-free access that may have changed.

Volumes of frozen sheep meat declined from a peak in 2015 to a trough in 2021. The six years in between saw an accelerated decline in frozen volumes, with relative stability in fresh exports. 2022 and 2023 saw growth from the low in 2021, to total 38,600 tonnes of frozen sheep meat exported in 2023. For fresh sheep meat, volumes are considerably lower than frozen, given the length of shipping time taken to reach the EU, volumes peaked at 19,600 tonnes in 2017, with a low of 15,400 tonnes in 2023. The largest cut exported from New Zealand include frozen bone-in lamb, assumed to be frozen sheep legs, at 47% of total exports.

Annual fresh and frozen sheep meat exports from New Zealand to the EU-27

Source: New Zealand Statistics via Trade Data Monitor LLC

Potential impact on the UK

With the increase in volume of sheep meat that can enter the EU from New Zealand, how could this impact the UK’s exports? The UK is the EU’s largest supplier of sheep meat, with 79,700 tonnes of fresh and frozen sheep meat exported in 2023. EU sheep production fell in 2023, and is set to fall further for 2024, which provides strength to UK exports.

The largest cut exported to the EU is fresh lamb carcases, which accounts for 84% of total UK sheep meat exports to the region. Under current trade volumes, New Zealand are not filling their current WTO quota for export into the UK, which means that the UK FTA for sheep meat has not been enacted so far. New Zealand’s exports into the EU are high-value cuts, such as sheep legs, and not whole carcases that the UK supplies to the EU. This would suggest that New Zealand exports, when the FTA is in place, will not displace UK exports into the EU, given the different products and markets of both countries.

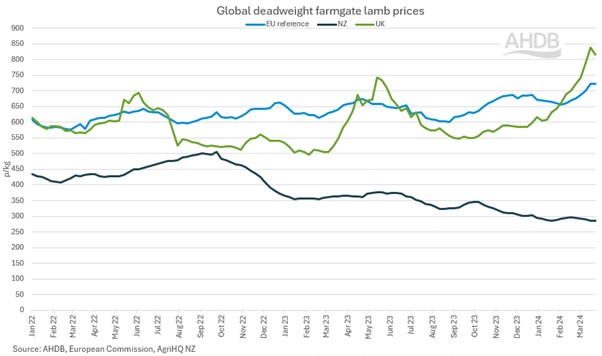

Looking into price differentials across the EU, UK, and New Zealand, we can see that New Zealand lamb is considerably cheaper than its UK and EU counterparts. Growth in EU and UK prices in recent months has resulted from tighter supplies which are set to continue, compared to a decline in New Zealand pricing. Prices in New Zealand have seen declines as they try and compete with deflated Australian prices on the international market.

Global deadweight farmgate prices

Source: AHDB, European Commission, AgriHQ NZ

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.