UK dairy product availability: Mixed picture in Q4 2023

Tuesday, 12 March 2024

Key trends

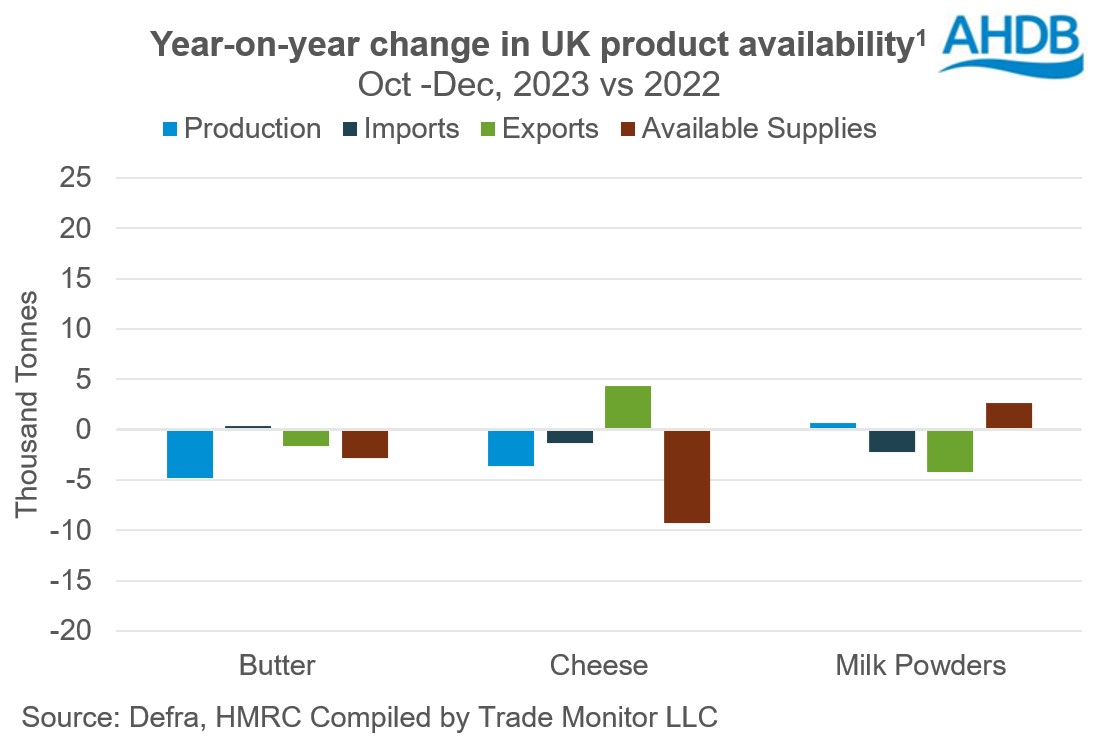

- Available supplies of cheese and butter eased while that of milk powders increased

- Good export demand for cheese was witnessed from Africa and Middle -East

- Recovery in prices in UK dampened export market

Dairy product availability* remained mixed in the fourth quarter of 2023 with milk powders registering some small growth year-on-year while cheese and butter saw a drop in available supplies. Lower milk production during the period contributed to production declines for butter and cheese. UK milk deliveries in the fourth quarter of 2023 (Oct -Dec) declined by 1.8% year on year to 3,570m litres. So far this milk year (Apr23 – Feb24), deliveries have declined modestly by 0.1% compared to the 2022/23 season.

Cheese production declined by 3,600 tonnes (2.9%) year-on-year and imports fell by 1,300 tonnes (1.2%). Exports of cheese denoted a significant increase of 9.6% (4,400 tonnes) during the period and is the only product to register an increase in export volume. This resulted in available supplies tightening by 4.9% (9,200 tonnes).

Butter production declined by 4,800 tonnes year on year in Q4. Exports fell by 1,600 tonnes (13.3%). Lower production resulted in drop in exports. Increased demand from EU firmed up prices and butter saw one of the largest rates of increasing prices on UK wholesale markets recently. Overall lower production drove supplies lower by 2,800 tonnes (5.7%).

Milk powders bucked the trend of lower available supplies. Production increased by 700 tonnes (4.0%) but imports declined by 2,200 tonnes (28.0%) in the fourth quarter year-on-year. Exports fell by 4,100 tonnes (16.8%) which paired with production growth led to an increase in available supplies of 2,700 tonnes. Demand from China, one of the major buyers of milk powders remained muted during the period. Geo-political tensions in the global market have also been affecting trade flows.

Moving forward, milk deliveries are expected to increase during the flush and likely to boost the product supply pipeline. Whether this additional stock creates pressure on the market will depend on the level of demand. Currently, the demand scenario looks uncertain amid inflationary pressure and key global markets such as China still sitting quiet. Trade dynamics will be the key watch point influencing available supplies in the market.

*product availability is defined as: production + imports – exports

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.