USDA forecast: Global exports of beef, pork and chicken set to increase in 2024

Thursday, 25 April 2024

The USDA has released its latest forecasts for global beef, pork and chicken production and trade.

Beef

Global production of beef and veal is predicted to remain similar to 2023 levels at 60.4 million tonnes, but large directional changes are forecasted within this. The latest predictions show US production volumes to falling 2%, as the size of the national herd entering 2024 was the smallest recorded since 1951. Meanwhile, production increases in Australia (+8%), Brazil (+2%), China (+2%) and India (+2%) help to stabilise the overall outlook.

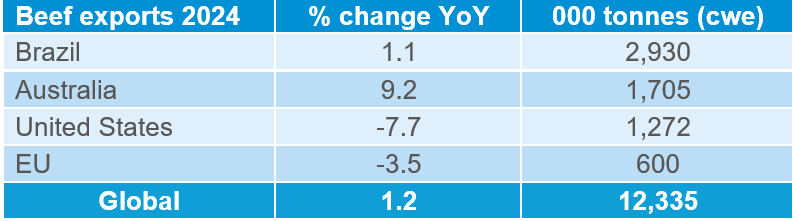

Global exports are forecasted to increase from 2023 levels by 2%, with Australian exports (+9%) boosted by strong US demand and competitive prices in East Asian markets. Brazil, having already filled their US quota for 2024 in February, are expected to remain the largest exporter, increasing marginally YoY.

Source: USDA

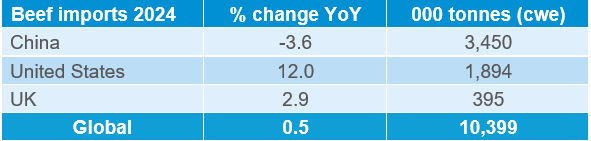

After an upward revision, the USDA expects beef imports to the US to account for 15% of global beef trade, up by 14% since 2023. Further strength of the market is also seen in the form of higher domestic consumption forecasts than previously predicted. Contrasting this, beef imports into China are predicted to drop by 4% vs 2023. Reasons include sufficient carry over from 2023, flat domestic consumption and increases in Chinese production.

Source: USDA

Pork

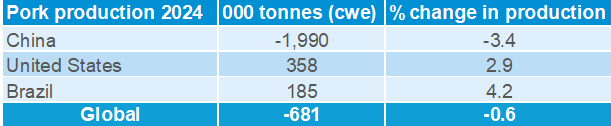

Global production is forecast to decline by 1% to 115.6 million tonnes. While production is reduced in China (-3%), the US and Brazil are expected to make up for much of this shortfall with gains of 3% and 4% respectively.

Source: USDA

Global exports are set to rise by 4% to reach 10.5 million tonnes in 2024. All major exporters are set to contribute towards this, with most growth stemming from the US and Brazil to deliver 8% and 5% greater shipments in 2024, respectively.

According to the USDA, EU production is set to rise (+1.7%), However, the most recent EU market update explains that the sector is yet to see growth. Although some uplift in prices has been seen recently, further declines in production are likely. With low incentive for investment in the sector and various environmental and welfare reforms coming into EU policy, the EU commission forecasts an annual decline of around 1% between now and 2035.

China is forecasted to further reduce share of demand in 2024, with a 64% drop in pork imports between 2020 and 2024. Again, high stocks contribute towards this. The increasing competitiveness of the Chinese market may lead to reduced production in some countries.

Meanwhile, the Mexican market is highlighted as a key watchpoint for exporters of pigmeat, as consumer demand increases.

Chicken

Global production is forecast to grow by 1% in 2024 to reach 104.2 million tonnes. This is predominantly driven by Brazil (+1%) and the US (+1%), counteracting significant declines predicted in China, (-6%) as highly pathogenic avian influenza causes ongoing restrictions. Brazil takes advantage of strong export and domestic demand coupled with low costs of production, predicted to facilitate a record high.

Global demand remains stable for chicken, with Chinese imports set to continue to hold a 6% share of global chicken meat imports for 2024.

Global exports are projected to rise by 2%, driven the growing Brazilian broiler sector. The current advantage of zero HPAI restrictions and ability to access the thriving halal market aids this further.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.