Dairy: modelling the impact of a UK-New Zealand trade deal

Thursday, 11 August 2022

Key points for Dairy sector (cheese):

- The model predicts that New Zealand cheese exports to the UK will only increase by around 260 tonnes (an increase of 194% in percentage terms on the baseline used within the model)

- Total UK imports are expected to increase by 190 tonnes (<0.1%), with the increase from New Zealand partially offset by reduced imports from the EU and US

- Changes to production and price are negligible for the UK and New Zealand production is predicted to increase by under 200 tonnes, but, as for the UK, there is an insignificant change in prices

The chosen network for cheese consists of the UK, New Zealand, EU, USA and China. The EU is the world’s largest cheese exporter and is a key trading partner for the UK. While the UK produces more cheese than New Zealand, domestic consumption of cheese in New Zealand is much lower in comparison and so the country has a considerable exportable surplus. China is a key market for New Zealand cheese.

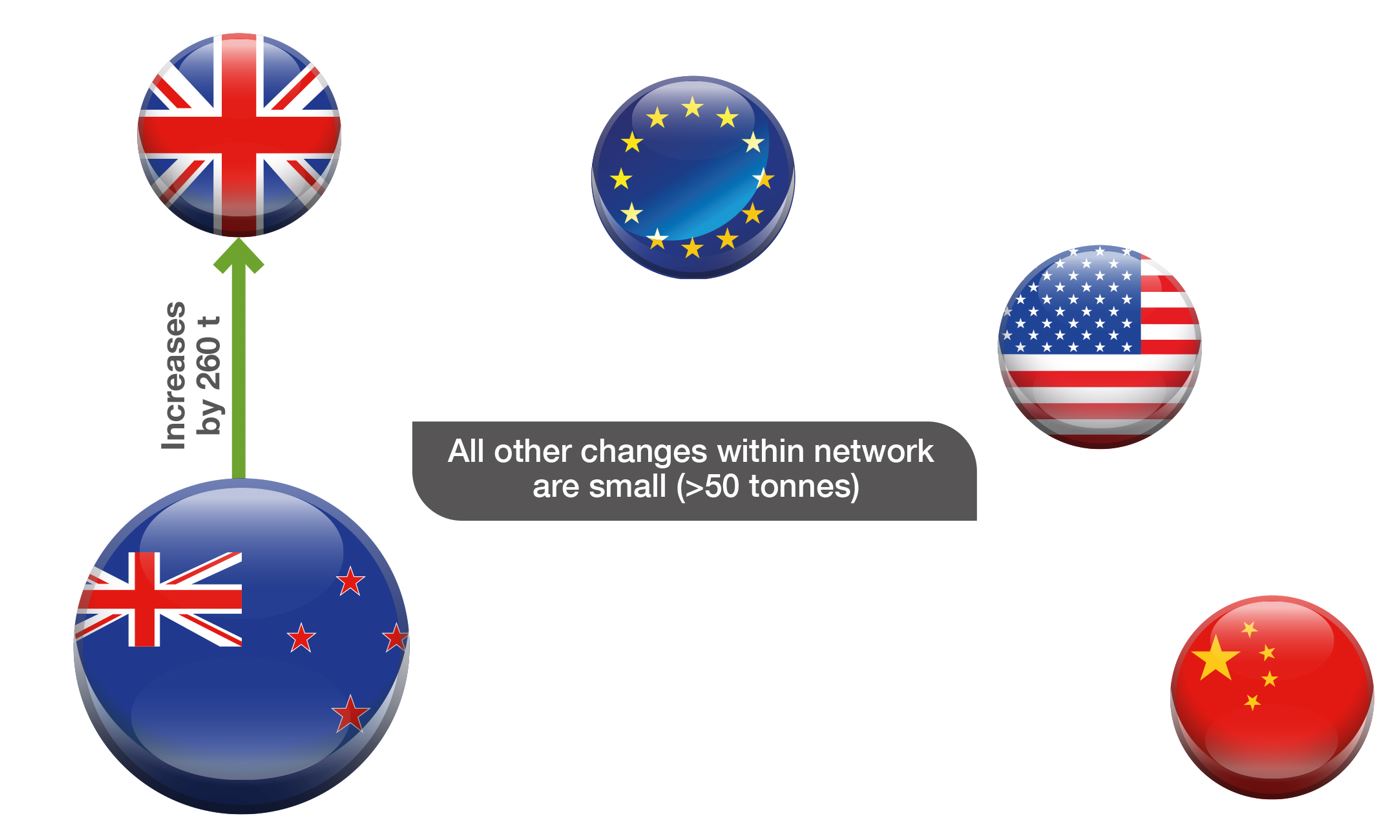

The model predicts that UK cheese imports from New Zealand will increase by 260 tonnes (194%) as shown in Figure 1. Total UK cheese imports will increase by 190 tonnes (less than 0.1%). The higher number of cheese imports from New Zealand will partially displace cheese imports from the USA and EU.

In order to send more cheese to the UK, New Zealand’s cheese production will increase by around 190 tonnes (0.1%) and less cheese would be sent to other countries in the network.

Figure 1. Network showing main changes in cheese trade flows

Source: AHDB/Harper Adams University

The predicted impact of the UK-New Zealand trade deal on UK prices is small (<0.1%) with an even smaller drop in production in percentage terms. The New Zealand farming sector is predicted to see a slight increase in production (0.1%) and prices, with the price paid to farmers only 0.01% higher.

Key points for Dairy sector (butter):

- The model predicts that New Zealand butter exports to the UK will increase by around 1,700 tonnes (an increase of 209% in percentage terms on the baseline used within the model)

- Total UK imports are expected to increase by 1,500 tonnes (2%), with the increase from New Zealand partially offset by reduced imports from the EU

- Changes to UK production are relatively small (less than 0.1%). UK retail prices fall by less than 0.5% and the decline in the price paid to farmers is even smaller (<0.01%). New Zealand’s output of butter is 1,100 tonnes higher (0.8%), with the price paid to farmers increasing by 0.8% as well

The network for butter is the same as for cheese. New Zealand exports more than 80% of the butter it produces. China is a key export market for New Zealand butter, while for the UK, the main market is the EU. The USA is also an important market for EU and New Zealand butter.

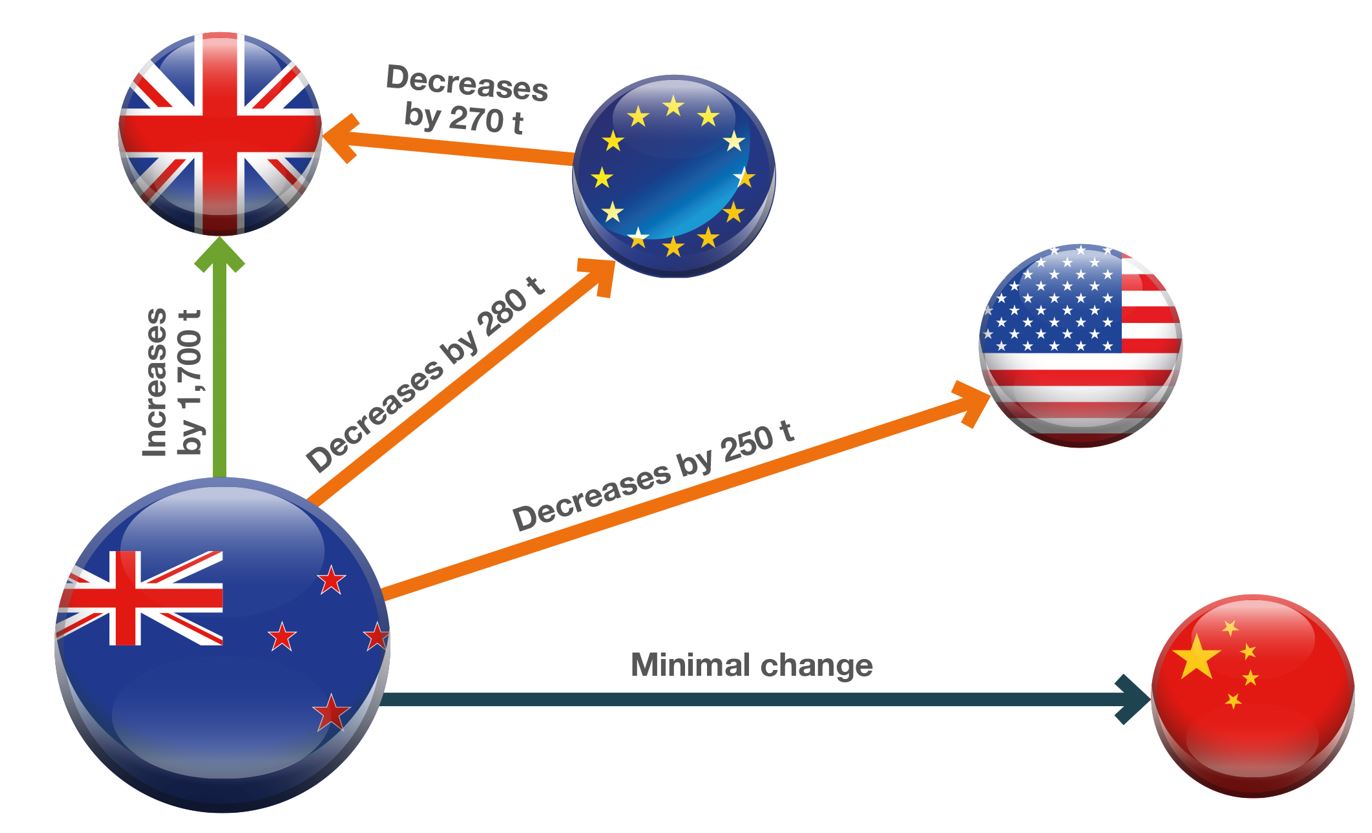

According to the model, the UK-New Zealand trade deal will lead to New Zealand butter exports to the UK increasing by 1,700 tonnes (209%) as shown in Figure 2. Total UK butter imports increase by 2% (1,500 tonnes), mainly due to the additional volume coming in from New Zealand, although some of this is offset by a drop in imports from the EU and USA.

Figure 2. Network showing main changes in butter trade flows

Source: AHDB/Harper Adams University

The model calculates that UK butter production will fall by 80 tonnes (less than 0.1%), while New Zealand butter output will increase by 1,100 tonnes (0.8%). In terms of prices, the UK retail price for butter would drop by less than 0.5% and there is negligible change in the price paid to farmers. New Zealand farmers would be paid less than 1% more than the 2018-20 baseline.