A trade deal with Canada - Cereals & Oilseeds

Friday, 9 July 2021

The UK has signed a trade agreement with Canada but is starting negotiations to “better” it. It is important for us to understand the similarities and differences in production and trade between the UK and Canada. This article will focus on cereals and oilseeds.

The UK and Canada have in place a short form agreement, in the way of a Trade Continuity Agreement (TCA). This continues the existing trade relationship between the UK and Canada since leaving the EU. The UK is now entering negotiations with Canada in order to “upgrade” the current trade deals. But what does cereals and oilseeds trade look like for Canada and the UK?

Wheat

- WHEAT table 08 07 2021.PNG)

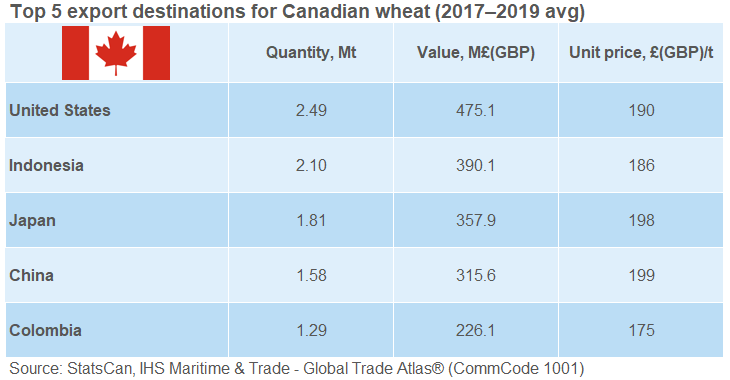

Canada is known for growing high quality wheat, much of which is exported. On average, Canada produces 31.80Mt of wheat, over double that of the UK. The grades of wheat differ significantly, with high protein Canadian wheat commonly entering the global market.

The main Canadian wheat classes are:

Canada Western Red Spring (CWRS) – The most commonly grown wheat in Western Canada and known for its superior milling and baking quality. CWRS is a high protein hard wheat, often used to blend with lower-quality wheat to improve the quality.

Canada Western Amber Durum (CWAD) – Likewise, this wheat is known for its high protein content but also its semolina yield. This is commonly used in pasta and couscous and gives a good bright yellow colour.

Canada Prairie Spring Red (CPSR) – Good for baking and noodle quality. This is a medium protein wheat with high milling yields, low flour ash and bright flour colour.

Canada Eastern Soft Red Winter (CESRW) – Typically a high flour yielding wheat with a bright and creamy colour. Generally good for cakes, pastry, cereal, crackers, biscuits and filling due to it’s low protein content.

Canada is the top exporter of durum wheat, providing just under one third of the global exports. On average 72% of Canada’s wheat production gets exported. The US is a key customer, closely followed by Indonesia. Canada is the top supplier of wheat to the UK, despite only 2% of Canada’s wheat exports heading there. UK millers tend to use Canadian wheat to blend with lower quality homegrown material to increase its baking qualities.

Canada imports relatively minimal volumes of wheat (158.4Kt) with the majority of it (c.93%) coming from the US.

Canada and the UK

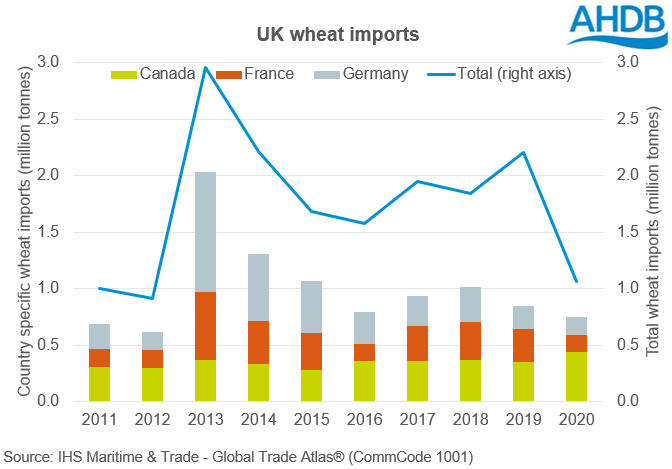

The UK net trade positions changes from year-to-year, depending on the domestic supply and demand picture. However, to the UK, Canada is an important trade partner when it comes to wheat. Typically, the UK imports milling wheat, and exports feed wheat. As mentioned previously, millers tend to use Canadian wheat to blend with lower quality homegrown milling wheat to increase quality. On average (over 2017-19 cropping seasons) the UK imported of wheat from Canada, 23% of the country’s total wheat imports.

Over 50% of the UKs wheat imports come from 3 main origins: Canada, France and Germany. Compared to imports from elsewhere, those from Canada differ less from year-to-year. However, requirement does vary depending on the success of the UK harvest from both volume and quality points of view.

A trade deal allowing Canadian wheat into the UK can actually benefit UK farmers. The ability to blend high spec wheat (IE Canadian or German E) allows just-out-of-spec milling wheat to still be used by mills, although often at a slightly reduced price. However, without the ability to blend with high quality imported wheat this would likely be reduced to a feed market, at a significantly discounted price. There is a threat that Canadian wheat could displace UK wheat but the distance it must travel, bumping up cost and the Rules of Origin (RoO) limits (explained below) will likely mitigate this. The trade deal between the UK and Canada is potentially more damaging to Germany’s trade with the UK, another key source of high-quality wheat used by millers for blending.

As previously mentioned, the UK generally exports feed wheat. Top destinations are within the EU but some African countries are also important. Due to the differences in the types of wheat exported by Canada and the UK they are generally not competing for the same markets.

Rules of Origin (RoO)

Rules of Origin limits apply to UK-made flour. Under the EU-UK Trade and Cooperation Agreement, EU materials and processing count as UK materials and processing for products exported to the EU, and vice versa. However, if non-UK and EU materials, for example, are used in UK product exports, then they may incur tariffs if the amount or value exceeds the agreed level. As mentioned, Canadian wheat is imported for milling purposes and so if flour is exported from the UK to Ireland, for example, a tariff will apply if it contains more 15% Canadian wheat.

Barley

- BARLEY table 08 07 2021.PNG)

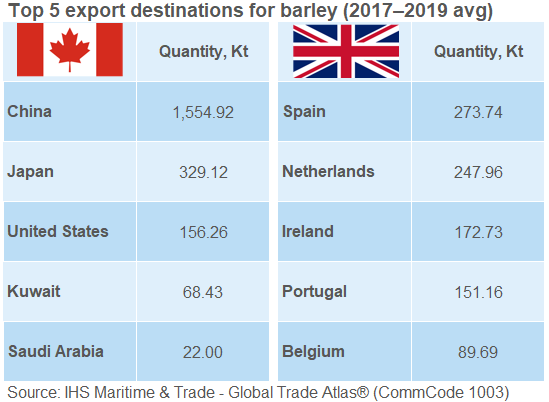

Canada’s barley production is also higher than the UK although somewhat closer than wheat. Both countries have seen year-on-year rises in production over the past two seasons. Also similarly, both countries are net exporters.

Despite both being net exporters, there is minimal cross over in markets. The bulk of Canada’s barley exports make their way to China, whilst much of the UK’s moves into Europe. Both Canada and the UK export barley to Saudi Arabia and this is where competition sits between the two. However, an FTA agreement between Canada and the UK has little effect on this.

The UK and Canada are also both net exporters of malt (unroasted) with Japan and the US being top destinations for both countries. Canada generally prices under the UK into both countries due to a distance benefit. Canada is the key supplier of malt into both Japan and the US, particularly the latter, supplying 76% of malt imports. However, the UK is consistently ranked number 3 for US malt imports.

Again, there is very little trade between the two when it comes to malt. On average (2017/18-2019/20) 1% of UK malt exports went to Canada but zero trade was returned. For Canada, malt imports from the UK equated to just 6%, over the 3-year period, and therefore a free-trade agreement between the two countries could see an opportunity for this to rise. However, the bulk of Canada’s malt imports come from the US and therefore it is unlikely that the UK will be able to compete against the US due to the freight required.

With minimal trade between the UK and Canada when it comes to malt, an FTA is unlikely to rock the boat too much.

Oilseed rape (canola)

- OSR table 08 07 2021.PNG)

Canada is the worlds largest producer of rapeseed (Canola), producing around ten times that in the UK. Due to agronomic issues within the UK recently, the planted area, and subsequently production, has been reducing each year. In 2020 the UK produced 1.04Mt of rapeseed, the smallest crop on record (since 1999).

It will come as no surprise to hear that Canada is the world’s top rapeseed (canola) exporter. From 2017/18-2019/20 Canada made up an average of 40% of the global exports and 55% of this went to China and Japan. The US is Canada’s biggest customer when it comes to rapeseed oil accounting for 56% of exports.

The UK has become a net importer of rapeseed. With a declining domestic production, this is unlikely to shift soon.

Canada and the UK

Despite Canada being a major exporter and the UK a net importer, trade between the UK and Canada is almost non-existent. Much of Canada’s canola is genetically modified (GM) and therefore is not favoured in the UK. EU legislation prevents GM oil in human consumption product lines, although demand comes mostly from industrial uses. But also legislation limits the use of GM products in animal feed. This makes it difficult for the by-product of Canadian canola (rapemeal) to find a home. If the UK were to override this legislation, now we have left the EU, it could open up the doors for Canadian canola to access UK markets and is therefore one to keep an eye on.

Recap

- Wheat is likely to be the most affected trade.

- Used by millers in the UK to blend with lower quality domestic milling wheat.

- Allows farmers to receive a premium over feed wheat even if they don’t quite reach milling spec.

- Likely to displace German E wheat imports rather that domestic milling wheat.

- If the UK changes legislation around GM products in animal feed, more Canadian canola could be seen entering the UK market to fulfil the import requirement from the UK.

- Currently this is stalled by the lack of market for the by-product (rapemeal).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: