How could the new Sustainable Farming Incentive payments stack up for arable farmers?

Thursday, 24 June 2021

With the process of reduction, and eventual elimination, of direct payments underway, we’ve been looking at what this means for farmers and growers. Previously, we’ve examined the proposals for lump sum and delinked payments as well as the upcoming Sustainable Farming Incentive (SFI). In this article we consider how SFI payments compare with the outgoing Direct Payments with regards to meeting objectives for arable and horticultural land. Similar analysis has also been carried out for grassland.

The first pilot of the SFI is due to begin this autumn in England. Farmers and growers who applied for the scheme will soon know if they have been randomly selected to take part in the pilot phase and will be getting ready to develop their plans for the scheme. Only land that is not covered by any other agri-environment scheme is eligible to take part in the SFI.

In this article, we’re looking at a very simplistic picture of how SFI payments could stack up against filling the gap left by the removal of Direct Payments. There are still a number of unknowns such as the costs involved. Its also important to be aware that the SFI is still being developed and learnings from the pilot process and feedback will be factored into this. As a result, payment rates are subject to change. However, due to the gradual reduction of basic payments, farmers will be eager to know how the various options of what’s on offer in the SFI pilot compare to historical support levels.

How do things look on a per hectare basis?

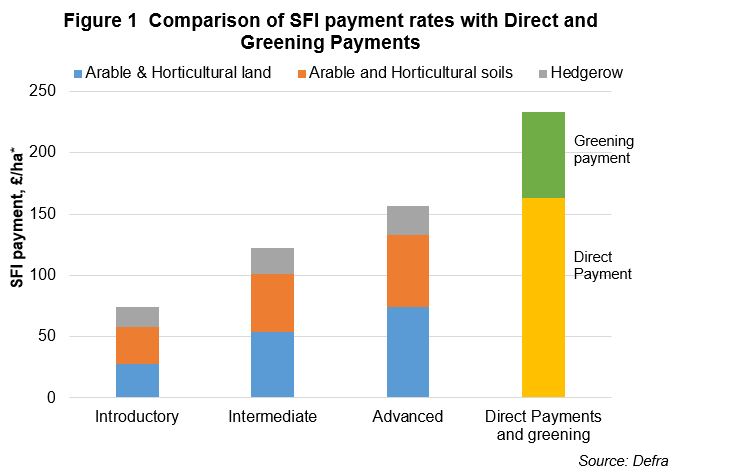

There are eight environmental standards in the SFI and more than one standard can be applied to the same area of land. For illustrative purposes, Figure 1 shows the payment rates (£/ha) for the arable and horticultural land standard, arable and horticultural soils standard and hedgerow standard.

*Note: Hedgerow standard is £16/100m. For this example we have assumed £16 per hectare which would equate to one side of a hectare 100m x 100m land parcel. The larger the perimeter of your fields, the higher the payment opportunity.

The Direct Payment value is based on the 2020 payment rate of £163/ha (for non-Severely Disadvantaged Area. The greening payment rate used is £70/ha.

From 2021, greening requirements have been removed but minimum standards on the environment, animal and plant health must still be met. The greening payment will be added to the main BPS payment.

It is also worth noting that SFI payment rates are subject to change as the scheme is developed.

A few key points from Figure 1 are:

- Under the Introductory level, even if three of the standards shown were applied, the total payment rate per hectare would only equate to 32% of the Direct Payment and greening value

- To receive payments that are closer to the Direct Payment and Greening payment value per hectare, a farmer/grower would need to target the Advanced level objectives (67% of the value of Direct and greening Payments)

- The combined payment rates for Advanced level measures shown still fall short of the Direct Payment value per hectare

- An important point to remember is that the graph does not show the costs involved in implementing changes to achieve the standards. To receive payments at the Advanced level actions in the Introductory and Intermediate levels must be done in addition to Advanced level actions. Examples of Advanced level actions for Arable and Horticultural land and soil include providing nesting and shelter for wildlife and limiting the area where farm machinery may travel. These factors need to be taken into consideration when looking at the overall picture.

There are also some additional payments available. For example, for the Arable & Horticultural land standard, there is an additional payment of £10 per tree planted (in field) under the introductory level. So if only the Arable & Horticulture land standard was applied (Introductory level) at a payment rate of £28/ha, around 14 trees would need to be planted per hectare to make up just the Direct Payment value. There are higher additional payment rates (£114-311/ha) available for carrying out actions for land that is more likely to flood or has high surface water run-off.

What’s the overall picture?

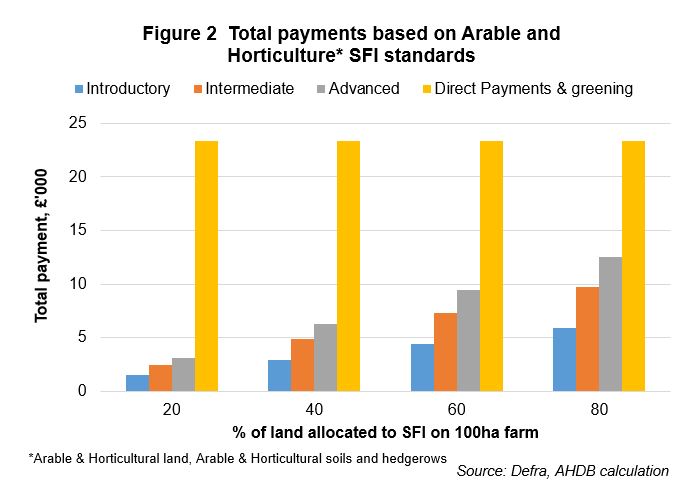

We now turn to putting these payment rates in context by considering the whole farm. For the examples below, we consider a 100ha farm where different proportions are allocated to the SFI. The same exercise illustrated in the graphs above has been applied except this has been extended to a whole farm level where different proportions of the overall farm land is considered.

It is not surprising to see that the higher of the proportion of farm land that is entered into the SFI, the higher the rate of payments, with the Advanced level yielding payments that are closest to the combined Direct Payments and greening payments . Nevertheless, the Advanced level payments still fall short of the corresponding Direct Payment and greening value and associated costs have not been taken into account. (No additional payments have been taken into account).

A flat rate payment of £5,000 a year for learning activities will be available and while this will help to make up some of the shortfall from the loss of Direct Payments, the total payment will still be less than what farmers and growers have received from Direct Payments and greening combined.

Key messages

While there are still a number of unknowns and payment rates have not been finalised, this very basic analysis shows that, based on current information, most farmers will not be able to completely offset the loss of Direct Payments with participation in the SFI. This is not that surprising given that the new schemes were never intended to be a like for like replacement of the Basic Payment Scheme.

If you haven’t done so already, now is a good time to look at your business in detail and plan for the changes ahead. The AHDB Business Impact Calculator will give you an idea of what the loss of Direct Payments will mean for your business. The Resilience Checklist will help provide insight as to the areas of your business which need fortifying and the Business Planning pages can help further with this.

Topics:

Sectors:

Tags: